For over a decade, DailyForex has been the trusted forex broker authority, establishing an unrivaled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions. Once you’ve read our in-depth review of the Australian broker Focus Markets, discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

Focus Markets, founded in 2019, offers traders an excellent choice of cryptocurrency CFDs from the MT5 trading platform. The balanced asset selection offers traders cross-asset diversification opportunities, but I rate Focus Markets as the best choice for cryptocurrency CFD traders. My Focus Markets review evaluated its trading conditions. Is Focus Markets the right choice for you?

Overview

Focus Markets provides cryptocurrency traders with a nice asset selection.

Headquarters | Australia |

|---|---|

Regulators | ASIC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2019 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 5 |

Average Trading Cost EUR/USD | 1.2 pips ($12.00) |

Average Trading Cost GBP/USD | 1.6 pips (16.00) |

Average Trading Cost WTI Crude Oil | $0.30 |

Average Trading Cost Gold | $0.84 |

Average Trading Cost Bitcoin | $325.10 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Focus Markets Five Core Takeaways:

- A $100 minimum deposit

- 1:30 maximum Forex leverage

- A St.Vincent and Grenadines entity for non-Australian residents

- 24/7 (excepting rollover periods) cryptocurrency CFD trading

- No volume-based rebates for high-volume traders

Focus Markets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Focus Markets has one regulated entity.

Country of the Regulator | Australia |

|---|---|

Name of the Regulator | ASIC |

Regulatory License Number | 514425 |

Regulatory Tier | 1 |

Is Focus Markets Legit?

This broker’s Australian entity has been regulated by ASIC since 2019. Therefore, I can recommend Focus Markets as it is a legitimate broker.

Focus Markets Regulation and Security Components

- Regulated by the Australian Securities & Investments Commission

- Founded in 2019

- Segregation of client deposits from corporate funds

- Negative balance protection

What Would I Like Focus Markets to Add?

Focus Markets caters to non-Australian residents from its unregulated but duly registered St.Vincent and Grenadines entity. More transparency about its core management team would further increase trust in this broker.

Fees

Average Trading Cost EUR/USD | 1.2 pips ($12.00) |

|---|---|

Average Trading Cost GBP/USD | 1.6 pips (16.00) |

Average Trading Cost WTI Crude Oil | $0.30 |

Average Trading Cost Gold | $0.84 |

Average Trading Cost Bitcoin | $325.10 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

I consider trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Focus Markets offers a commission-free Raw account and commission-based Standard accounts with typically lower spreads.

Focus Markets does not apply internal deposit and withdrawal fees, except on international Telegraphic Transfer (TT) which does incur a fee. Otherwise, third-party payment processing fees and potential currency conversion fees may apply. I found no mention of an inactivity fee during my Focus Markets review.

The minimum trading costs for the EUR/USD at Focus Markets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.0 pips (Standard) | $0.00 | $10.00 |

0.0 pips (Raw) | $7.00 | $7.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Range of Assets

Focus Markets offers a varied asset selection, allowing traders to achieve cross-asset diversification, but the absence of ETFs is regrettable.

Focus Markets covers the following sectors:

- Forex

- Cryptocurrencies

- Commodities

- Indices

- Equities

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Focus Markets Leverage

Maximum Retail Leverage | 1:30 |

What Should Traders Know About Focus Markets Leverage?

- Forex traders get a maximum leverage of 1:30

- Equity traders get a maximum leverage of 1:5

- Negative balance protection exists

- Traders should always use appropriate risk management with leveraged trading to minimise magnified trading losses.

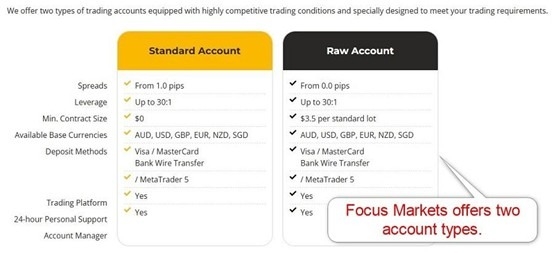

Account Types

Traders can choose between the commission-free Standard account and the commission-based Raw account. Focus Markets also offers a demo account, but a swap-free Islamic account was unavailable during my Focus Markets review.

My observations concerning the Focus Markets account types are:

- A $100 minimum deposit

- AUD, USD, GBP, EUR, NZD, and SGD as account base currencies

- 1:30 leverage with negative balance protection

- Automatic closeouts at 50% margin level

- MT5 trading platform

- The minimum trade size is 0.01 lots

Focus Markets Demo Account

Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders against using demo trading as a full simulation tool. It is best used to learn the basics of trading and to learn about the broker’s platform.

What Stands Out about the Focus Markets demo account?

- Traders can customize the demo account’s starting balance.

- The demo account expires after 30 days.

Trading Platforms

Focus Markets offers the out-of-the-box MT5 trading platform, available as powerful desktop clients, lightweight web-based alternatives, and popular mobile apps. I recommend the desktop client, featuring all the functions, including algorithmic trading. Traders can upgrade MT5 via 10,000+ custom indicators, templates, and EAs.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

No unique feature stood out during my Focus Markets review, as this broker focuses on its core trading environment.

Research & Education

Focus Markets is an execution-only broker and does not publish market research or actionable trading signals.

- Traders should seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Focus Markets offers 24/5 customer support via e-mail, phone, and live chat. I recommend that traders browse the FAQs before contacting support.

Bonuses and Promotions

During my Focus Markets review, neither bonuses nor promotions were available.

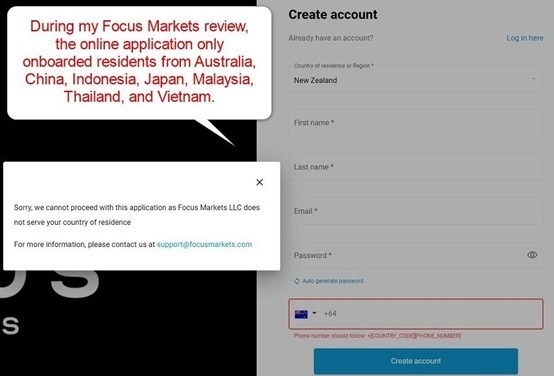

Opening an Account

The Focus Markets online application asks for a country of residence, name, e-mail, and desired username. Clicking “Create account” grants access to the account application process.

What Should Traders Know About the Focus Markets Account Opening Process?

- Focus Markets complies with mandatory account verification, as stipulated by regulators in compliance with global AML/KYC rules.

- Account verification is mandatory.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- Focus Markets may ask for additional information on a case-by-case basis.

Minimum Deposit

The Focus Markets minimum deposit is $100 or a currency equivalent.

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

Focus Markets accepts bank wires, credit/debit cards, Skrill, and China UnionPay.

Accepted Countries

During my Focus Markets review, only Australia, China, Indonesia, Japan, Malaysia, Thailand, and Vietnam were accepted countries.

Deposits and Withdrawals

The Focus Markets back office handles financial transactions for verified clients.

What are the Key Takeaways from the Deposit and Withdrawal Process at Focus Markets?

- The minimum deposit is $100 or a currency equivalent.

- An internal $20 deposit and withdrawal fee exists for each Telegraphic Transfer (TT).

- Focus Markets does not list a minimum withdrawal amount.

- Traders must submit their wire transfers by 1:00 p.m. AEST for same-day processing.

- Third-party payment processing costs and currency conversion fees may apply.

- The name on the payment processor and Focus Markets trading account must match in compliance with AML regulations.

Is Focus Markets a good broker?

I like the trading environment at Focus Markets for cryptocurrency CFD traders due to the asset selection of 90+ cryptocurrencies. Focus Markets is an execution-only broker that does not specifically cater to beginners. MT5 is a quality trading platform, and the Raw account offers competitive trading fees, but a volume-based rebate program is missing. Overall, traders can consider Focus Markets a good broker. Focus Markets processes withdrawals within 1 to 5 business days. The Focus Markets minimum deposit is $100 or a currency equivalent. The ASIC regulated Focus Markets since 2019. Focus Markets has its headquarters in Australia.FAQs

How long does it take to withdraw from Focus Markets?

What is the Focus Markets minimum deposit?

Is Focus Markets regulated?

Where is Focus Markets located?