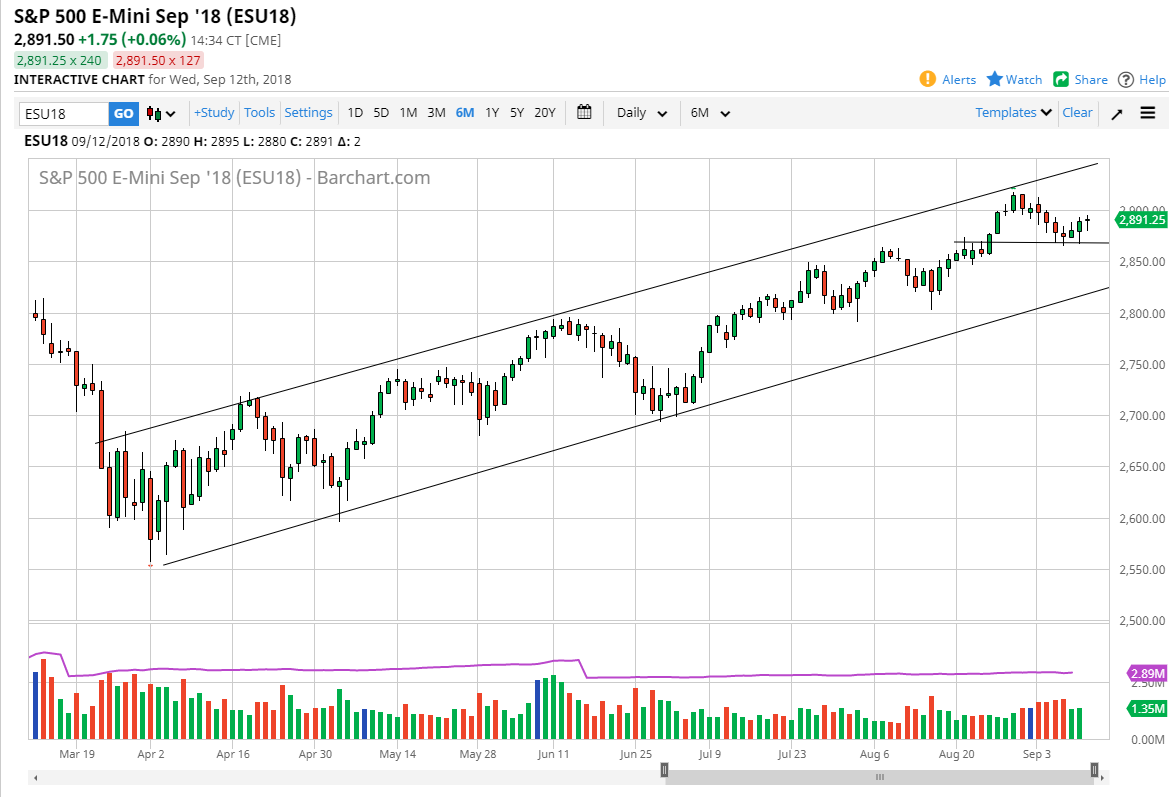

S&P 500

The S&P 500 has been very volatile but ended up forming a bit of a hammer during the trading session on Wednesday which is very positive. I think that the market is ready to rally again, and now it looks like only a matter time before we go looking for moves above the 2900 level. Once we get above that level, the market should then go looking towards the highs and then the 3000 handle. Beyond that, the market should continue to find buyers on dips as it has proven itself to be extraordinarily resilient. A break down below the lows from last week could send this market down towards the 2850 handle, but I believe that market participants will continue to look at this market as one that offers value on dips.

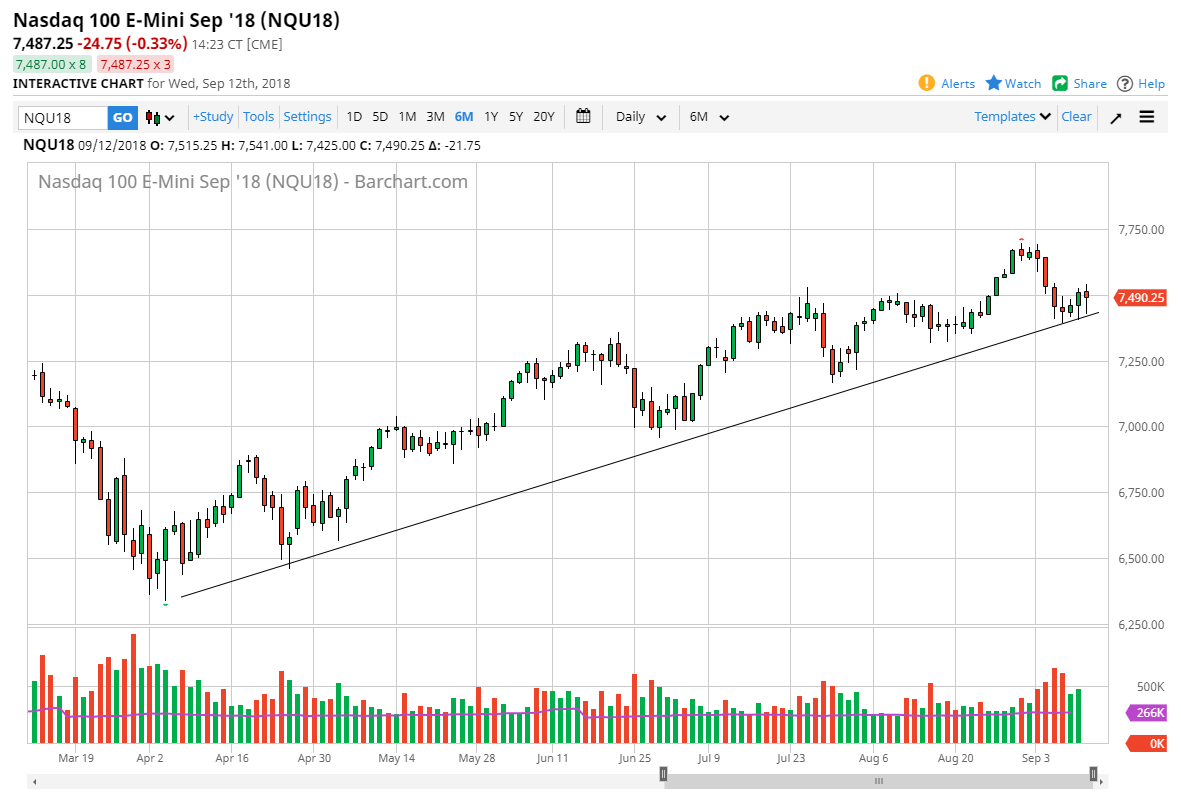

NASDAQ 100

The NASDAQ 100 has pulled back during the trading session on Wednesday, showing signs of support at the uptrend line yet again. Ultimately, I think at this point the market is probably going to continue to try to go higher, so therefore I am a buyer of dips as the trend line has proven itself to be so resilient. The 7700 level above would be the target, and I think that we would go much higher than that given the chance. At this point, every time we selloff it seems to be an opportunity to pick up value in this market. If we were to break down below the uptrend line, then the 7250 level would be targeted next. Overall, I fully anticipate that the trend is very much intact, especially considering that the US and China look likely to be talking again relatively soon.