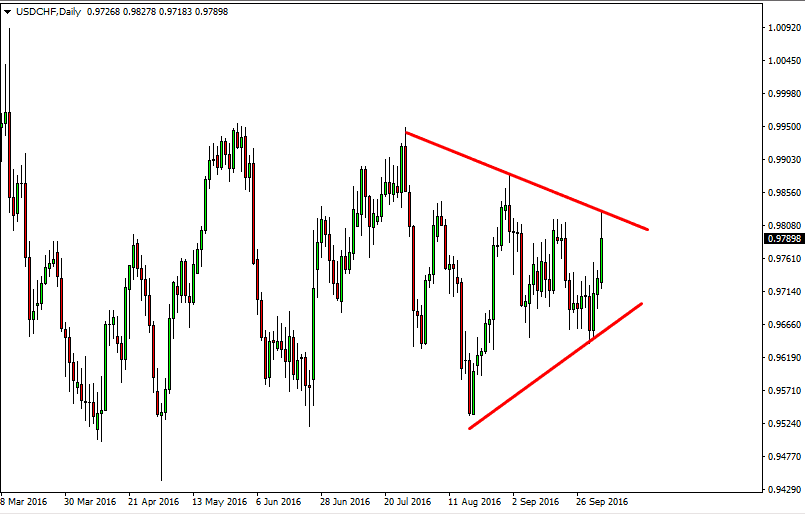

Today’s USD/CHF signal

Risk 0.25%

Trades may be entered anytime during the day.

Trade 1 - Long

• a break above 0.9840 signals increasing bullish pressure, at that point in time the market is breaking out of asymmetrical triangle.

• Place the stop loss near the 0.98 handle.

• Move the stop loss to breakeven as soon as the market reaches 0.99 above.

• Once you move the stop loss to breakeven, take half off for profit.

Trade 2 – Short

• another failure nearly 0.9840 level could trigger selling.

• Sell and aim for 0.9750 below

• stop loss should be at 0.9855

USD/CHF analysis

As we have been grinding back and forth, and makes sense that sooner or later we have to make a decision. Both of these are considered to be safety currencies, so that could be let’s been driving most of the recent action. With this, simply waiting for a breakout of the triangle makes the most sense.