Financial data flows in milliseconds, algorithms handle 80%+ of the daily deal flow, and high-speed, high-frequency trading using NDD/STP Forex brokers via ECN or DMA dominates trading activity. Therefore, Forex traders require a cutting-edge trading platform, where cTrader and MT4 dominate the market, but which one is better for Forex trading?

cTrader, used by 8M+ traders, is a genuine STP/ECN trading platform and embraces the Traders First™ and Open Trading Platform™ approaches. It became the preferred choice for brokers and prop firms that value cutting-edge technology, transparency, and trust. MT4 remains the leading algorithmic trading solution, but it has failed to innovate over the past decade. So, which trading platform should you choose?

Is MT4, the golden standard of Forex trading, sufficient, or should you innovate with cTrader, which continues to evolve to accommodate the requirements of today’s Forex traders? My cTrader vs. MT4 comparison provides you with the data to use the best option for your trading needs.

Top Regulated Brokers

Introduction: Forex Trading Platforms Overview

My cTrader versus MetaTrader 4 comparison starts by exploring the core features of cTrader vs. MT4.

Features | cTrader | MT4 | |

General | Release date | 2011 | 2005 |

Apps | iOS, Android, Windows, Mac, Web, Amazon, APK | iOS, Android, Windows, Mac, Web, Linux, Huawei | |

Pricing for traders | Free via brokers | Free via brokers | |

Interface | Dark mode | Yes | Yes |

App languages | 23 | 22 | |

In-app user guide | Yes | No | |

Workspaces cloud syncing | Yes | No | |

Instant modification of UI scale | Yes | No | |

At-glance symbol info | Yes | Yes | |

Multiple chart view | Yes | No | |

Multiple indicator panels | Yes | No | |

Trading history | Yes | No | |

Customizable watchlists | Yes | No | |

Trading | Quick chart trading | Yes | Yes |

Order types | 4 (market and stop-limit) | 4 (market and stop-limit) | |

Quick stop-loss and take-profit options | Yes | Yes | |

Advanced stop-loss and take-profit levels | Yes | No | |

Trailing stop loss | Yes | No | |

Smart stop out | Yes | No | |

Charting | Chart objects | 31 | 31 |

Chart drawing | Yes | Yes | |

Supported instruments | Forex, cryptocurrencies, indices, cash indices, metals, energies and soft commodities | Forex, metals, indices and stocks | |

Chart types | 6 (bar, candlestick, line, dot, line, and HLC) | 3 (bar, candlestick, and line) | |

Changing symbols on the chart | Yes | No | |

Periods for time-based charts | 26 | 26 | |

Period types | 5 | 3 | |

Detachable charts | Yes | No | |

Standard indicators | 86 | 30 | |

Depth of Market | Yes | No | |

Market sentiment | Yes | No | |

Trade receipts | Yes | No | |

Symbol search by asset name | Yes | No | |

Lots/units toggle | Yes | No | |

Risk-reward tool | Yes | No | |

Algo trading | Cloud algo hosting | Yes | No |

Cloud execution for trading robots | Yes | No | |

Backtesting for trading robots | Yes | No | |

Opening algo files on mobile | Yes | No | |

Programming language | C# | MQL4 | |

Built-in code editor | Yes | No | |

Copy trading | Expansive strategy catalog | Yes | No |

Strategy performance stats | Yes | No | |

Automatic equity-to-equity copying | Yes | No | |

Profile page with strategies | Yes | No | |

Equity stop-loss protection | Yes | No | |

IB tools | Attribution toolkit/app | Yes | No |

Shared access for money managers | Yes | No | |

Signal links | Yes | No | |

Sharing copy strategies as links | Yes | No | |

Sharing algos as links | Yes | No | |

Sharing deals | Yes | No | |

Sharing symbols | Yes | No | |

Sharing price alerts | Yes | No | |

Integrations | News feed | Yes | Yes |

Economic calendar | Yes | No | |

TradingView | Yes | No | |

Trading Central | Yes | No | |

Autochartist | Yes | No | |

Plugins for third-party integrations | Yes | Yes | |

APIs | Open API | Yes | No |

FIX API | Yes | No |

Understanding the cTrader Trading Platform: Pros and Key Features

The primary cTrader vs. MT4 edge is its cutting-edge technology. Forex traders benefit from an intuitive and modern user interface, fast order execution measured in milliseconds, the most advanced charting solution available, algorithmic trading, including Open API for developers to create customized trading applications, and lower trading fees, as cTrader only supports ECN, STP, and NDD brokers.

The pros and key features of cTrader include the following:

- Server-side trailing stops for enhanced trade management

- Advanced protection tools for fast decision-making

- ChartShot for swift screenshots

- Trade receipts with chronological events, slippage, L2 snapshot and execution time

- A user-friendly mobile trading app

- A powerful desktop client

- An excellent web-based alternative built on HTML5

- Cross-broker social (copy) trading

- Free cloud execution for algos with no VPS required

- Extensive backtesting for algorithmic traders

- Level II data

- $40M+ Invested in Infrastructure

- 99,99999% Average Uptime

- A growing and active community of 8M+ developers and traders

- cTrader live chart streams

- The cTrader Store featuring 650+ cBots, custom plugins, and indicators

Understanding the MT4 Trading Platform: Advantages and Unique Aspects

MT4 is the leading algorithmic trading platform with dominant versatility from 25,000+ custom indicators, scripts, templates, and EAs, granting it its primary cTrader versus MetaTrader 4 edge.

The advantages and unique aspects of MetaTrader 4 include the following:

- Versatile trading platform with 25,000+ custom indicators, scripts, templates, and EAs

- Widespread availability with industry-leading brokers

- Supports 100 open charts with fully customizable templates

- Allows advanced algorithmic and AI-assisted trading solutions to connect

- Excellent community of traders and developers

- Massive trading community for copy traders and signal providers

- Traditional account management via MAM/PAMM accounts

Comparing cTrader and MT4 on Performance and Usability

While the broker’s trading infrastructure influences both aspects, cTrader offers superior technology that continues to evolve with dynamic market requirements. Therefore, the cTrader vs. MT4 performance and usability point favor cTrader, where Forex traders get a trading platform capable of sub-millisecond processing speeds and nearly 100% uptime, as well as a seamless trading experience across Mobile (iOS and Android), Desktop, Mac, and Web, translated into 23 languages.

cTrader, a multi-asset FX/CFD trading platform developed by Spotware, meets the market demands and long-term interests of Forex traders, Forex brokers, and prop firms with its STP/ECN approach, Traders First™ and Open Trading Platform™ principles that allow traders and partners to develop and integrate their applications within an advanced technological framework of cTrader, and Open API.

Traders benefit from high-performance features, including free cloud execution for algorithmic trading, eliminating the need for VPS, advanced charting capabilities, ultra-fast order execution, and built-in social trading. cTrader also includes a comprehensive toolkit for Introducing Brokers (IBs).

Charting Tools and Customization in cTrader vs. MT4

The cTrader vs. MT4 advantage in charting tools lies with cTrader, which offers six chart types and five chart-building methods, 85+ built-in indicators, comprehensive technical analysis tools, a wide variety of order types (including market, market range, limit, stop, and stop-limit orders), multi-chart trading, chart streaming, and detachable charts. Both platforms allow custom indicators, scripts, and algorithmic trading. While MT4 has a long-established library, cTrader offers a growing selection of 650+ custom indicators and trading tools.

Since the quality upgrades cost money, cTrader provides a better out-of-the-box trading platform with built-in trading solutions that Forex traders must add to MT4 via paid-for upgrades.

User Interface Comparison between cTrader and MT4

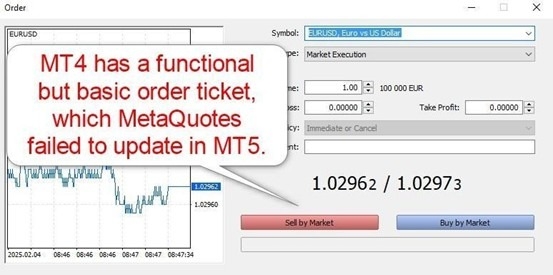

The MT4 user interface is highly functional but dated, while cTrader shines with a sleek user interface and multi-screen trading. cTrader offers easy navigation from account setup to trade execution and analysis. Forex traders can fully customize their workstations and them to any device with cloud syncing.

Multiple indicator panels and customizable watchlists help traders manage assets, depth of market with Level II data offers detailed information, and traders can swiftly access copy trading, the built-in code editor for algorithmic trading, the analysis section featuring cutting-edge technical analysis tools, including third-party services from Trading Central and Autochartist, and the widgets tab to customize the workspace.

cTrader offers a visually impressive, user-friendly interface, ensuring traders of all experience levels get a cutting-edge trading environment.

Transaction Fees and Costs on cTrader and MT4

Brokers determine transaction fees and costs for cTrader vs. MT4, but the former partner with low-priced commission-based brokers, while the latter may include more expensive, commission-free alternatives. Therefore, trading with the cTrader trading platform usually results in lower trading fees, with few exceptions. Most cTrader Forex brokers also offer volume-based rebates, which will decrease costs and increase traders’ profits.

Additionally, since cTrader is an STP/ECN trading platform, traders can capture the price they want in a fast-paced market, which most cTrader brokers support with price improvement technology that further offers a cost advantage in cTrader over MT4.

Which Platform Offers Better Resources?

cTrader and MT4 offer excellent resources. While cTrader has fewer upgrades than MT4, it features superior underlying technology. Its out-of-the-box trading platform does not require costly upgrades, like MT4, to offer Forex traders a cutting-edge trading platform.

Since algorithmic trading dominates today’s financial markets, especially Forex trading, Forex traders without existing algorithmic trading solutions developed on the MT4 infrastructure should consider cTrader, which maintains superior technology to run algorithmic trading solutions, including cloud algo hosting, cloud execution for algorithmic trading solutions, better backtesting solutions for developers and traders to create algorithmic trading solutions known as cBots in cTrader, the equivalent of EAs in MT4, and the ability to open algo files on mobile devices to help potential code fixes on the go.

cTrader is also a leading choice among prop trading firms due to its swift integration and cutting-edge technology. Signal providers and copy traders benefit from a platform that understands their requirements, including detailed trading statistics. It allows the former to improve their strategy and the latter to understand and compare signal providers. Therefore, the cTrader vs. MT4 resources edge goes to cTrader.

cTrader is very customizable and allows brokers and proprietary trading firms to seamlessly integrate their solutions due to the Open Trading Platform nature of cTrader. Traders can use third-party services, plugins, and advanced trading solutions connected via APIs.

Making Your Choice Between cTrader and MT4

The choice between cTrader vs. MT4 depends entirely on traders’ preferences, as both trading platforms shine in select categories. With its advanced features, user-friendly design, and commitment to transparency, cTrader continues to set the industry standard for modern trading solutions.

8M+ traders trust cTrader, an exceptional platform for developers to monetize their trading solutions, Open API apps, and custom indicators via the cTrader Store. cTrader features secure transactions, built-in licensing, an easy onboarding process, and seamless publishing. Therefore, developers can focus on innovating, while the dynamic marketplace allows them to reach a global audience. It also assists Introducing brokers (IBs), who can use their proprietary algo offerings to attract more traders, boost referral conversions, and drive growth.

Unlike MT4 and its successor, MT5, cTrader continues to innovate and evolve to meet the demands of active traders, industry-leading brokers, and innovative prop firms. With STP/ECN at its core, it can deliver faster order execution and lower pricing. Therefore, for most Forex traders, cTrader is the better choice.

Final Thoughts

The preferences and requirements of traders determine the cTrader vs. MT4 decision, but cTrader offers superior underlying technology that makes a significant difference. Traders without existing trading infrastructure will mostly find cTrader a better choice amid superior functionality, including a built-in copy trading system, cutting-edge trading charts, technical analysis tools, better algorithmic trading function, including comprehensive backtesting and cloud-based algo execution, and a trader-friendly, fully customizable workspace that traders can use on any device via cloud syncing.

MT4 is highly functional but requires upgrades to unlock its full potential, granting cTrader another edge. Additionally, cTrader partners with STP/ECN Forex brokers that offer lower trading fees and cutting-edge trading infrastructure, resulting in faster order execution and lower trading fees. While MT4 has its strengths, its failure to innovate, adapt, and evolve with trading needs and requirements in a manner cTrader continues to do makes cTrader the better trading platform choice.