Editor’s Verdict

My Funded Futures, a US-based retail prop trading firm founded in 2022, offers one-step verification and a clear path to managing a live account. It supports six trading platforms, and the minimum funded account is $50,000 with a maximum payout ratio of 90%, but traders get 100% of the first $10,000. My in-depth My Funded Futures review evaluated the trading conditions and environment. Should you consider My Funded Futures as your prop trading firm?

The Pros and Cons of My Funded Futures

Traders should consider the pros and cons of the prop firm My Funded Futures. I have summarized the ones that stood out the most during my My Funded Futures review.

Overview

My Funded Futures offers prop traders low-cost funded accounts with crypto withdrawals.

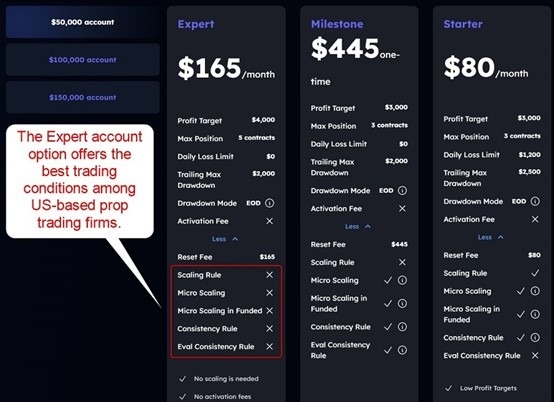

I like the trading platform choices at My Funded Futures and the low monthly subscription fees. The Expert option stands out for having no scaling rules, micro scaling restrictions, or consistency rules. Prop traders keep 100% of the first $10,000 they earn before an industry-leading 90% profit share applies.

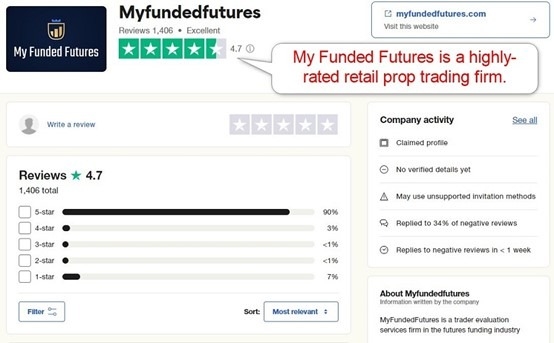

My Funded Futures Trustworthiness and Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is My Funded Futures Legit and Safe?

My Funded Futures, founded in 2022, lacks operational history, but it has a 4.7 out of 5.0 rating on Trustpilot based on 1,406 reviews.

During my My Funded Futures review, I found numerous complaints about withdrawals, rule changes that negatively impacted prop traders, and dismal customer support. I advise traders to consider the negative comments skeptically, as they could come from traders who have failed the evaluation or violated trading rules. Therefore, I cautiously rate them as a prop trading firm interested traders could try to establish a rapport with.

My Funded Futures Features

My Funded Futures follows best practices established across the expanding prop firm industry.

The most notable features of My Funded Futures are:

- One-step evaluation

- No time limits during the evaluation process

- A minimum of one trading day to reach the profit target

- At least one trading day per seven days to avoid inactivity fees

- No daily drawdown limit

- No scaling or consistency rules for the Expert account option

- A monthly fee per funded account

- Six trading platform choices

- 90% profit share, but prop traders keep 100% of their first $10,000

- No single profit can exceed 40% of the overall profit per payout cycle

- Traders can use copy trading software to copy their trades across a maximum of ten accounts

- No news trading (dependent on the account type)

Evaluation Fees and Profit-Share

Prop traders at My Funded Futures pay a monthly fee per funded account. They can choose from three account sizes of $50,000, $100,000, and $150,000, and from three account options: Starter, Milestone, and Expert. The monthly fees are as low as $80 and as high as $665, placing My Funded Futures among the most competitively priced prop firms in the US.

Please note that traders cannot change the account value once approved, meaning if they qualify on a $50,000 account, they will manage a $50,000 portfolio. The profit share at My Funded Futures starts at 100% for the first $10,000 in profits and adjusts to 90%, allowing traders to earn the industry maximum.

The minimum evaluation fee at My Funded Futures for a $50,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $0 |

Monthly evaluation fee | $80 |

Hold-over-the-weekend | $0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $50,000 account | $80 |

Account Types

My Funded Futures has a one-step verification process for its three account types with three sub-account options. The account sizes are $50,000, $100,000, and $150,000. Prop traders can have up to ten funded accounts.

The sub-account options are Starter, Milestone, and Expert. I highly recommend the Expert option, which offers the best trading conditions.

What Are the Trading Rules at My Funded Futures?

The My Funded Futures evaluation begins after prospective prop traders choose their preferred evaluation account and pay the monthly fee. There is no time limit, and traders can qualify in as little as one day, while the profit target depends on the account size, starting with $3,000 on a $50,000 account and a $2,500 trailing threshold.

Traders can reset their evaluation account if they violate the trading rules by paying the initial fee again.

The trading rules for the My Funded Futures evaluation are:

- No single trade can exceed 40% of profits (20% in the Milestone option)

- Traders cannot exceed the maximum contract size limit

- A minimum of one trading day per seven-day cycle

Noteworthy:

- My Funded Futures will grant access to live trading accounts after traders pass the evaluation

Trading Platforms

My Funded Futures works with TradingView, Volumetrica, Volsys, NinjaTrader, QuanTower, and Tradovate. During my My Funded Futures review, qualifying traders managed live trading accounts. Therefore, the maximum leverage was 1:1, meaning prop traders can only trade the funded account size, which makes sense from a risk management perspective.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Education

My Funded Futures does not offer education, and beginners should never consider prop trading. Prop traders get a series of blog posts and YouTube videos. They feature general and promotional content, plus content with educational value but not structured education.

Customer Support

One issue during my My Funded Futures review was complaints about customer support response times and the quality of responses. The FAQ section answers many questions before traders sign up for a funded account, and My Funded Futures offers 24/7 live support via chat.

I am missing a direct line to the finance department, where most issues could arise, and I found many complaints concerning withdrawals. Customer support is an area where My Funded Futures must improve.

How to Get Started with My Funded Futures

Interested prop traders can start the evaluation after selecting their desired package and paying the monthly fee.

Minimum Evaluation Fee

The minimum monthly fee at My Funded Futures is $807 for the $50,000 funded account with the Starter configuration.

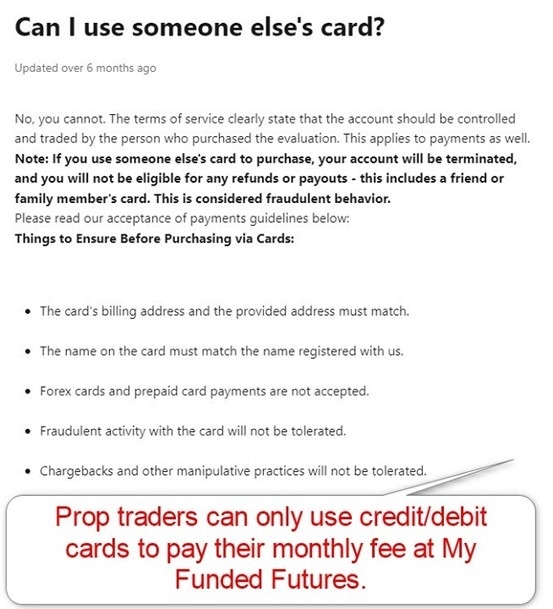

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

My Funded Futures relies primarily on credit/debit cards for transactions.

Accepted Countries

My Funded Futures accepts traders from 120+ countries.

Here is the latest restricted country list, as discovered during my My Funded Futures review:

Afghanistan | Côte d'Ivoire | Laos | Slovenia | Albania | Crimea |

Lebanon | Somalia | Algeria | Croatia | Liberia | South Sudan |

Angola | Cuba | Libya | Sri Lanka | Bahamas | Democratic Republic of Congo |

Mauritius | Sudan | Barbados | Ecuador | Mexico | Syria |

Belarus | Ethiopia | Mongolia | Trinidad and Tobago | Bosnia & Herzegovina | Ghana |

Montenegro | Tunisia | Botswana | Iceland | Nicaragua | Turkey |

Bulgaria | Indonesia | North Korea | Uganda | Burma (Myanmar) | Iran |

Pakistan | Ukraine | Burundi | Iraq | Panama | Vietnam |

Cambodia | Jamaica | Papua New Guinea | Venezuela | Central African Republic | Kosovo |

Russia | Yemen | Serbia | Zimbabwe | Burkina Faso | Kenya |

Philippines | Cameroon | Macedonia | Qatar | China | Mali |

Romania | Gibraltar | Mozambique | Senegal | Haiti | Myanmar |

South Africa | Hong Kong | Namibia | Tanzania | Jordan | Nigeria |

United Arab Emirates |

How to Pay the Evaluation Fee

Prop traders can pay their evaluation fee via credit/debit cards. Please note that Forex and prepaid debit cards are not accepted.

The Bottom Line - Is My Funded Futures a Good Prop Firm?

I like My Funded Futures for its trading platform choice, low-cost monthly subscription fees, and trade copier to manage up to ten accounts. An industry-leading 90% profit share exists, but prop traders keep 100% of their first $10,000. My Funded Futures offers live accounts without trading leverage, but its withdrawal and account sub-classifications are unnecessarily complex and confusing. My My Funded Futures review found the usual complaints about prop trading firms. Still, I cautiously recommend My Funded Futures to retail prop traders if they opt for the Expert account. My Funded Futures permits up to ten live accounts per trader. Potential prop traders must pay a monthly fee and pass a challenge to get access to live portfolios. My Funded Futures takes a 10% fee, plus the monthly subscription fees, of profits and grants 90% to traders, but traders keep 100% of their first $10,000. Traders can pass the My Funded Futures challenge in one day. My Funded Futures, like all retail prop trading firms, is not regulated. My Funded Futures processes withdrawal requests daily, Monday through Friday until 3 p.m., but my My Funded Futures review found the usual withdrawal complaints.FAQs

How many funded accounts can I have with My Funded Futures?

How does My Funded Futures work?

Can I pass My Funded Futures in one day?

Is My Funded Futures regulated?

Does My Funded Futures pay out?