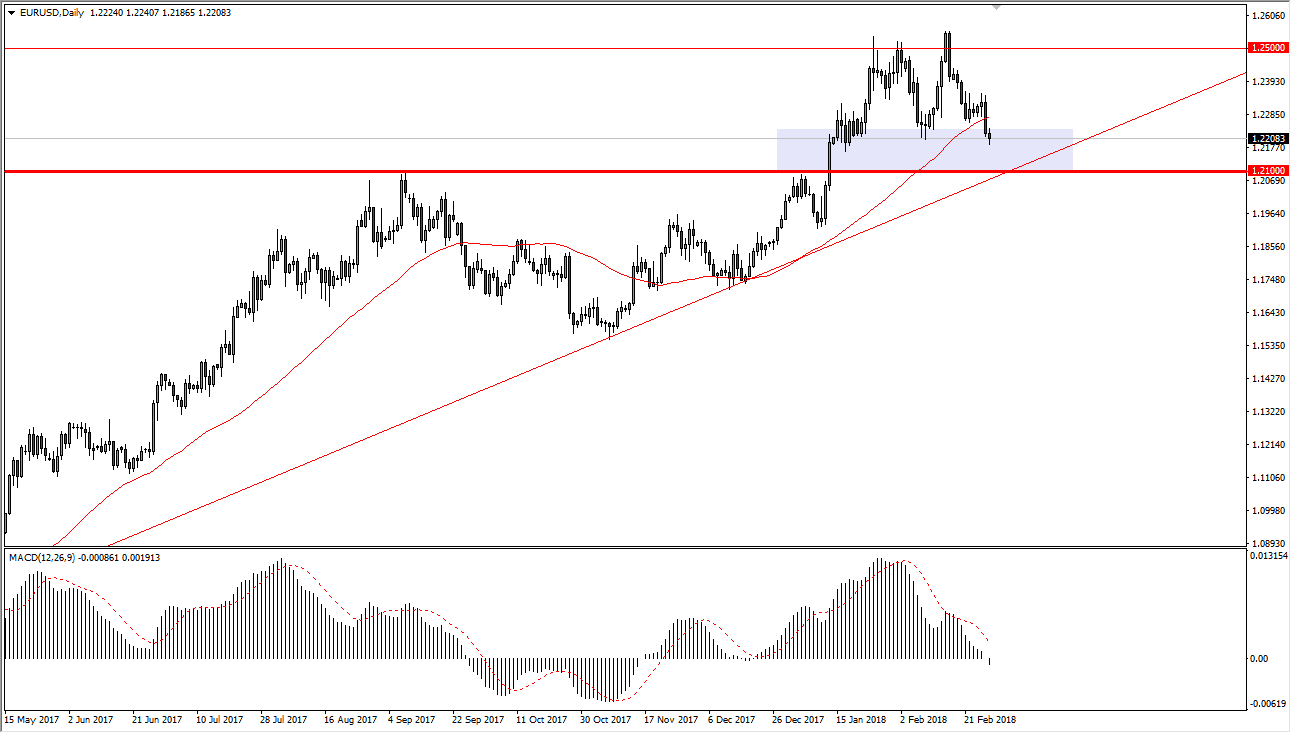

EUR/USD

The EUR/USD pair has gone back and forth during the trading session on Wednesday, as we continue to see softness in the market. However, there are so much in the way of support underneath that I have no interest in shorting. I think that the 1.21 level underneath is massively supportive, as it was massively resistive. You can see that I have a lavender box on the chart that shows where we have a lot of potential support and noise, so I’m waiting to see some type of bounce underneath that I can take advantage of, so I can join the longer-term uptrend. I also recognize that there is a nice uptrend line just below, which crosses the 1.21 level, and could offer yet another reason for the buyers come back. I have no interest in shorting this market if we can stay above 1.21 over the next several sessions.

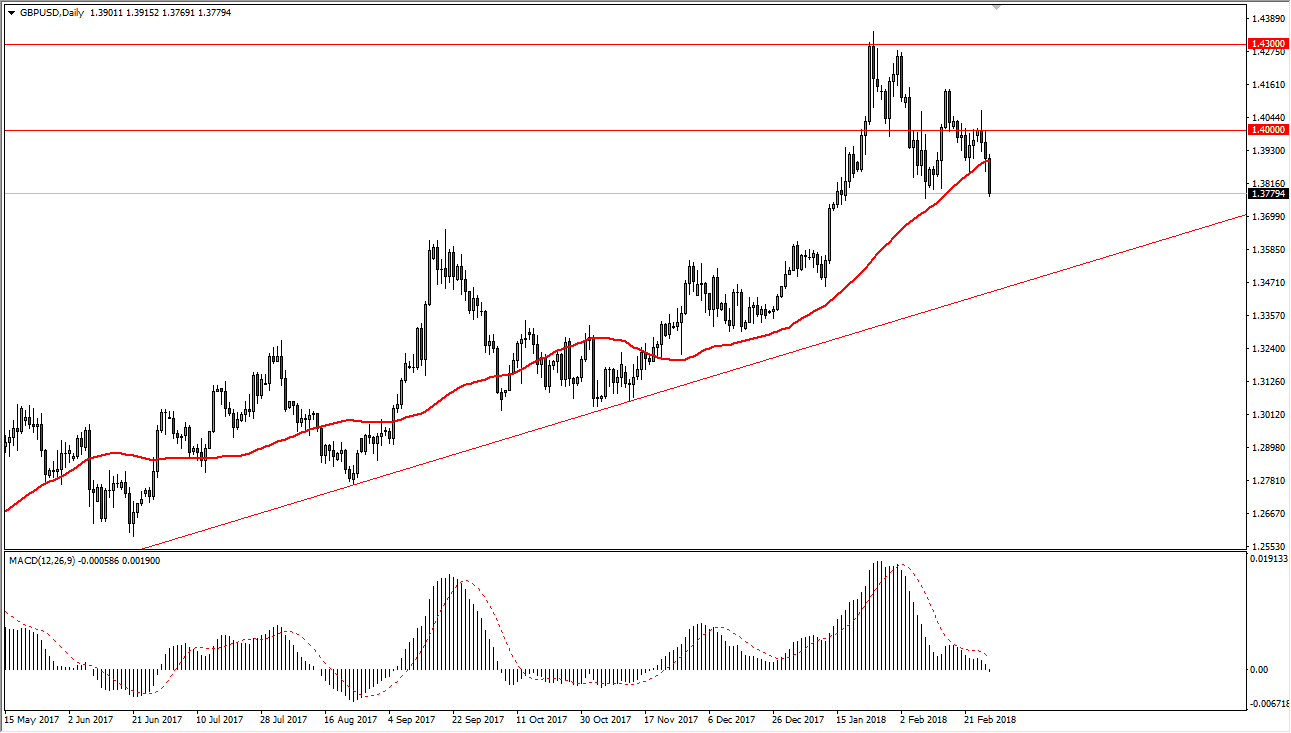

GBP/USD

The British pound has broken down rather significantly during the trading session on Wednesday, reaching down towards the 1.3750 level. If we break that level, then the market probably goes down to the 1.3650 level, an area that has been very important in the past. We also have a coinciding uptrend line, so just like in the EUR/USD pair, I think we could drift a little bit lower but there is much more support underneath that will probably make for a nice longer-term trade to the upside. If we were to break down below the uptrend line, then I feel that the British pound will break down rather drastically. Otherwise, I think it’s just a matter of short-term selling, followed by a longer-term “buy-and-hold” opportunity presented itself. The US dollar has strengthened due to treasury markets over the last several sessions, but I think that might be a bit overdone.