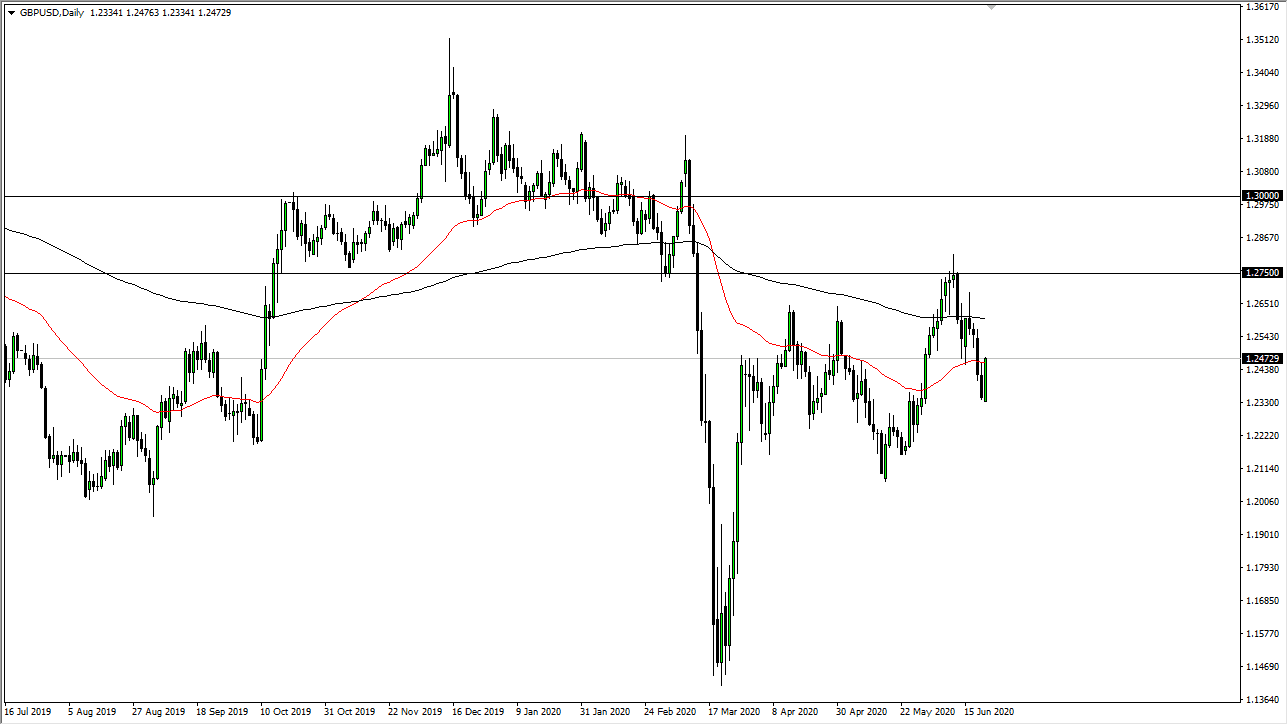

The British pound shot higher during the trading session on Monday, taking a serious shot at breaking above the highs from the Friday session. However, the market has shown itself to be a bit hesitant to break above the 50 day EMA so I think we are starting to run into an area that could cause some issues. Yes, the candlestick is very impressive, but it does not tell the whole story.

One of the things that the daily candlestick does not point out is just how stubborn the action was towards the end of the trading session. While the British pound it necessarily break down drastically, it could not gain very much once we got to just the US session either. That of course has people needing to look towards the overall risk appetite of the markets, and I think at this point the candlestick was simply a reaction to an oversold condition. I fully anticipate that the British pound will selloff sooner rather than later, and I am looking for signs of exhaustion to take advantage of that.

The obvious area would be the shooting star that pierced the 200 day EMA, at roughly the 1.26 level. If we can reach towards that area, I would be more than willing to take a selling opportunity because the risk to reward ratio is relatively small. Otherwise, the market is likely to simply turn around from the 50 day EMA which can cause some issues as well, but I do not like that as a trade as much as fading short-term rallies. After all, you have to think about what you are buying and whether or not it is a “bargain” in terms of the average price. If we can by the US dollar at a higher level on this chart, then obviously are going to do much better than down here.

I believe that we have plenty of reasons to expect exhaustion on rallies though, not the least of which of course will be the Brexit headlines that clearly are not going to be favoring the British pound anytime soon. Beyond that, the United Kingdom still has a lot of economic damage that has to sort itself through as the economy tries to reopen. The United States is much further along in the reopening process than the United Kingdom is, so at this point it makes sense that we continue to drop from here.