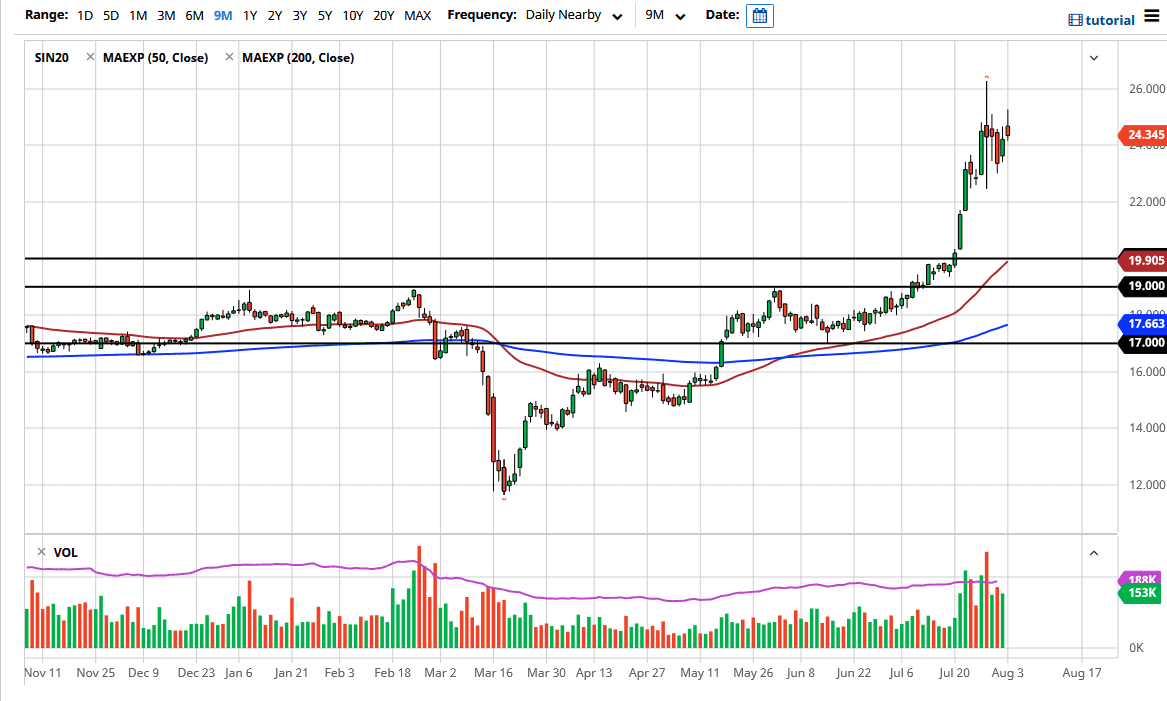

Silver markets have tried to rally a bit during the trading session on Monday but gave back quite a bit of the gains to end up forming a bit of an exhaustive looking candlestick. This suggests that we could pull back a little further. Ultimately, I think that the $23 level could be targeted but I am not a seller of silver. The US dollar continues to lose strength in general, although it is a little overdone. That might be what we are looking at here, a simple reaction to the US dollar getting a little bit of a relief rally.

When you look at the huge candlestick from last week, you can see that the $22.50 level was supportive, just as the $26 level was resistant. As we have gone back and forth on that particular trading day, we have set up a nice range. The question now is not so much whether or not you should be long or short, but whether or not we are going to stay in this range, or are we going to fall further to offer even more value? I would prefer to see the latter of the two scenarios, but we will have to deal with the market that we have. After all, this is moving basically on the Federal Reserve out there flooding the market with US dollars, and that means that the value of the US dollar will continue to put upward pressure on precious metals in general, not only here but in platinum, gold, and even some base commodity metals such as copper.

At the very least, I believe that the market is going to try to go back and forth, perhaps trying to build up the necessary momentum more work off the excess that we have seen as of late. The market had gotten far ahead of itself, so it does make quite a bit of sense that we would have to take a breather. For a minute there, the silver market looks like it was going to jump into the stratosphere, which it cannot do without some type of pullback. I look at this chart as one that offers value at lower levels, especially the closer we get to the $22 level. Where we are now, I would not be a seller, nor would I be a buyer. It is a matter of being patient and waiting for the value to enter the equation.