Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Short Trades

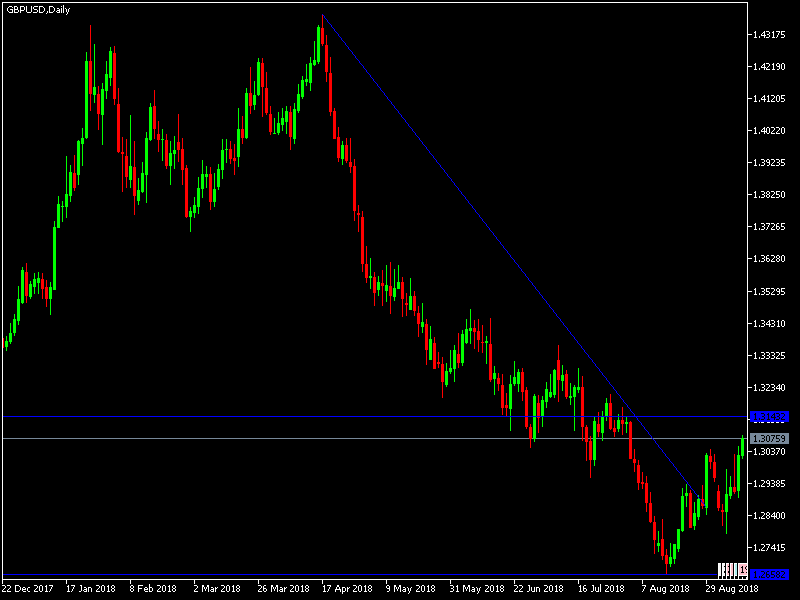

- Go short following a bearish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.3070 or 1.3150.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trades

- Go long following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.2900.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

New optimistic Brexit news supported new gains in this pair, which moved up to 1.3060. Gains are supported by statements by an EU negotiator on the possibility of reaching Brexit agreement within three to four weeks. Investors will need further clarification and details for the pair to complete the correction to the upside. On the other hand, the ongoing US-China trade war will continue to be a catalyst for further gains for the US dollar. The Pound will remain bullish for a while until the final agreement on trade relationship between the two sides is reached.

Regarding the GBP, there will be the release of the change in British jobs data, average wages and unemployment rate. Regarding the USD, there will be the release of the Job Opening Data.