EUR/USD

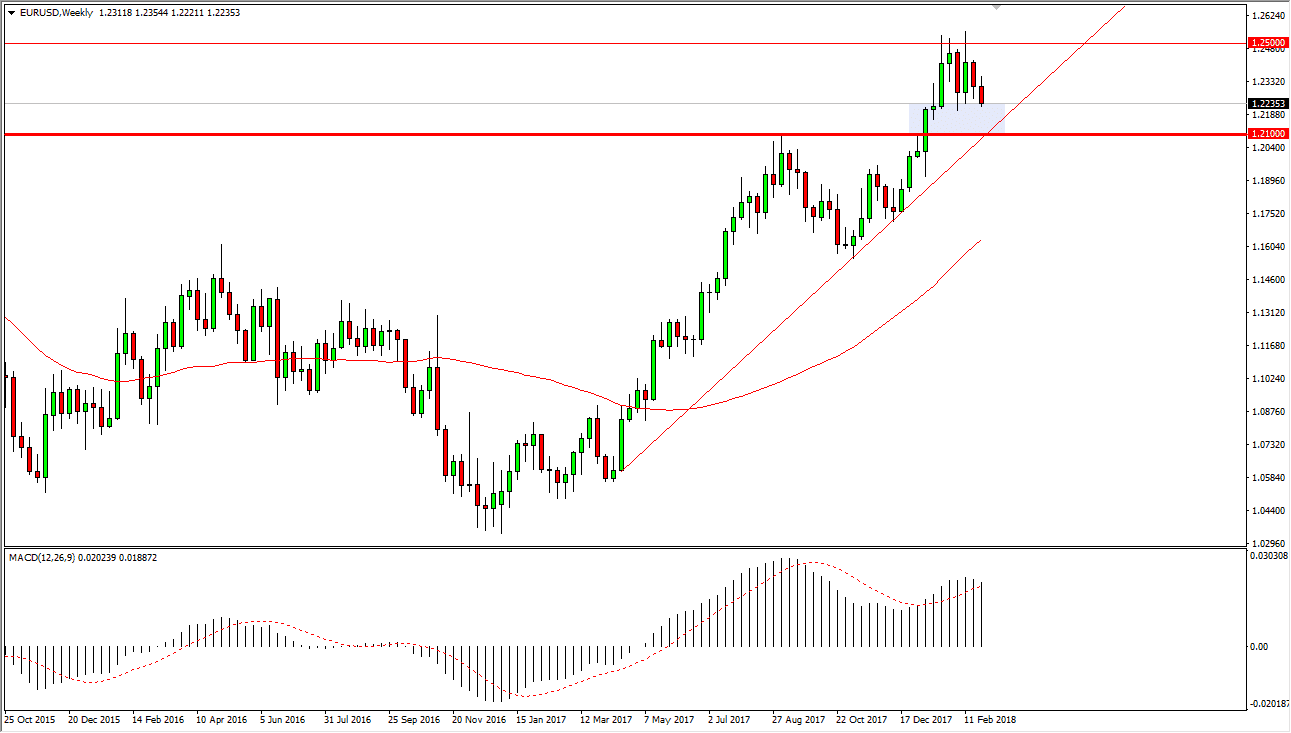

The Euro was noisy during the month of February, and I believe it will continue to be. On the weekly chart, you can see that I have a lavender box underneath current pricing, and I believe that will be an area of significant support. I think the support extends down to the 1.21 level, an area that was structurally resistive in the past, and I think at this point we are probably going to reach towards the 1.21 handle again. It coincides nicely with an uptrend line, which of course will also offer support. I believe that it is only a matter of time before the buyers return, so therefore I think by the end of the month, this pair should be higher, and perhaps even trying to reach towards the 1.25 handle.

It is well-known that the Federal Reserve is going to raise interest rates, but now we are starting to factor in the idea of the European Central Bank cutting back on quantitative easing, which is essentially the same thing. I think this market continues to rise, and although it is a bit counterintuitive, history tells us that quite often the markets will sell off the US dollar going into an interest rate hike cycle. This is because the market has already priced in the potential of the move at least 6 months ahead of time. We are now focusing on what’s going on in Brussels more than Washington DC. Remember, the “smart money” has already put its capital to work and should continue to favor the upside in general. I think that if we break down below the uptrend line, that could change some things, especially if we break down below 1.20, but I don’t think it’s going to happen. However, we always have to keep an eye on the potential opposite move. On that breakdown, I would anticipate a return to the 1.16 level.