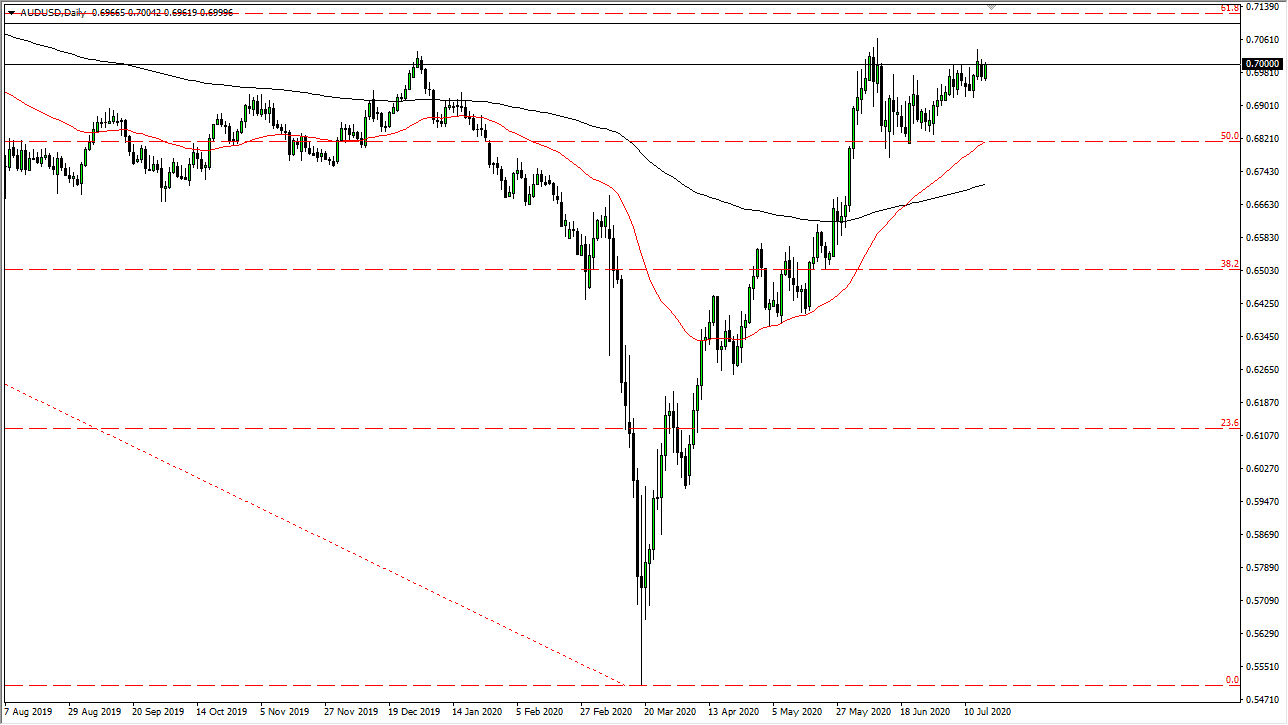

The Australian dollar rallied again during the trading session on Friday to reach towards the 0.70 level, an area that has offered massive resistance for some time. The fact that we simply will not roll over and fall apart tells me that we are going to continue to press to the upside here and eventually try to break through the overall “band of resistance” that extends to the 0.71 handle. If that is going to be the case, this is probably going to be a very choppy and difficult few weeks, but it certainly seems as if the buyers are remaining to be very relentless. That is something to pay attention to because we cannot sell off for a big move quite yet, and therefore I think that dips are still buying opportunities.

To the downside I see the 0.68 level underneath offering a significant amount of support, reaching to the bottom of the most recent pullback. The 50 day EMA underneath is sitting in roughly the same area, so I think there are plenty of buyers waiting on that dip down to that region. The overall attitude of the Australian dollar is bullish, or perhaps more importantly: you should probably think of it as significant anti-US dollar sentiment.

The central bank in the United States continues to loosen monetary policy and that of course works against the value of the greenback. We are seeing this here, just as we are seeing it in other markets. The Euro broke above the 1.14 handle and stayed there this week, so it looks like we are getting ready to see the US dollar get hit rather hard, and therefore I think that will translate into this market breaking above the 0.71 handle given enough time.

If we did turn around a break down below the 0.68 level would be an extremely negative sign, perhaps sending the market down to the 0.65 level on the way down to the 0.63 level. That is the least likely scenario, but we could get some type of panic or shock to the system that has people looking to buy US dollars. That being said, it is going to take a lot of work to break out above here, so I would not be surprised at all to see a short-term pullback that can be bought into at the first sign of a bounce.