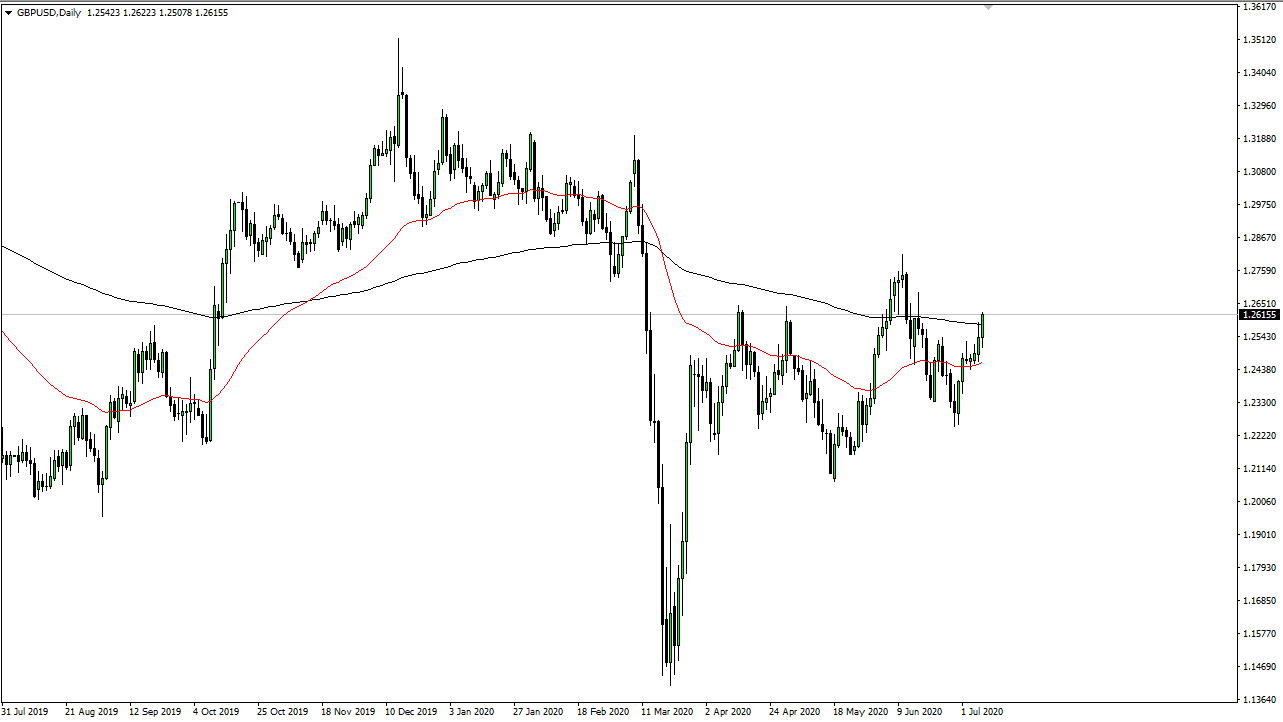

The British pound has now broken above the 200 day EMA, which of course is a very bullish sign. Because of this, it is likely that we will continue to see buying pressure in this pair, as the US dollar has taken a bit of a hit. Granted, there is still a lot of concern out there and it could work against the value of the British pound, but I do believe that ultimately it looks as if the market is destined to go higher.

As far as a fundamental reason for that happening, I do not necessarily think that is going to be easy to come up with. Granted, the British economy is opening up a bit but at the end of the day but it is obvious that the market has no concern about Brexit, or the slowing down of the economy for the longer-term. After all, there are multiple issues when it comes to the opening but given enough time, I think it is only an amount of time before people focus on troubles again.

Looking at this chart though, the fact that we are closing at the top of the candlestick yet again and have broken above the 200 day EMA means that we will probably go looking towards the 1.2750 level above. That is an area that we have seen a lot of selling pressure at, so I think that is going to be difficult to break out above. If we do, then the market is likely to go looking towards the 1.30 level. If you look at the longer-term chart, you can see that we have seen “higher lows”, so that of course is a bullish sign so this is one of those things where you simply have to “hold your nose” and buy this market. On the other hand, if we break down below the red 50 day EMA on the chart, that could send this market back down to the 1.2250 level. Having said that, I think the only thing that we can count on is going to be a significant amount of volatility in choppiness, and unfortunately, even if we do rally from here, it is likely that it is only a matter of time before we get some type of negative headline that shakes a lot of buyers out. Ultimately, the market looks destined to be volatile, but it is still bullish in general.