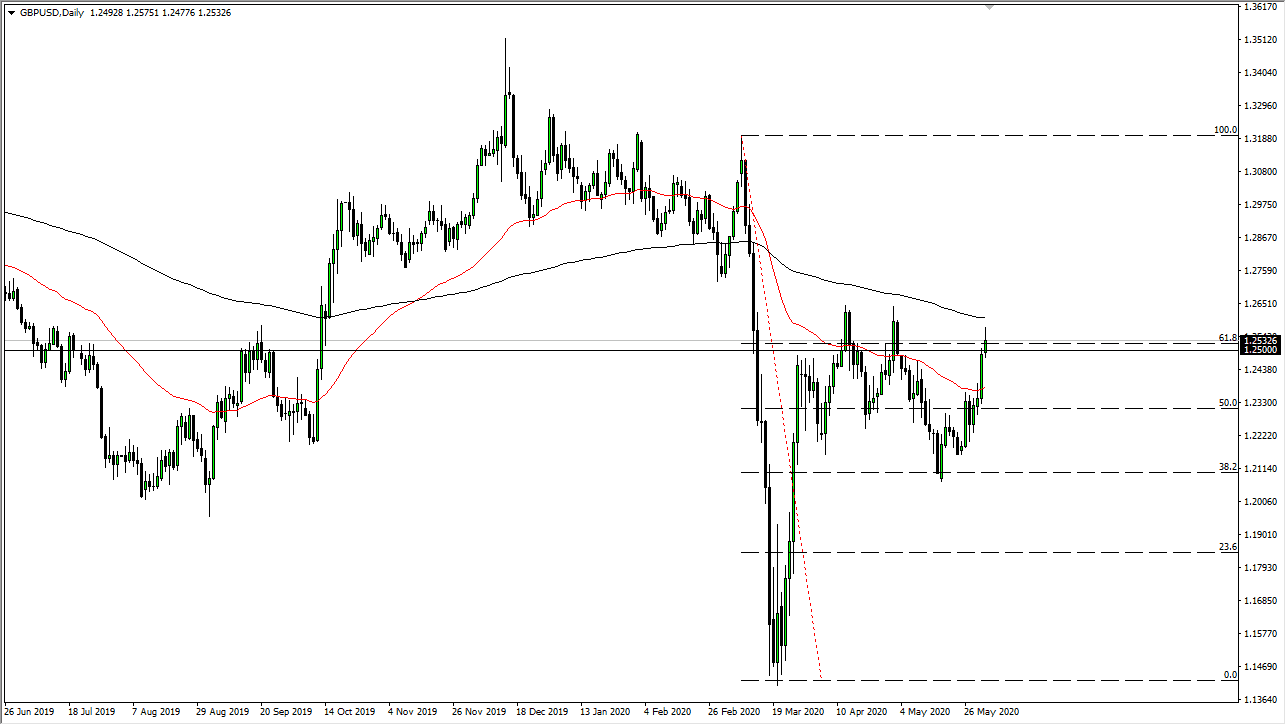

The British pound rallied significantly during the trading session on Tuesday, reaching towards the 1.2550 level and even extending above there for a little bit of time. However, we have pulled back enough to show signs of exhaustion and I think that the 200 day EMA above will also come into play as well, so I think it is only a matter of time before the British pound cells off. Quite frankly, we are overextended to say the very least so one would have to think that we are more likely than not to see a pullback.

The 200 day EMA above and the 1.2650 level or both a couple of areas that I am paying attention to. I think at this point if we were to break above that level then it is likely that this market should go much higher. If we do break out above that level, then the 1.30 level would make quite a bit of sense from a longer-term standpoint, as it is a large, round, psychologically significant figure, and an area where we have seen a lot of noise in the past. Because of all of that, I think most traders will look at that area as a great place to take profit, and of course an area to be worried about due to the fact that we had sold off so hard from that region.

The coronavirus issue in the United Kingdom has not gone anywhere, and of course we have to worry about the Brexit which of course will drive the British economy going forward. The Brexit is set to be an absolute mess still, so I do believe it is only a matter of time before the British pound gets hammered. That does not mean that it happens now, and it does not mean that we cannot get to the 1.30 level before that, but it does mean you need to be aware of the potential problems. The 200 day EMA is just above and that will attract a certain amount of attention in and of itself. Because of this, I am much more comfortable shorting this pair on signs of exhaustion, but you may need to drill down to shorter term time frames in order to get that position. Expect volatility, that is probably the only thing that you can count on when it comes to markets at the moment, and of course the British pound is not going to be any different.