For over a decade, DailyForex has been the trusted forex broker authority, establishing an unrivaled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions. Once you’ve explored our in-depth review of CFI, discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

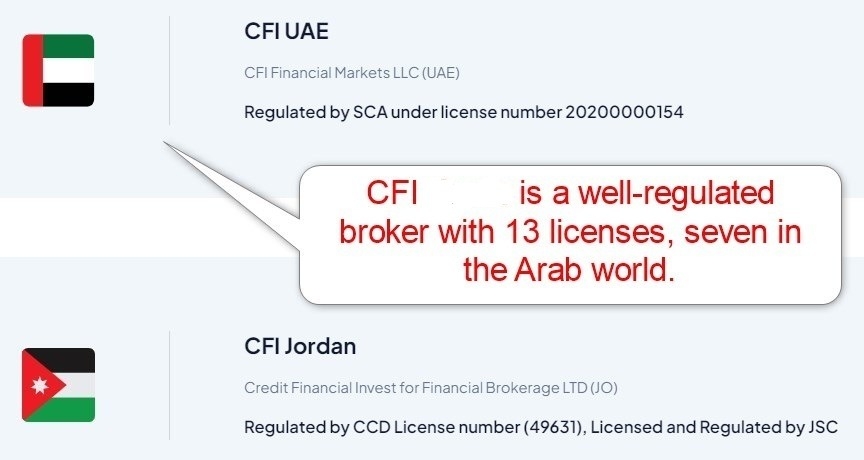

CFI, founded in 2005, is an industry-leading multi-asset broker compliant with 13 regulators worldwide. It has a distinct focus on the Arab world, where it has licenses with seven regulators. Traders benefit from an excellent asset selection, low trading fees, and swap-free Islamic accounts. My comprehensive CFI review evaluated its trading conditions and found its competitive edge. Should you open an account with CFI?

Overview

CFI provides demanding traders with a cutting-edge trading environment.

Headquarters | United Arab Emirates |

|---|---|

Regulators | CMA, CySEC, FCA, FSA, FSC Mauritius, FSCA, VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | 0.4 pips ($4.00) |

Average Trading Cost GBP/USD | 0.4 pips ($4.00) |

Average Trading Cost WTI Crude Oil | $0.026 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | Undisclosed |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.4 pips |

Minimum Commission for Forex | Undisclosed, but volume-dependent |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

CFI Five Core Takeaways:

- Advanced trading infrastructure, including in-house AI trading assistant Kaiana

- $1T+ in quarterly trading volume

- Commission-free spreads from 0.4 pips

- Quality beginner research and education, including Trading Transparency+

- Limited payment processors and lack of regional mobile and e-wallet options

CFI Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. CFI has 13 regulated subsidiaries with a clean track record.

Country of the Regulator | United Arab Emirates, Azerbaijan, Cyprus, Egypt, Jordan, Lebanon, Mauritius, Oman, Seychelles, United Kingdom, Vanuatu, South Africa |

|---|---|

Name of the Regulator | CMA, CySEC, FCA, FSA, FSC Mauritius, FSCA, VFSC |

Regulatory License Number | 20200000154, 49631, 40, CMA CMI054, ISNL/L-7/2016, 101, PMCA/CFI/4, 828955, 179/12, SD107, 700479, C161178, 53711 |

Regulatory Tier | 2, 2, 5, 5, 5, 5, 5, 1, 1, 4, 4, 4, 2 |

Is CFI Legit and Safe?

My review found no misconduct or malpractice by this broker. Therefore, I recommend CFI as it is a legitimate broker.

CFI regulation and security components:

- Regulated by the SCA in the UAE, the JSC in Jordan, the BDL in Lebanon, the FSA in Oman, the CBA in Azerbaijan, the FRA in Egypt, the PMCA in the Palestine Territories, the FCA in the UK, the CySEC in Cyprus, the FSA in Seychelles, the VFSC in Vanuatu, the FSC in Mauritius, and the FSCA in South Africa.

- Founded in 2005

- Segregation of client deposits from corporate funds

- Negative balance protection

- Investor compensation fund where required by the regulator

What would I like CFI to add?

While I rank CFI among the safest brokers, I would appreciate an investor compensation fund at all entities, not just where the regulator demands it. It could do so via the Hong Kong-based Financial Commission, which includes independent financial audits. CFI could also offer a third-party insurance program.

Fees

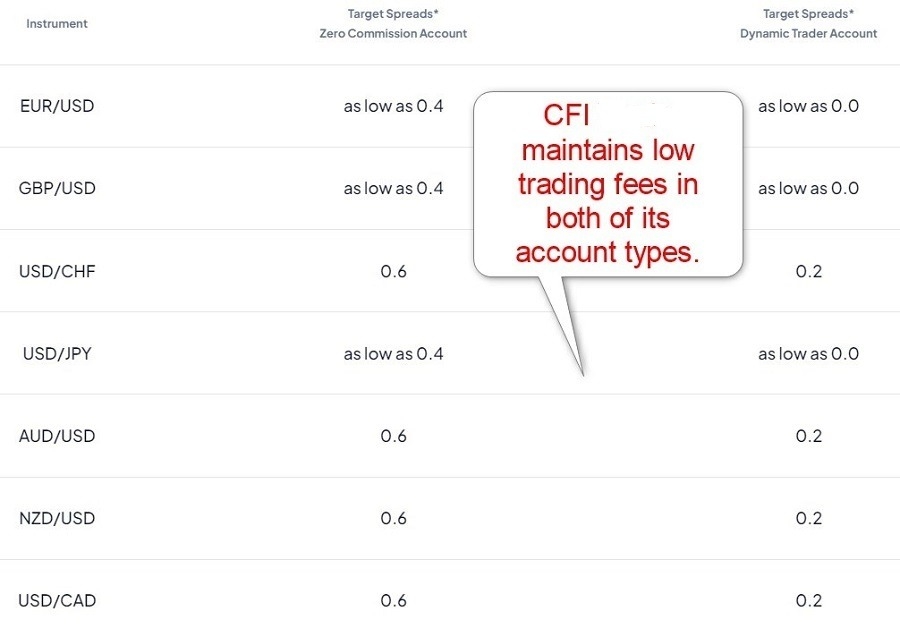

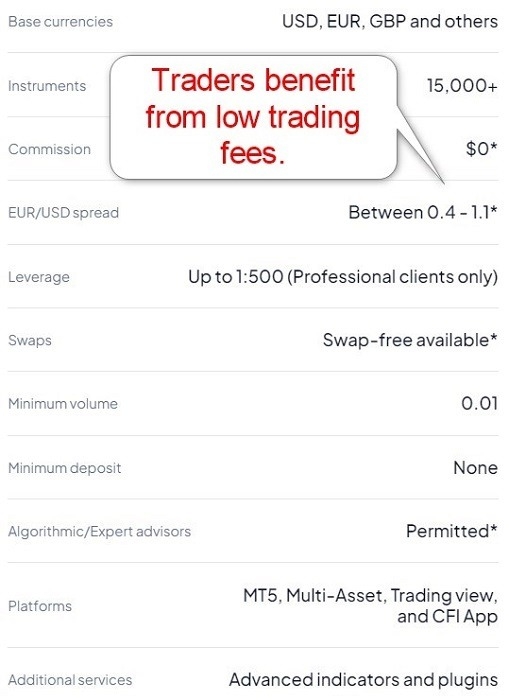

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. CFI offers two low-cost pricing environments: one commission-free and one commission-based alternative. The former has spreads from 0.4 pips or $4.00 per 1.0 standard round lot, and the latter has raw spreads from 0.0 pips for an undisclosed but volume-dependent commission.

CFI does not levy internal deposit or withdrawal fees, but traders may face third-party processing costs, and currency conversion fees may apply. During my CFI review, after eleven consecutive months of dormancy, an inactivity fee of $100 was due.

Average Trading Cost EUR/USD | 0.4 pips ($4.00) |

|---|---|

Average Trading Cost GBP/USD | 0.4 pips ($4.00) |

Average Trading Cost WTI Crude Oil | $0.026 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.4 pips |

Minimum Commission for Forex | Undisclosed, but volume-dependent |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

CFI offers a swap-free Islamic account for Muslim traders, where no swap rates on leveraged overnight positions apply. Additionally, traders can avoid swap rates by closing leveraged positions before the swap rate cut-off time, usually 17:00 EST.

Range of Assets

CFI presents an excellent and well-balanced asset selection of 15,000+ trading instruments covering eight asset classes. It also caters to buy-and-hold investors with unleveraged stocks and ETFs and the ability to head with options.

CFI covers the following sectors:

- Forex

- Cryptocurrencies

- Commodities

- Indices

- Equities (leveraged and unleveraged)

- ETFs (leveraged and unleveraged)

- Futures

- Options

- Bonds

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

CFI Leverage

Maximum Retail Leverage | 1:500 |

Maximum Pro Leverage | 1:500 |

What should traders know about CFI leverage?

- The maximum retail Forex leverage is 1:500.

- Not all assets within a class qualify for the maximum leverage.

- Negative balance protection ensures traders cannot lose more than their deposit.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

Traders can choose between a commission-free and a commission-based trading account. Both offer low trading fees, and the latter includes volume-based commissions. A demo account and a swap-free Islamic account are also available.

My observations concerning the CFI accounts types are:

- No minimum deposit requirement

- Low trading fees

- Swap-free trading in the Islamic account

- Account base currencies include the USD, EUR, and GBP

- Maximum leverage of 1:500

- Negative balance protection

- A minimum transaction size of 0.1 lots

CFI Demo Account

Demo trading does not grant exposure to real trading conditions and psychological pressures and can create unrealistic trading expectations. I want to caution beginner traders against using demo trading and expecting a full trading simulation with real money. Demo trading is good for education, practice, and familiarizing yourself with a platform and broker.

What stands out about the CFI demo account?

- Fully customizable MT5 demo accounts

- The CFI demo account has no time limit

- Convenient demo account management via the secure dashboard

- Traders can request a demo account via the CFI App

Trading Platforms

Algorithmic traders are offered a choice between the MT4 and MT5 trading platforms. Non-algorithmic traders can also use these platforms, but they are known to be especially suited to automated trading. Traders can upgrade MT5 via 10,000+ custom indicators, templates, and EAs, while CFI offers integrated Trading Central services.

Social traders can connect their CFI account to TradingView, where 50M+ peers engage in market discussions, share trading ideas, and deploy algorithmic scripts. CFI also features an in-house mobile app and its CFI Multi-Asset platform for Forex, CFD, options, and equity trading.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my CFI review, the in-house AI trading assistant, Kaiana, powered by OpenAI and Trading Transparency+ to help traders improve their market approach, stood out.

Research & Education

CFI offers actionable trading signals by Trading Central and analyst views published by TipRanks. It also features in-house curated daily technical reports and quarterly reports. Traders may also find trading ideas on the CFI blog.

What about education at CFI?

Education at CFI consists of written content, webinars, and seminars. Trading Transparency+ magnifies the educational value at CFI, and I recommend beginners start their education with the available resources.

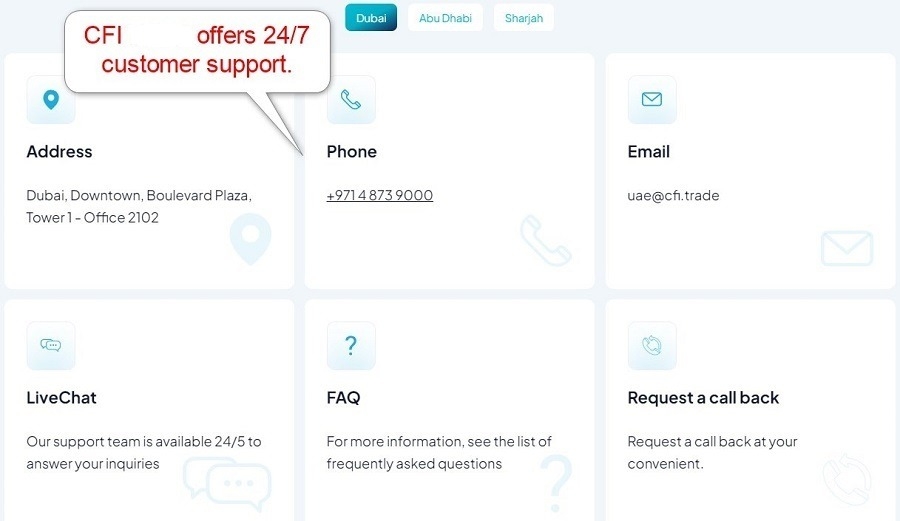

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |   |

Traders can contact customer support 24/7 via e-mail, phone, call back, and live chat. CFI explains its products and services well, and I had no reason to contact them during my CFI review. I recommend traders with questions browse the FAQ section before contacting live chat, which is the simplest method.

Bonuses and Promotions

During my CFI review, the CFI Reward program promised “exclusive access to money can’t buy experiences that reflect your ambitions and lifestyle,” which shows that CFI understands its trader base. Interested traders can register their interest, and CFI will inform them how to qualify.

Awards

CFI lists dozens of industry awards. Three of the most recent ones are the UF Awards for Best CFD Broker MEA 2025, the UF Awards for Best Mobile Trading App MEA 2025, and the Gulf Business Game Changer Awards for MENA's Leading Broker 2024.

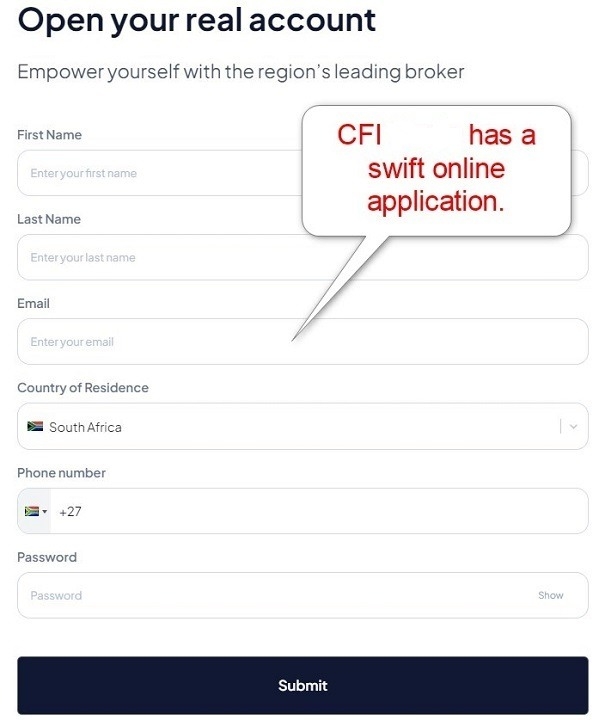

Opening an Account

The CFI online application asks for a name, e-mail address, country of residence, phone number, and desired password. Clicking “Submit” completes the registration, and I appreciate the absence of data mining.

What should traders know about the CFI account opening process?

- CFI complies with global AML/KYC requirements.

- Account verification is mandatory

- Traders can verify accounts by uploading a copy of a government-issued ID and one proof of residency document.

- CFI may ask for additional information on a case-by-case basis.

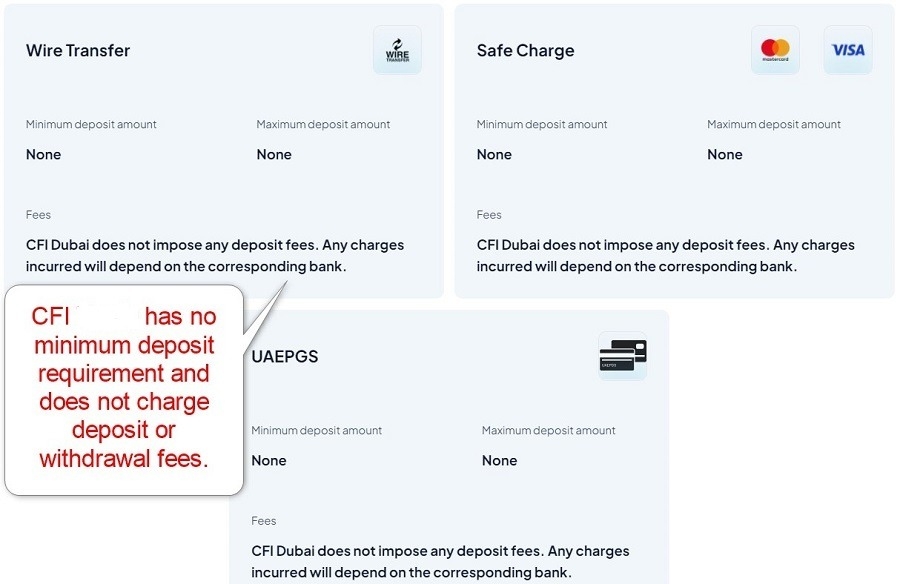

Minimum Deposit

CFI does not have a minimum deposit requirement.

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

CFI accepts bank wires, credit/debit cards, Apple Pay, Google Pay, and UAE PGS. CFI also accepts local payments on the different locations they operate.

Accepted Countries

CFI accepts clients resident in most countries. Its website lists residents of “USA, Sudan, Syria, Republic of Korea and other countries, as those listed to FATF and MONEYVAL recommendations” as ineligible to open an account.

Deposits and Withdrawals

The secure CFI client portal handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at CFI?

- No internal deposit or withdrawal fees exist.

- CFI has no minimum or maximum deposit or withdrawal requirements.

- Third-party payment processing costs and currency conversion fees may apply.

- Deposit currencies include the USD, EUR, and GBP.

- CFI processes withdrawals within 30 minutes during regular business hours.

- A withdrawal hierarchy exists, meaning that traders must withdraw the deposit amount to the payment processor used for the deposit and the remaining balance via bank wire.

- The name on the payment processor and CFI trading account must match, in compliance with AML regulations.

- Payment processor availability depends on the geographic location of traders.

Is CFI a good broker?

I like the trading environment at CFI for its competitive fees and excellent asset selection. Trading tools by Trading Central and TipRanks add value. The in-house AI trading assistant, Kaiana, powered by OpenAI, stands out, and beginners get quality education, including the in-house Trading Transparency+ service. CFI has 13 regulatory licenses, seven in Arab countries, and an excellent track record spanning 20+ years. Therefore, I rank CFI among the best Forex brokers. CFI is a multi-asset broker headquartered in Dubai. The CFI maximum leverage is 1:500. CFI has no minimum deposit requirement. Hesham Mansour and Eduardo Fakhoury founded CFI and continue to own the broker.FAQs

What is CFI ?

What is the maximum leverage at CFI?

What is the minimum deposit for CFI ?

Who is the owner of CFI ?