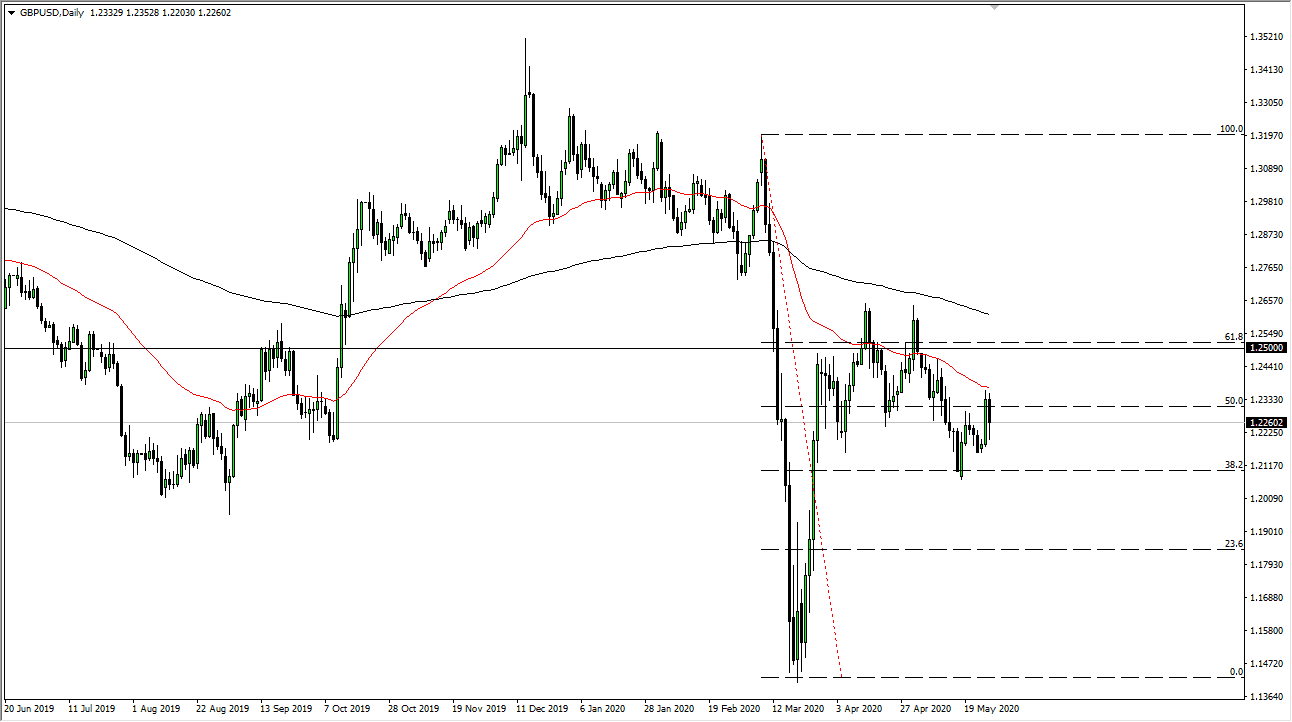

The British pound pulled back a bit from the 50 day EMA during the trading session on Wednesday as we continue to see the US dollar strength in overall. Looking at this chart, you can see that we have most certainly seeing a lot of negativity, although the last 10 days or so has been a little bit positive. The 50 day EMA of course is an area that a lot of people will pay attention to, and it is interesting that this happened almost simultaneously to the chief UK negotiator in the Brexit talk suggesting that the “EU needs to evolve it’s plans to reach some type of an agreement for Brexit.” This of course have the British pound falling from there, showing signs of continued weakness.

However, by the end of the day we ended up seen enough support near the 1.22 level to cause a bit of a bounce, reaching towards the 1.2260 level by the time New York started to wrap up the business for Wednesday. At this point, I do think that we will continue to see sellers come back into this market, showing signs of continued downward pressure as the British pound has a whole plethora of problems to deal with.

One of the biggest issues of course is the fact that the United Kingdom has suffered an extreme amount of death at the hands of the virus, and then of course the Brexit is still something that needs to be dealt with. With the economy closed the way it has been in the United Kingdom and of course a rush into the US Treasury market, it sets up for a perfect break down from these levels given enough time. This does not mean that it will happen suddenly, as it could be more of a grind. I prefer to fade rallies, and it looks as if the 1.2350 level will continue to be important as it had been previously on short-term charts. Given enough time, I believe that the British pound will continue to go down to the 1.20 level over the longer term, but obviously it is going to take quite some time to get there. As far as buying is concerned, it is not until we break above the 1.25 level that I would be seriously considering buying the British pound, as that has so much working against it from a fundamental standpoint.