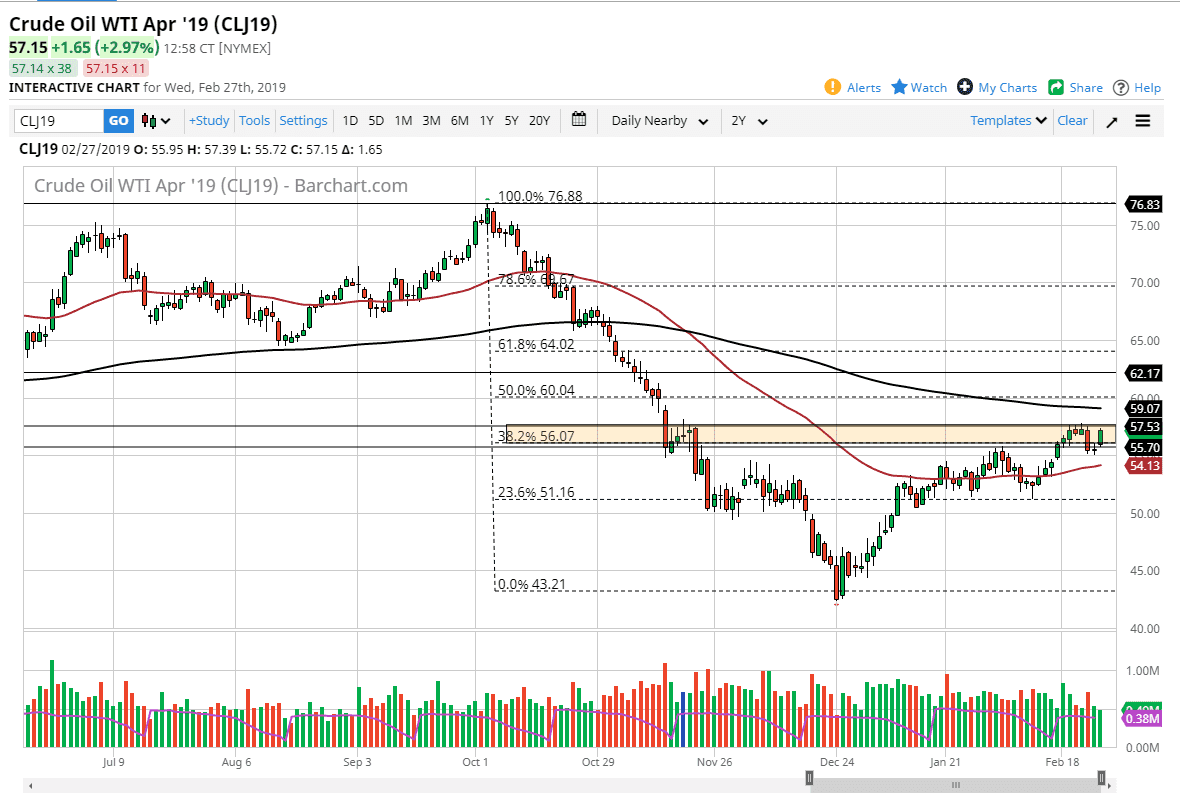

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Wednesday as the inventory numbers were extraordinarily bullish. In fact, we expected a 2 million barrel build, but got a slightly larger than $8 million withdrawal. This shocked the market straight up in the air like a rocket, but it is not lost upon me that we have struggled at the same level that we cannot break above. It now looks as if the $57.50 level is going to be massive resistance, and it’s not until we break above there significantly that I think the market is free to go higher. As a proxy, I am using the candle stick from last Friday, which has a high at roughly $57.80 at the top of the shooting star. While the day was very impressive, it hasn’t changed much and that might be another piece of the puzzle when it comes to where we are going considering that we could break out. I suspect a pullback is coming.

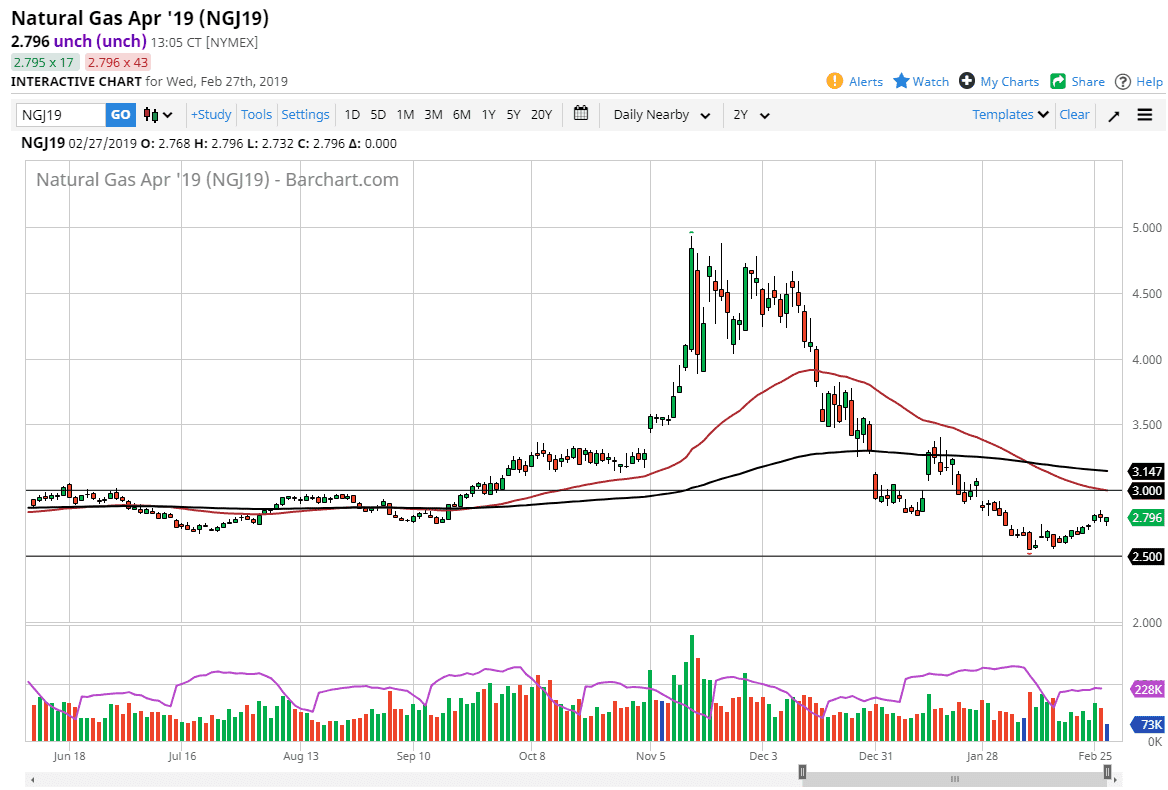

Natural Gas

Natural gas markets pulled back to slightly during the trading session but turned around to pick up a bit. The market looks as if it is ready to continue to grind to the upside, it’s very likely that the market is going to try to go higher to fill the gap near the $3.00 level. I’m looking for signs of exhaustion near that area that take advantage of and start shorting right away. The 50 day EMA sits right at the $3.00 level as well, so that’s another reason to think that the sellers will return. Were in a downtrend, but the $2.50 level underneath is massive support. With this being the case, I like the idea of shorting a rally towards the three dollars, but we may have to sit on our hands for several more days.