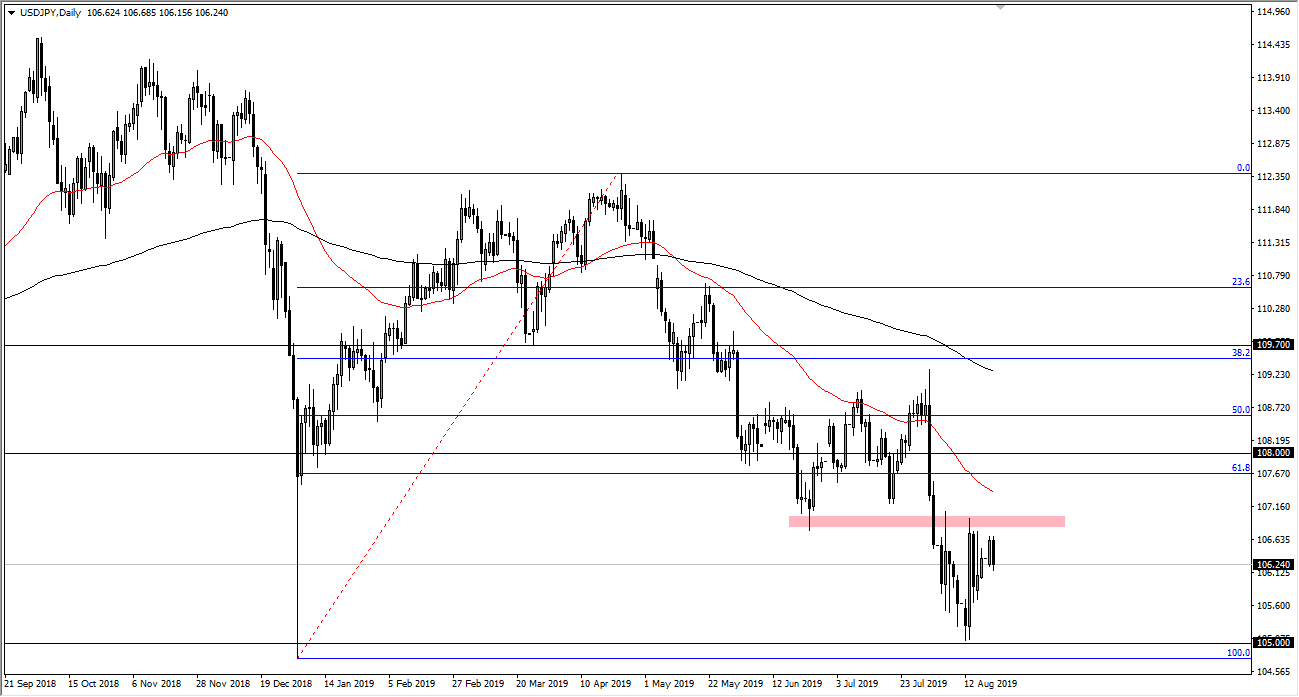

Even though the US dollar had a strong couple of days against the Japanese yen, the Tuesday session was of course very negative. In fact, we wiped out the gains from the Monday session and that shows signs of negativity in general. At this point, we have been in a downtrend and this was simply a continuation of what had been the case for some time.

To the upside, the ¥107 level has been resistant, and I think that will continue to be the case. The 50-day EMA is just above and continuing to tilt lower, perhaps reaching towards the ¥107 region. It is because of this that I think that the market will struggle to get above that level for any significant amount of time. In fact, we need to see some type of significant gain in risk appetite around the world to turn this thing around. All things being equal though, there are enough geopolitical concerns out there to keep traders looking for the Japanese yen to find safety. Ultimately, although the US dollar has strengthened against most currencies it is on its back foot in this pair, as is the case typically when we are struggling.

The ¥105 level never got broken at the last attempt, so this bounce is probably going to be the market trying to build up enough momentum to finally do that. Ultimately, I think that if we can break below the ¥105 level, the market is likely to go down to the ¥102.50 level. After that, it’s likely that we go down to the ¥100 level which is an area that will attract a lot of attention from not only the media and speculators, but also from the Bank of Japan. Because of this, I think that we could get a bit of a bounce from there, once we finally get down to that level. In the meantime, I am simply looking for short-term rallies that I can take advantage of to start shorting. The trend is downwards, and quite frankly there’s nothing on this chart that suggests that we are going to turn around and suddenly break this downtrend. Beyond that, the Japanese yen has been strengthening against most other currencies around the world, so it makes sense that we continue to see plenty of strength to the downside here.