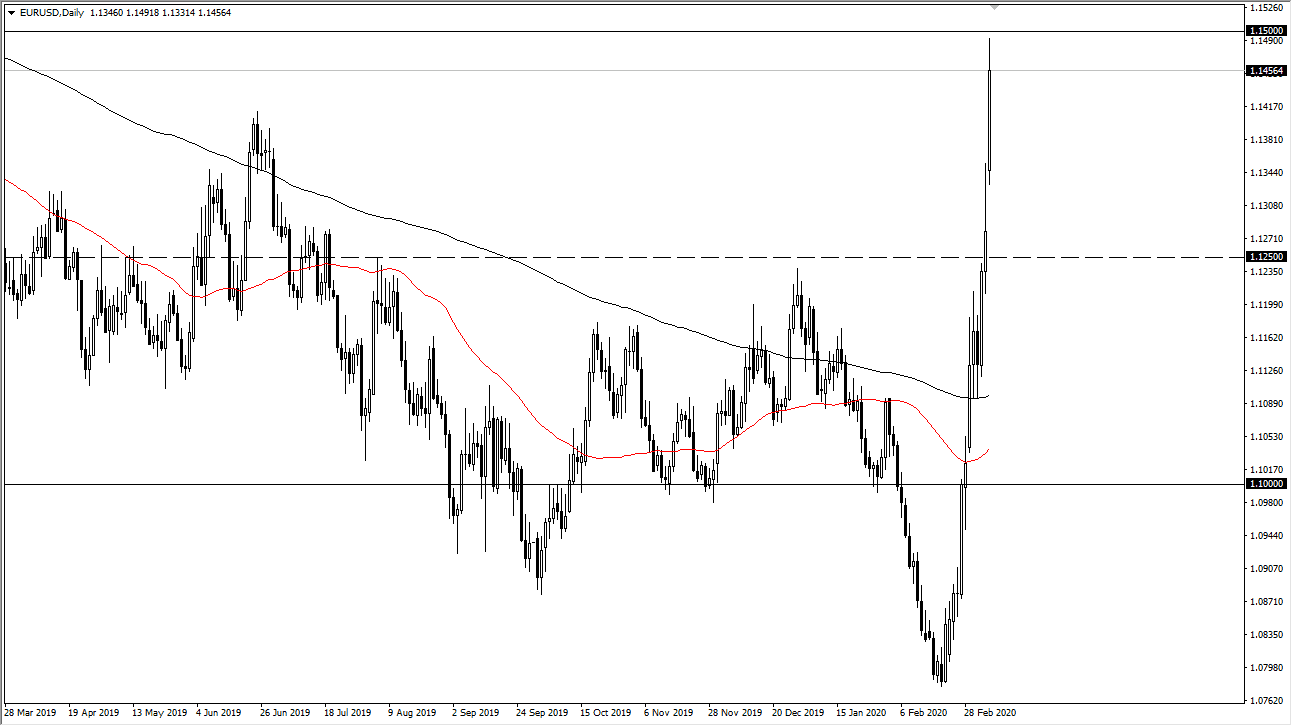

The Euro spiked significantly during the trading session on Monday as we gapped higher and then continued to just straight shoot to the moon. Having said that, the Euro is a bit offending from the idea that the Federal Reserve is going to cut interest rates, not necessarily that there’s anything strong about the European Union itself. With that in mind, it’s likely that we continue to see a lot of volatility, but the 1.15 level should be really difficult to break above. In fact, intraday we have seen several attempts to break out but have not been able to.

Looking at the size of the scandal, there will more than likely be several attempts, but the question now is whether or not the 1.15 level will hold? If we do rollover, it’s very likely that the gap underneath could offer support, especially near the 1.30 level. At this point, it’s very likely that the market continues to be noisy in general, but I think until we get clarity as to what the Federal Reserve is actually going to do, the speculation will be negative for the greenback overall.

One thing is for sure, the market is most certainly overbought, so it’s likely that the pullback is necessary to say the very least. All things being equal, this is probably what we will see due to the fact that sooner or later the shortage of dollars is going to become a problem. Funding markets out there demand more greenbacks, and it’s only a matter of time before they do in fact see that translate into the markets. In the short term though, it certainly looks as if we will continue to see the Euro gain due to the fact that it is the “anti-dollar”, and it has been short for so long. In fact, it’s probably more of a short covering rally than anything else as the markets try to reprice the idea of interest rate differential between the two central banks. However, keep in mind that the European Central Bank also will be doing something to alleviate the situation, so it is possible that could be what turns this entire thing around. The most important thing that a trader can do right now is to keep their position size small, as we will certainly have the occasional hiccup in either direction coming over the next couple of days.