cTrader vs MT5 Trading Platforms Comparison - Pros & Cons Revealed

Today’s financial market data flows in milliseconds, as algorithms handle over 80% of the deal flow. Therefore, traders require an efficient, stable, and reliable trading platform supportive of algorithmic trading solutions. cTrader and MT5 are industry-leading trading platforms with unique advantages, but which is the best choice for your trading requirements?

MT5 is the successor to the popular MT4 trading platform and is available at 1,000+ brokers. cTrader continues to take market share from MT5 as it listens to the requirements of traders and evolves to meet the demanding needs of tech-savvy Forex traders. It innovates and disrupts the status quo, while MT5 rests on its laurels.

Top Regulated Brokers

cTrader distinguishes itself with its commitment to Traders First™ principles, which ensures a transparent and fair trading environment. This includes onboarding only regulated brokers, prohibiting manipulative server plugins, and providing detailed trade receipts for accountability.

In addition, its Open Trading Platform™ approach offers a wealth of customization options, allowing seamless integration with over 100 different third-party solutions and enabling developers to create tailored trading applications.

Trusted by over 8 million traders and supported by a dedicated team of 150+ developers, cTrader is favored by brokers and prop firms for its cutting-edge technology and user-centric design. But, should you value the quantity of MT5 or trust the quality of cTrader? My cTrader vs. MT5 comparison will help you make an informed choice.

Introduction: Forex Trading Platforms Overview

I will start my cTrader versus MetaTrader 5 comparison by introducing core features for cTrader vs. MT5.

Features | cTrader | MT5 | |

|---|---|---|---|

General | Release date | 2011 | 2010 |

Apps | iOS, Android, Windows, Mac, Web, Amazon, APK | iOS, Android, Windows, Mac, Web, Linux, Huawei | |

Pricing for traders | Free via brokers | Free via brokers | |

Interface | Dark mode | Yes | Yes |

App languages | 23 | 22 | |

In-app user guide | Yes | No | |

Workspaces cloud syncing | Yes | No | |

Instant modification of UI scale | Yes | No | |

At-glance symbol info | Yes | Yes | |

Multiple chart view | Yes | No | |

Multiple indicator panels | Yes | No | |

Trading history | Yes | Yes | |

Customizable watchlists | Yes | No | |

Trading | Quick chart trading | Yes | Yes |

Order types | 4 (market and stop-limit) | 4 (market and stop-limit) | |

Quick stop-loss and take-profit options | Yes | Yes | |

Advanced stop-loss and take-profit levels | Yes | No | |

Trailing stop loss | Yes | No | |

Smart stop out | Yes | No | |

Charting | Chart objects | 31 | 44 |

Chart drawing | Yes | Yes | |

Supported instruments | Forex, cryptocurrencies, indices, cash indices, metals, energies, soft commodities, shares & ETFs | Forex, cryptocurrencies, indices, cash indices, metals, energies, soft commodities, equities, ETFs, bonds, futures | |

Chart types | 6 (bar, candlestick, line, dot, line, and HLC) | 3 (bar, candlestick, and line) | |

Changing symbols on the chart | Yes | No | |

Periods for time-based charts | 26 | 26 | |

Period types | 5 | 3 | |

Detachable charts | Yes | No | |

Standard indicators | 86 | 80+ | |

Depth of Market | Yes | Yes | |

Market sentiment | Yes | No | |

Trade receipts | Yes | No | |

Symbol search by asset name | Yes | No | |

Lots/units toggle | Yes | No | |

Risk-reward tool | Yes | No | |

Algo trading | Cloud algo hosting | Yes | No |

Cloud execution for trading robots | Yes | No | |

Backtesting for trading robots | Yes | Yes | |

Opening algo files on mobile | Yes | No | |

Programming language | C# | MQL5 | |

Built-in code editor | Yes | Yes | |

Copy trading | Expansive strategy catalog | Yes | Yes |

Strategy performance stats | Yes | Yes | |

Automatic equity-to-equity copying | Yes | No | |

Profile page with strategies | Yes | No | |

Equity stop-loss protection | Yes | No | |

IB tools | Attribution toolkit/app | Yes | No |

Shared access for money managers | Yes | No | |

Signal links | Yes | No | |

Sharing copy strategies as links | Yes | No | |

Sharing algos as links | Yes | No | |

Sharing deals | Yes | No | |

Sharing symbols | Yes | No | |

Sharing price alerts | Yes | No | |

Integrations | News feed | Yes | Yes |

Economic calendar | Yes | Yes | |

TradingView | Yes | No | |

Trading Central | Yes | Yes | |

Autochartist | Yes | Yes | |

Plugins for third-party integrations | Yes | Yes | |

APIs | Open API | Yes | No |

FIX API | Yes | No |

Understanding the cTrader Trading Platform: Pros and Key Features

The cutting-edge technology and modern user interface rank among the primary cTrader vs. MT5 benefits. cTrader features an intuitive and modern user interface, lightning-fast order execution measured in milliseconds, and the most advanced charting solution available. Algorithmic Forex traders benefit from several tools, including:

- Free Algo Hosting - cTrader allows free hosting of algorithmic trading robots directly from its platform, integrated with cTrader Algo. This tool allows bots to run continuously and stably, with minimal latency.

- Cloud Execution - you can execute trades or run algos using cTrader’s cloud, without having to utilize device resources. This is another low-latency, reliable tool and it is especially useful for high-frequency trading (HFT).

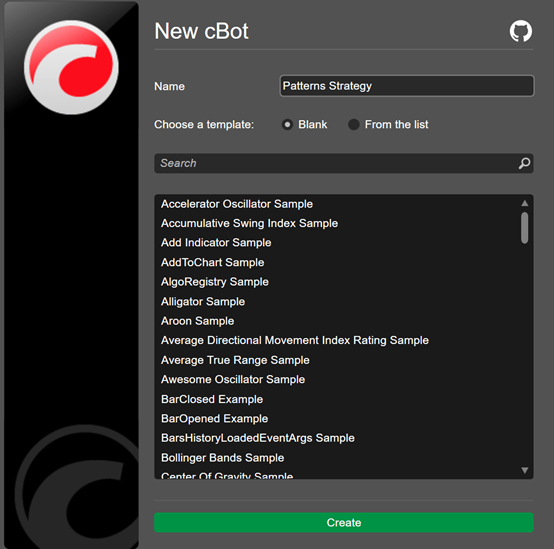

- cTrader Algo API - a powerful C#-based programming interface which can be used to create trading robots (cBots) and custom indicators. This includes access to deep historical market data and offers an integrated development environment making the design of even sophisticated algos easier. This is especially useful for programmers and quantitative traders who want to build and automate complex strategies using C#.

cTrader also offers lower trading fees, as cTrader only supports ECN, STP, and NDD brokers, while MT5 also caters to market makers.

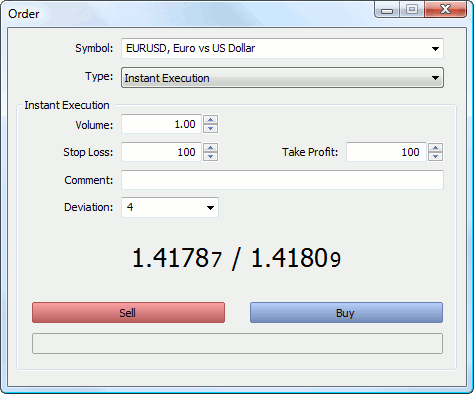

cTrader Order Ticket

The pros and key features of cTrader include the following:

- Ultra-fast order execution due to sub-millisecond processing

- Advanced stop loss and take profit, server-side and trailing protections

- Depth of market (Level 2) and market sentiment

- Detailed trade receipts with chronological events, slippage and execution time

- Free algo hosting with cross-device accessibility

- 24/7 cloud execution for trading robots without a VPS

- Accurate backtesting of trading robots on historical data

- 86 built-in and thousands of custom indicators for technical analysis

- Versatile plugins for third-party services and UI customisation

- Broad collection of algo trading tools in cTrader Store

- Built-in copy trading with successful cross-broker strategies

- Outstanding tools for IBs to maximise conversion

- Best-in-class mobile trading apps for iOS and Android

- Powerful desktop apps for Windows and Mac

- Stunning interface and user-centric design

- Growing community of 8M+ traders, developers, partners

- 99.99999% average uptime

- $40M+ invested in infrastructure

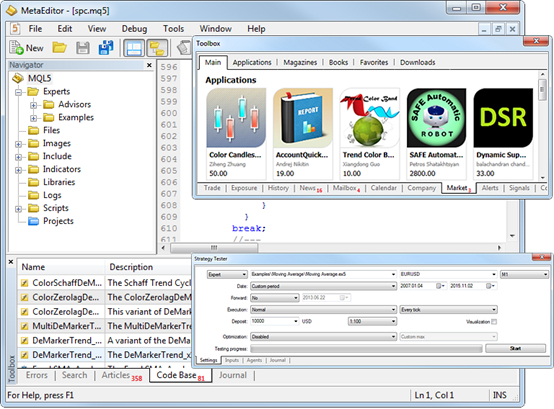

Understanding the MT5 Trading Platform: Advantages and Unique Aspects

MT5 offers traders an edge with its comprehensive library of custom indicators, scripts, templates, and EAs, creating a more versatile trading platform.

MT5 Order Ticket

The advantages and unique aspects of MetaTrader 5 include the following:

- Versatile trading platform with 10,000+ custom indicators, scripts, templates, and EAs

- Widespread availability with industry-leading brokers

- Supports 100 open charts with fully customizable templates

- Allows advanced algorithmic and AI-assisted trading solutions to connect

- Excellent community of traders and developers

- Massive trading community for copy traders and signal providers

- Traditional account management via MAM/PAMM accounts

Comparing cTrader and MT5 on Performance and Usability

Platform Architecture & Execution Speed

cTrader

- Modern architecture: high-performance cloud computing.

- True ECN/STP: Offers direct access to liquidity providers with no dealing desk.

- Low-latency execution: Especially with brokers that host infrastructure close to cTrader's servers.

- Fixed server architecture: cTrader’s trade servers and infrastructure are managed by Spotware, ensuring uniform performance.

MT5

- Legacy & Modular: Architecture tied to broker servers.

- Dealing desk or ECN: Varies by broker.

- Latency depends on broker setup: Varies by broker.

- Server quality varies

cTrader offers more consistent, low-latency execution, and a cloud-first architecture.

Uptime & Reliability

cTrader

- Cloud-hosted automation: Free Algo hosting and cloud execution help avoid device over-reliant.

- Platform-managed updates: without breaking functionality.

- Stability: Even during highly volatile periods.

MT5

- Broker-hosted: uptime varies according to the broker's server setup.

- Local execution unless using VPS.

- More prone to local interruptions: Device issues can interrupt trading.

cTrader is usually more reliable due to its integrated cloud infrastructure.

Algorithmic Trading Performance

cTrader

- Uses C# via cTrader Algo: A high-performance coding language.

- Built-in backtesting & optimization.

- Cloud hosting for cBots: No need for external VPS.

MT5

- Uses MQL5: May be less accessible than C#.

- Integrated strategy tester: Allows multi-threaded backtesting.

- Requires VPS or broker-hosted solution: For 24/7 algo trading, traders need external solution.

Both are strong, but cTrader may have a slight edge.

Broker Dependence

cTrader

- Platform integrity is consistent due to Spotware-managed infrastructure.

- Brokers can customize pricing and liquidity, but core platform experience remains stable.

MT5

- Highly broker-dependent: Execution, slippage, spreads, and even features can vary significantly.

- Some brokers may throttle services (e.g., delay orders).

cTrader holds the advantage here.

While MT5 has improved significantly and is the more commonly offered platform in the industry, cTrader offers a more modern, consistent, and reliable trading environment, especially for algorithmic and ECN traders.

Charting Tools and Customization in cTrader vs. MT5

cTrader takes the lead with its charting tools, featuring six chart types and five chart-building methods, 86 built-in indicators, comprehensive technical analysis tools, a wide variety of order types (including market, market range, limit, stop, and stop-limit orders), multi-chart trading, chart streaming, and detachable charts.

Both cTrader and MT5 allow custom indicators, scripts, and algorithmic trading. Still, cTrader provides a better out-of-the-box trading platform with built-in trading solutions that Forex traders must add to MT5 via paid-for upgrades.

User Interface Comparison between cTrader and MT5

The user interface at cTrader is modern and trader-friendly, including multi-screen trading, while MT5 relies on a clean but dated user interface that performs well.

Snapshot of the cTrader Trading Platform

MT5 Trading Platform

The advantages of the cTrader interface include easy navigation from account setup to trade execution and analysis and fully customizable workstations with the widgets tab that syncs to any device with one login via cloud syncing.

Forex traders can use multiple indicator panels and customizable watchlists to manage assets swiftly, receive Level 2 for detailed trade information, and analyze assets with cutting-edge technical analysis tools, including third-party services from Trading Central and Autochartist. The built-in code editor assists algorithmic traders and copy traders can utilize the integrated copy trading system.

Transaction Fees and Costs on cTrader and MT5

While transaction fees and costs on cTrader vs. MT5 depend entirely on brokers, cTrader generally works with well-priced, commission-based brokers, while MT5 can include more expensive, commission-free alternatives.

Therefore, most Forex traders will experience lower costs, with few exceptions, with cTrader. Additionally, many cTrader Forex brokers offer volume-based rebates that lower trading fees and increase traders’ profits. Another cost benefit is the STP/ECN nature of cTrader. It allows traders to execute trades they seek in a fast-paced market, further magnified with cutting-edge price improvement technology available at most trader brokers.

Which Platform Offers Better Resources?

cTrader and MT5 ensure Forex traders have excellent resources, where the former shines with superior underlying technology, and the latter offers more upgrades. The edge lies with cTrader, as Forex traders receive a cutting-edge trading platform with its out-of-the-box trading platform that does not require costly upgrades, like MT5.

cTrader offers algorithmic traders superior technology to run algorithmic trading solutions, including cloud algo hosting and cloud execution for trading robots. cTrader also provides the most accurate backtesting of algorithmic solutions known as cBots in cTrader in the industry as well as the ability to open algo files on mobile devices and launch them on the go.

Algorithmic trading dominates today’s financial markets, especially Forex trading, and cTrader has a better overall algorithmic infrastructure.

cTrader Algorithmic Trading

cTrader Algo Indicators

MT5 Algo Trading

More brokers and proprietary trading firms favor cTrader thanks to its highly customizable features that allow for seamless integration of solutions as an Open Trading Platform™. It allows streamlined integrations, extensible UI and functionality, custom trading solutions, and community-driven development.

Operating under Traders First™ principles, cTrader onboards only regulated and ethical brokers, safeguarding traders' funds.

Server plugins that manipulate trades and deviate from fair market execution are unavailable.

Price injection and stop-loss hunting are strictly prohibited on cTrader.

cTrader promotes honest practices to shield traders from re-quotes and rejected trades.

cTrader provides detailed trade receipts, making brokers accountable to their clients.

Prop trading firms prefer cTrader amid its swift integration and cutting-edge technology, ensuring their traders have an edge. cTrader can be easily embedded into all areas of client activity for convenient and flexible trading. So, it is clear that cTrader bests MT5 in the cTrader vs. MT5 resources category.

Final Thoughts: Making Your Choice Between cTrader and MT5

Traders’ preferences and requirements will determine whether they choose cTrader or MT5, as both trading platforms shine in select categories. However, cTrader continues to set the industry standard for modern trading solutions with its advanced features, user-friendly design, and commitment to transparency.

cTrader is especially powerful for developers, with an Open API, monetization options via the cTrader Store (used by 8M+ traders), and built-in licensing and publishing tools. Introducing brokers can leverage proprietary algos to boost referrals and growth, all supported by secure transactions and easy onboarding.

Built on STP/ECN infrastructure, cTrader ensures faster order execution and lower fees, making it ideal for high-frequency trading environments. It excels with integrated copy trading, advanced charting, robust backtesting, and cloud-based algo deployment—all accessible across devices.

While MT5 offers extensive customization and strong functionality, it often requires upgrades for full access and lags behind in adapting to fast-evolving market needs. In contrast, cTrader delivers superior technology and trader-focused innovation, making it the preferred choice for serious traders.