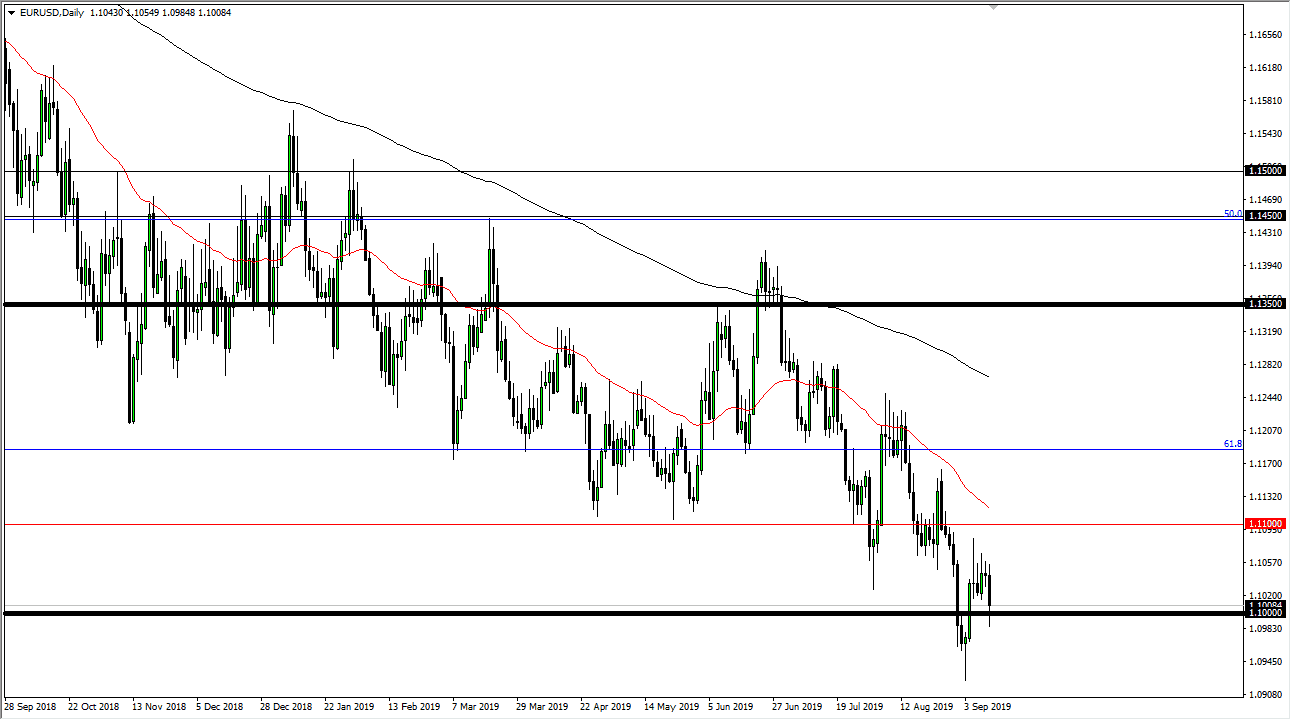

The Euro fell a bit during the trading session on Wednesday, slicing through the 1.10 level yet again. However, we have the European Central Bank coming out with an interest rate decision on Friday, and that of course will have a massive influence on what we do over the next couple of days, ultimately, this is a market that is going to continue to react to the 1.10 EUR level which is an area that is a large, round, psychologically significant figure. We had formed a hammer underneath that level, so now it’s obvious that it is a “line in the sand” that traders will pay attention to.

At this point, the market is well below the 61.8% Fibonacci retracement level, which should send this market down to the 100% Fibonacci retracement level. If that’s going to be the case, it’s likely that the market has much more to go to the downside, perhaps as low as the 1.05 level given enough time. That doesn’t mean that we are going to get there in the next few days, but it’s very likely that we are going to see more of a grind to the downside, as the market continues to be very volatile and ugly.

To the upside, the 50 day EMA which is painted in red on the chart should be a barrier as it approaches the 1.11 EUR level, an area that has been difficult as of late, and now that we have seen more downward pressure, it looks as if we continue to see a lot of dovish attitude out of the ECB, it’s very likely that the Euro could continue to go much lower. Overall though, at this point I think it’s only a matter time before the ECB produces a “bazooka” when it comes to monetary policy. If that happens, then we should continue to go much lower. However, if we get some type of shock or hawkish statement, which of course would necessarily be hawkish but less dovish than anticipated, then we could get a sudden reversal. Regardless, expect a lot of volatility during the early hours of Friday, as that announcement comes out. Having said that, the downtrend is very much intact, and it’s likely that we continue to sell every time we show some type of exhaustion. This has been the play for quite some time, and I don’t see that changing anytime soon, despite the fact that the Federal Reserve is probably going to cut rates as well.