The USD/JPY pair fell during the session on Thursday as the Federal Reserve continued to expand its monetary easing policies. The larger than expected package rocked the markets and as such the US dollar got pummeled in afternoon trading. The expansion included $40 billion worth of MBS purchases each month going forward, and a pledge to keep easing until well after an economic turnaround happens.

Because of this, it makes perfect sense that the Dollar would lose value. However, this pair is quite a bit different than many others as it has a competing central bank. After all, the Federal Reserve in the Bank of Japan is in a bit of a currency war at the moment. Both banks want to see weaker currency out of their own countries to advance their competitiveness. Quite frankly, the Bank of Japan is a master at this game, but the only central bank in the world it has more power at it seems to be the Federal Reserve.

Strange action in this pair

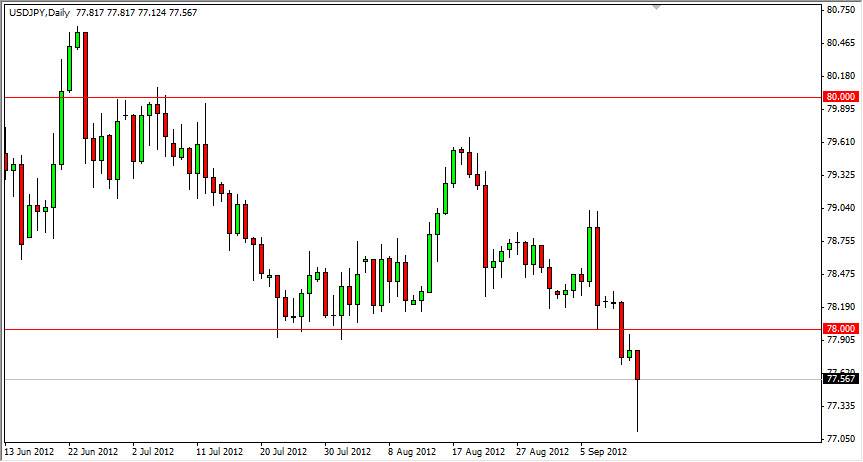

What I found so interesting about the move on Thursday was the fact that we got the significant fall, but saw a significant bounce from the lows. The lows were at just above the 77 handle, and this does suggest that perhaps this pair could have been manipulated a bit towards the end of the day. We know that the Bank of Japan has admitted openly to clandestinely intervening in the currency markets somewhere in this general vicinity. Because of this, I am not completely convinced of the Bank of Japan didn't step back.

If you look at the candle, it is an absolutely wicked hammer and a strong buy signal under normal circumstances. I still think we need to get well above the 78 handle in order to be confident going long this pair, but I certainly don't plan on selling it as the central bank will or than likely do something to stem the value of the Yen. In fact, I am looking for buying signals for the spare, but would need to see the market move back over the 78 handle decisively to be convinced that we can go any farther.