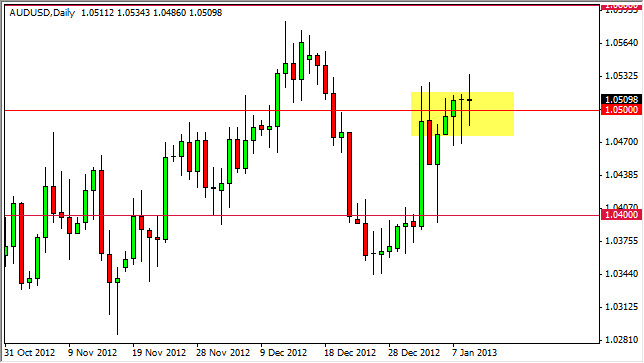

The AUD/USD pair had a back-and-forth session during the Wednesday trading hours, but what struck me the most about this pair is the fact that we are hanging tough just above the 1.05 level. Also, you have to keep in mind that the Monday and Tuesday candles were both hammers, which of course suggests that the sellers try to push the pair down below the 1.05 level and failed. Because of this, the fact that we have proven it to be supportive yet again tells me that there is quite a bit of buying pressure in this market.

Of course, the first question will be whether or not we can go higher. After all, we tried to rally during the session but failed. I believe this is the first attempt to break out, and as a result will have cleared out some of the weaker hands above. The 1.06 level above is the first target for the buyers in my opinion. I think that is exactly where they are going to be aiming for in the short run.

1.08 And 1.10

I still think that if we can get above the 1.06 level on a daily close, we could see a significant run higher. The 1.08 and 1.10 levels both would make sense, as we keep grinding higher in this market in both of those areas look resistive. Also, you have to keep in mind that this consolidation area we've been stuck in runs about 400 pips tall, and this is what you would measure for the move. I have no doubt that we can hit 1.10 over the longer-term.

As for shorting this pair, I see far too many minor support levels below to be interested. Quite frankly, we would have to break down below the 1.03 level for me to even entertain the idea. It's not that we can't go lower; it's just that it will be a lot of work for the sellers to do, and as such I think there will be easier trades out there if we go back into the "risk off" mode.