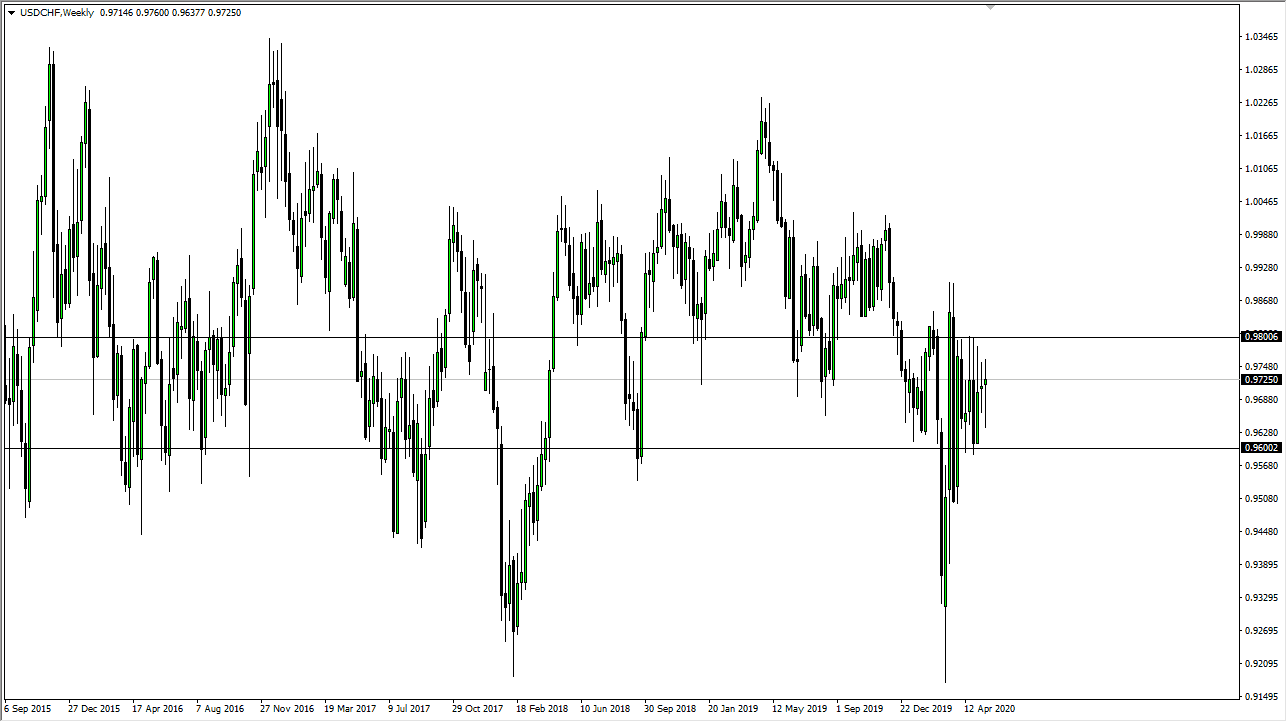

USD/CHF

The US dollar has gone back and forth in a relatively tight range against the Swiss franc and I think that will continue to be the case. After all, by the end of the week we did up basically in the middle of this range again. The 0.98 level above has been significant resistance and I think will continue to be so. To the downside, the 0.96 level will offer support and I think we are just going to bounce around between these two areas. With that in mind, look to trade from the outer edges of the trading range and you should do okay.

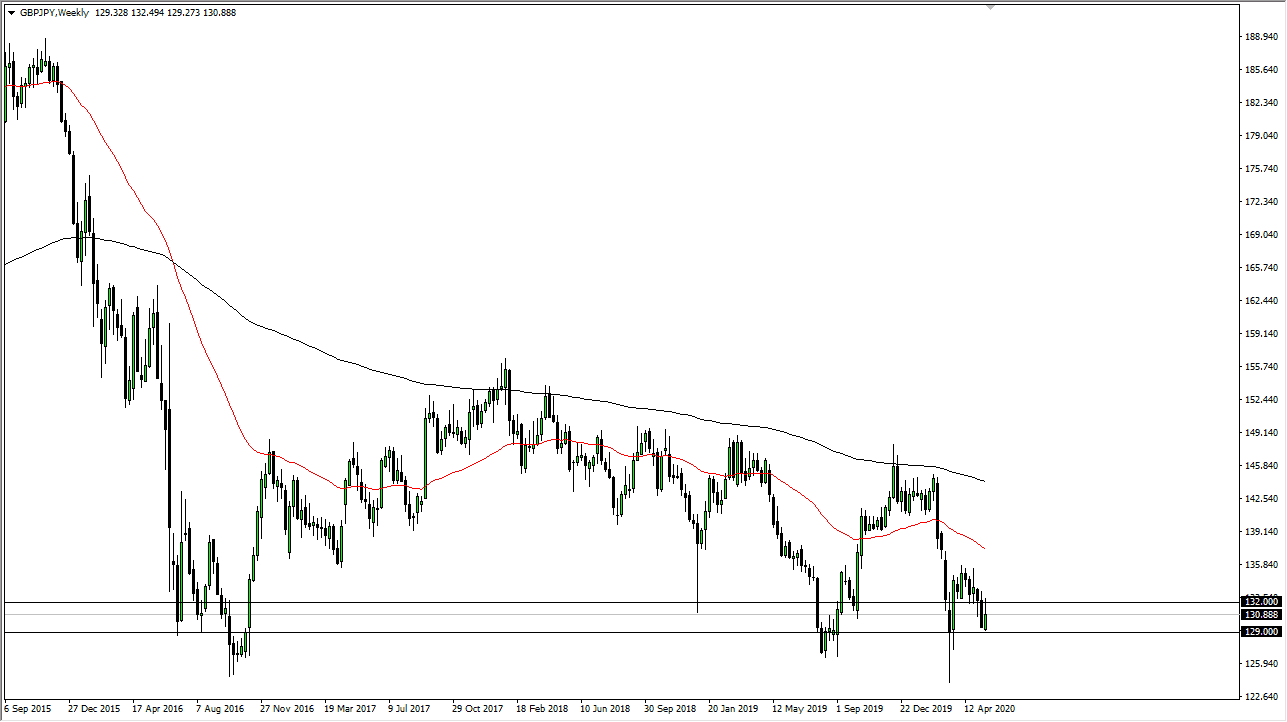

GBP/JPY

The British pound has rallied during most of the week, reaching towards the ¥132 level where we start to see some resistance. For myself, I will be fading rallies but if we were to break above the highs of the week then I will sit on the sidelines and wait until we reach the ¥135 level where I would be a seller there as well. I think this is a market that has a lot of weight around its neck, and rightfully so due to the fact that it is so extremely sensitive to risk appetite. That being said, we are sitting just above an area that has massive support so expect and noisy fight.

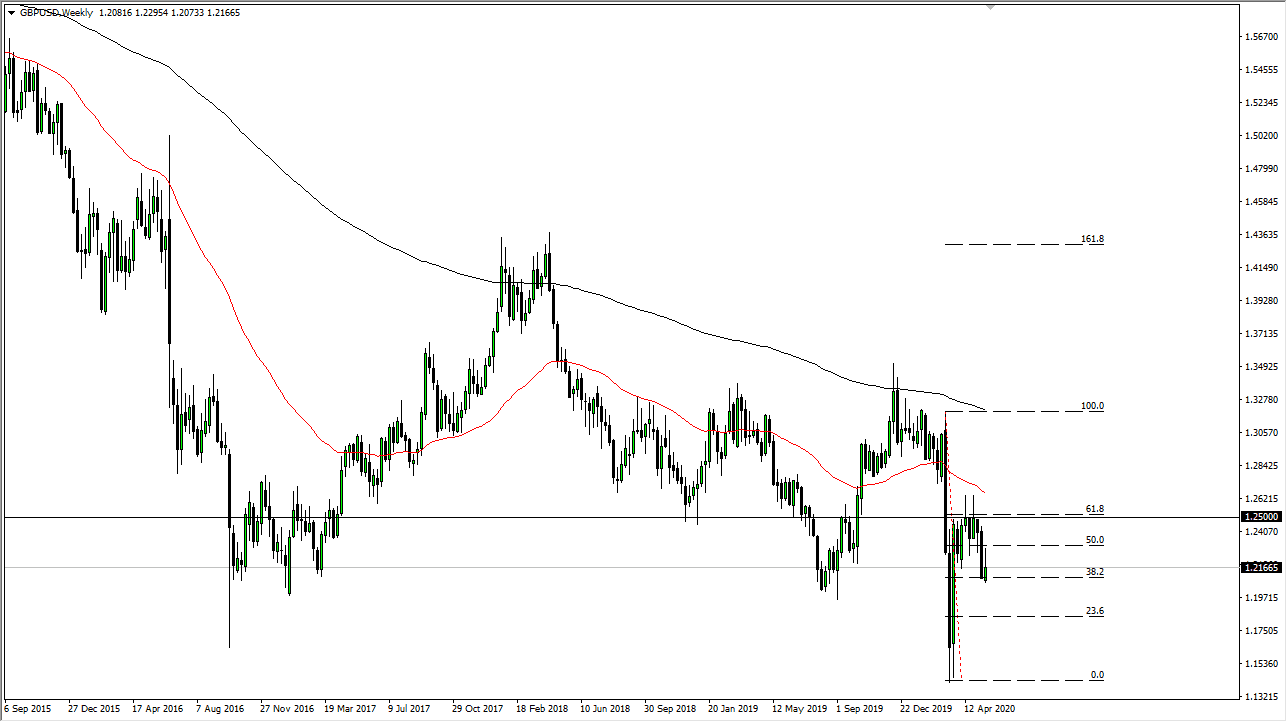

GBP/USD

The British pound initially rally during the week but found enough resistance around the 1.23 level against the greenback to pull back and forming inverted hammer. If this market breaks the bottom of the inverted hammer, it could open up a lot of selling, perhaps down to the 1.20 level, and then the 1.1750 level. If we do rally from here, I am looking to fade rallies every time it shows a bit of hesitation as the British pound has a lot to think about with the UK economy and Brexit, and of course the coronavirus numbers in the United Kingdom which are worse than many other places in the world. Bank of England officials have even recently suggested that negative interest rates are a real possibility.

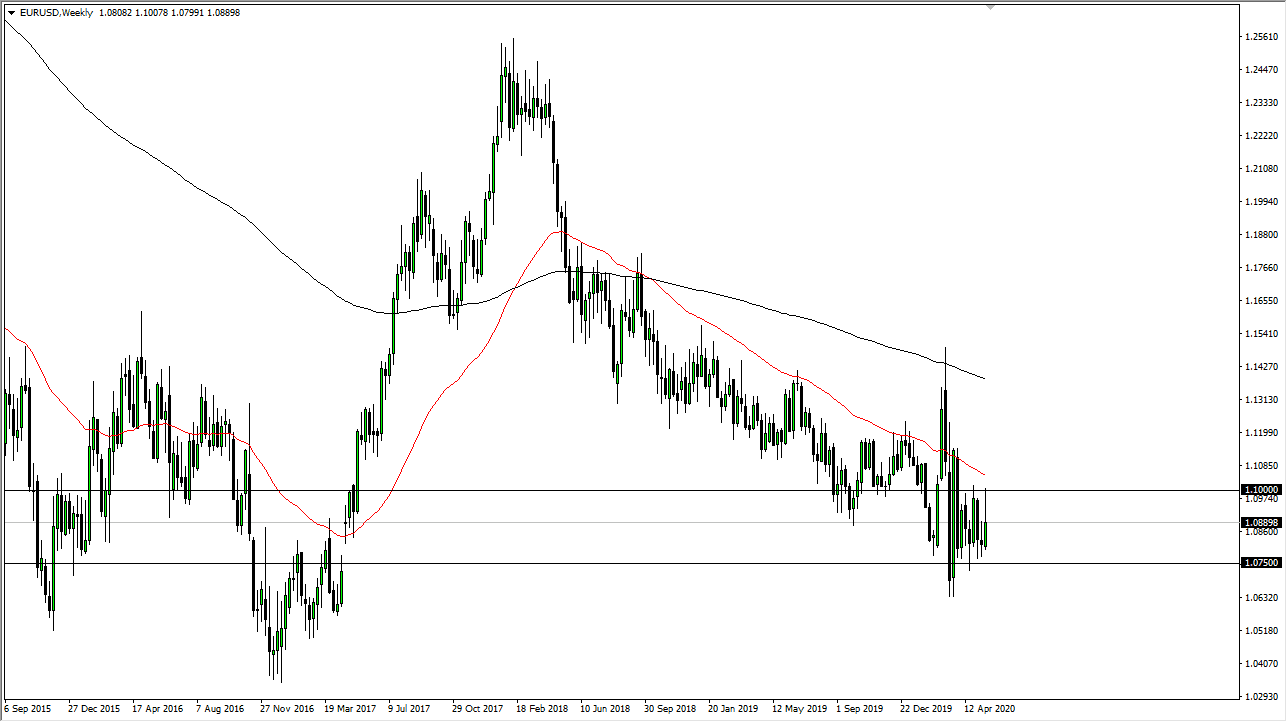

EUR/USD

The Euro rallied during the week, reaching all the way to the 1.10 level, before pulling back rather significantly. We are currently in the middle of a range, hanging around the 1.09 level which is essentially “fair value.” I think we continue to bounce around between 1.10 on the top and 1.08 on the bottom for the bulk of the week, as there is no real catalyst to get this thing going.