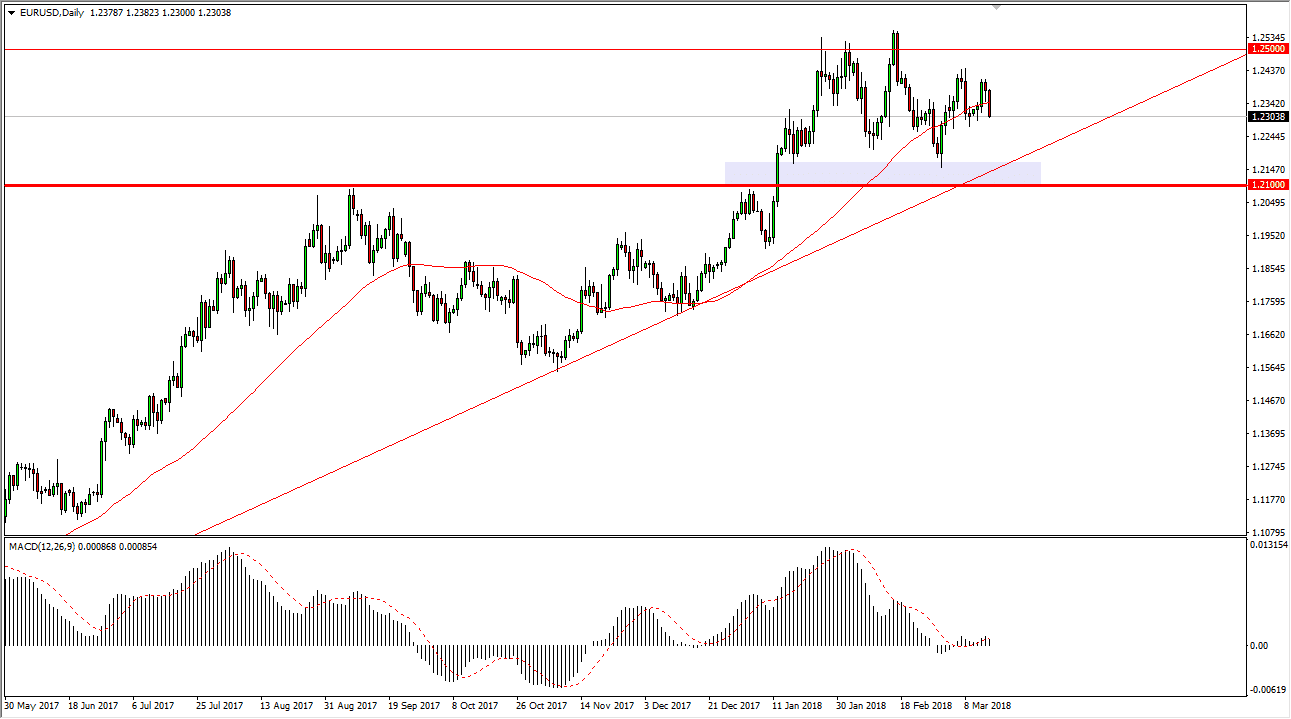

EUR/USD

The EUR/USD pair broke down significantly during the trading session on Thursday, breaking down below the bottom of the hammer that had seen support at the 50-day EMA during the Wednesday session. Because of this, the market reached down to the 1.23 level, and we could continue to go lower from there. Ultimately, I see the uptrend line underneath as the “floor” for the market, and of course the 1.21 handle as well. If we were to break down below both of those, the trend would change completely and probably break down. I expect to see the markets looking for buyers just below, so don’t be surprised at all if we rally from here. In general, I suspect that we need to consolidate for a while, at least until we get some type of clarity and direction.

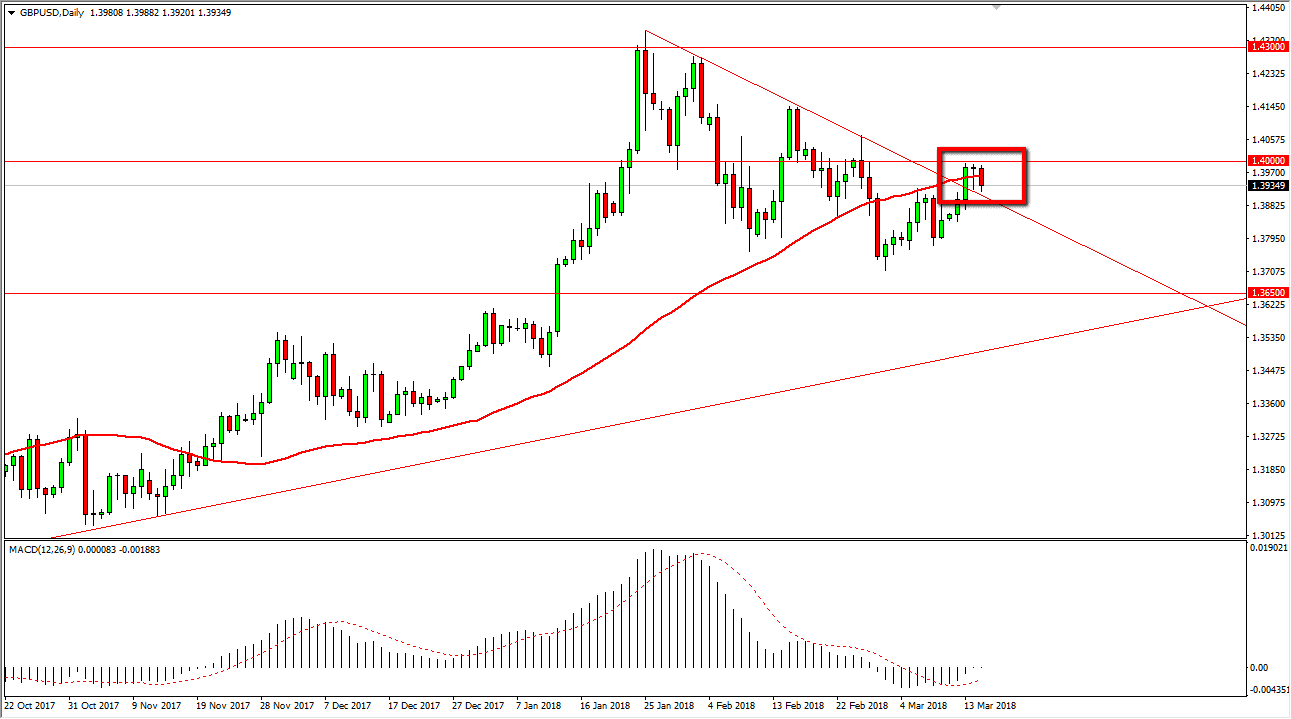

GBP/USD

The British pound fell significantly during the trading session on Thursday, reaching down towards the bottom of the hammer from the previous session on Wednesday. It looks as if the previous downtrend line is starting to offer support again, so I think that the market could bounce from here and try to break above the 1.40 level. If we do, the market should continue to go even higher, and that would be more of a buying opportunity then I see right now. However, if we were to break down below the 1.3850 handle, the market probably falls from there and down to the 1.3650 level. We are at a very important level right now, and I think that we could perhaps see a lot of choppiness in the meantime. I have a couple of parameters laid out as mentioned previously, and therefore once we make that move, I’m willing to jump in. Until then, it’s probably best to just observe.