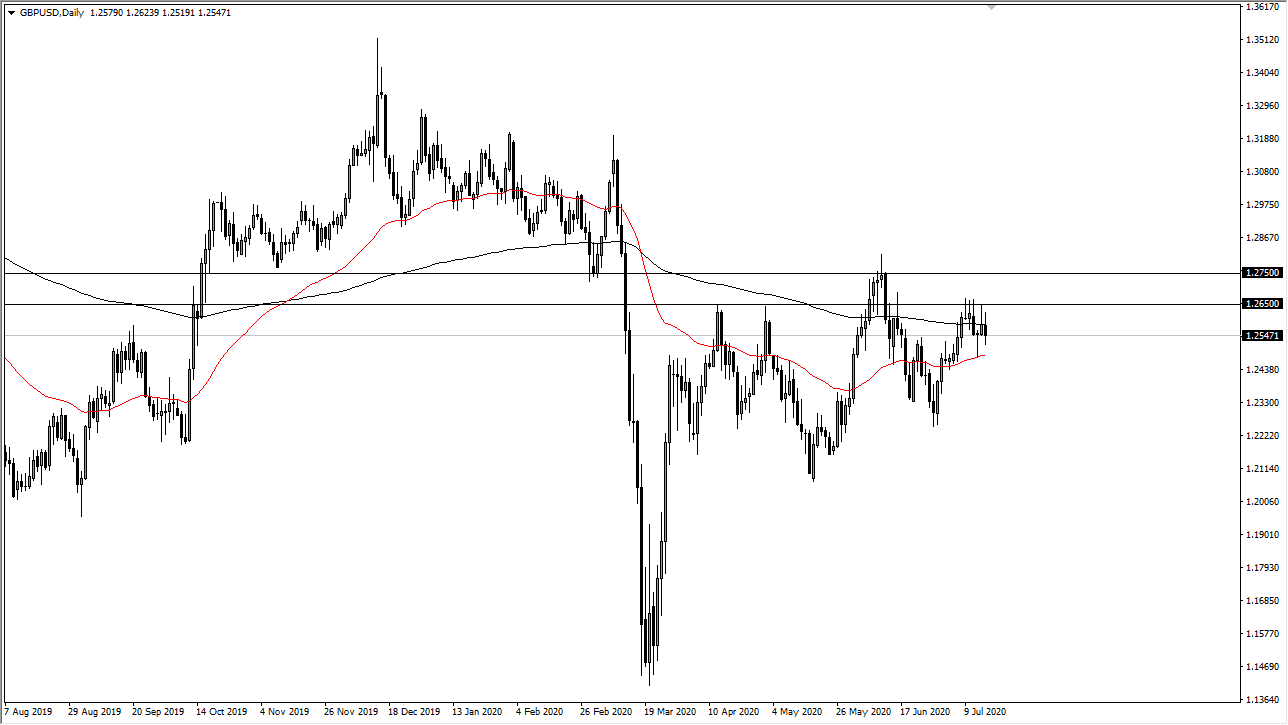

The British pound has initially gone higher during the trading session on Thursday, only to turn around and fall apart again. After that, we did recover a bit, closing the day right around the 1.2550 level. This is stuck between the 50 day EMA and the 200 day EMA range but seeking to break out to the upside. I think at this point we probably do not have enough momentum to break out to the upside heading into the weekend, but it certainly looks as if the market favors that move. This makes quite a bit of sense, because the Federal Reserve is doing everything it can to liquefy the markets, and thereby devalue the greenback.

The 50 day EMA continues to attract a lot of support in this market, but I also see a lot of resistance near the 1.2650 level. If we can ever break above there, then we are going to go looking towards 1.2750 level, followed by a run towards the 1.30 level. This is how I think the market plays out, but obviously we have a lot of work to do before that can happen. This is a decidedly dollar related move, so what we are probably going to see is that the dollar will fall against everything at once, not just the British pound. This makes quite a bit of sense, because the British pound is not necessarily the strongest currency out there. It just happens to not be the US dollar which is the biggest asset.

Keep in mind that Great Britain still have to deal with Brexit and a whole host of other issues. If that is being ignored by the market right now, give it time, because it will not be forever. Once that comes into play you can expect even more obnoxious volatility. Markets right now are hanging on the latest headline involving the coronavirus, and that is one of the things that is moving this market as well. If we have a good “risk on” type of trading session, then it means that we have a real shot at perhaps seeing the British pound rally against the US dollar. On the other hand, if we get “risk off” trading then the British pound falls a bit. The 50 day EMA should continue to offer plenty of support but if we were to break down below there it is likely that we could go down to the 1.2250 level. Either way, this is going to be a mess.