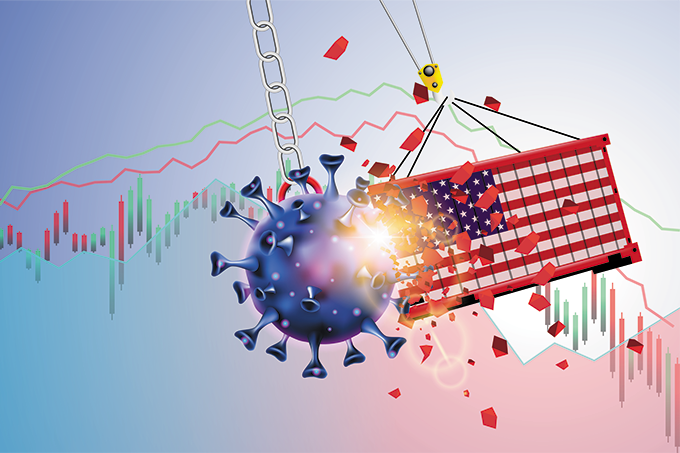

US Market Continues Rising After Inflation Data; Chinese Stimulus Looks Likely in 2022

The following Forex news reports are the latest developments of the Forex market. The news reports are updated frequently and include all the events that affect the foreign exchange trading industry.

Most Recent

US inflation rises again this month to reach its highest level since 1982, but financial markets barely reacted.

Pound Weakens on New Corona Restrictions; Bank of Canada Keeps Policy Steady

Top Regulated Brokers

Stocks Strong on SA Omicron Data; Commodities, Crypto Stronger

Stocks Rise on Hints that Omicron is Mild; RBA Boosts Aussie

Major Cryptos Down Since Friday; COT Shows 2-Year High in Dollar Bulls

Last Friday’s NFP data showed a strong undershoot in new US jobs created last month, but markets remain relentlessly focused on US inflation and the virulence of the omicron coronavirus variant.

As crude oil falls lower and lower on declining demand, producers agree to increase production anyway.

Likely Omicron Impact Remains Unclear; Turkish Lira Hits Record Low Again

Bonuses & Promotions

The discovery of the new omicron coronavirus variant and the Fed Chair’s more hawkish tilt on tapering, rates, and inflation have injected volatility and fear into markets – but the outlook is uncertain.

Fed Suggests Benign Omicron May Drive Earlier Tapering End, Removes “Transitory” Language; Omicron Morbidity Remains Unclear; Markets Volatile

Likely Omicron More Resistant to Vaccines, Infectious; Omicron Morbidity Unclear; Stocks Lower; Japanese Yen Strong, Commodity Currencies Weak

Very Early Signs Omicron Manageable; US & Europe Stocks Rebound; Japanese Yen Strong, Commodity Currencies Weak

FOMC Minutes Have Little Effect; US GDP Slightly Undershoots; USD/JPY at 4-Year High; EUR/USD at 1-Year Low

US Preliminary GDP data released earlier today shows the US economy is growing at an annualized rate of 2.1%, slightly lower than the 2.2% expected by analyst consensus.