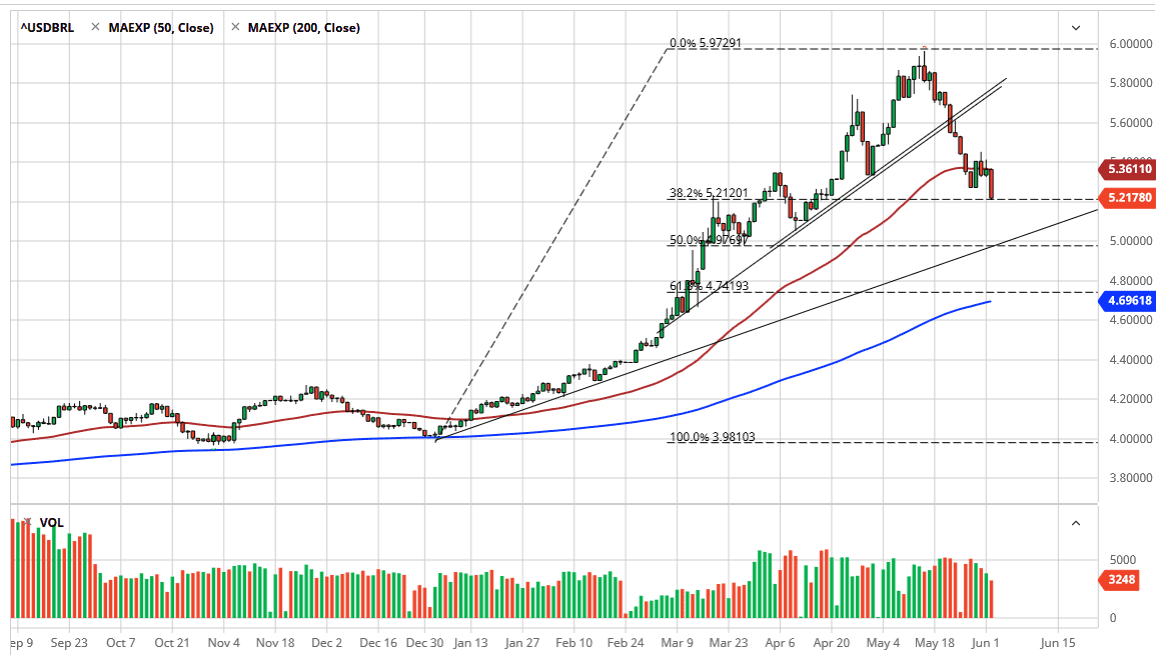

The US dollar has fallen against the Brazilian Real during the trading session on Tuesday, slicing through the 50 day EMA again, and closing towards the bottom of the range. It lost almost 3%, which of course is an excessively big move in the currency markets. This suggests that perhaps the US dollar has more losses ahead for it, and the Brazilian Real is a great way to measure that due to the fact that it is such a major emerging market currency. Furthermore, Brazil has its own situation with the coronavirus outbreak, and it appears that traders are finally starting to price in the idea of a recovery in that country.

However, I would also point to the 50% Fibonacci retracement level which is currently right at the uptrend line, so I do think that it is only a matter of time before buyers will return. In the short term though, it looks like we could drop as low as 5 Real, but obviously there is going to be a lot of noise in that general vicinity. Below there, then we have the 200 day EMA which is currently trading at 4.69623 BRL. In other words, I think we have a little further to go to the downside but longer-term I would anticipate people coming back in and picking up the greenback.

Remember that the Brazilian Real represents the entire economy of South America for most traders, so it is a good way to play Latin America, with the only other somewhat liquid pair available for that part of the world being the Mexican peso. At this point, it looks like the US dollar is finally losing some of its grip, but the question now is whether or not we can continue to go lower? After all, the US dollar is considered to be a “safety currency”, and there is a lot of debt in South America and other places around the emerging markets that are priced in greenbacks. Because of this, there should be a built in “bid” for the greenback. However, as long as we continue to fall here, it is likely that the US dollar will continue to lose strength in this currency pair. If we were to turn around a break above the 5.40 Real level though, then it is likely that we go looking towards the 5.65 Three level rather quickly as it would be a significant turnaround.