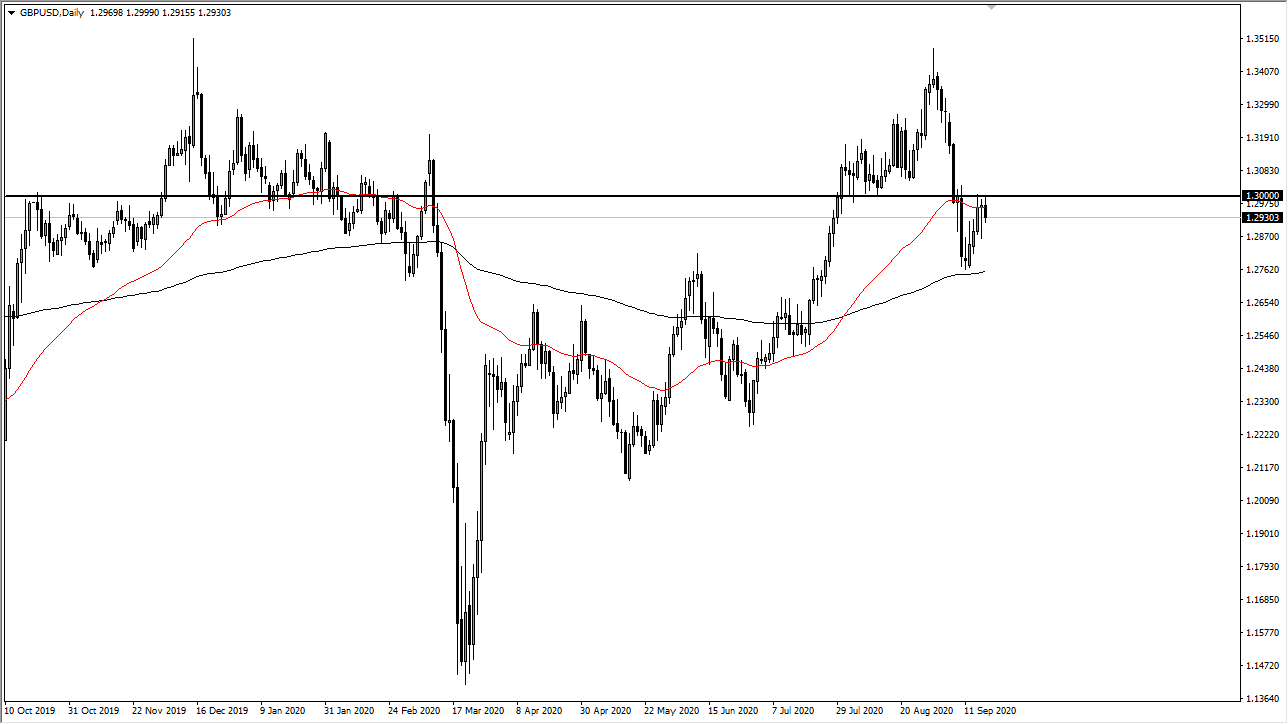

The British pound initially tried to rally during the session on Friday but failed at the 1.30 level yet again. The 1.30 level has been both support and resistance, so it is worth paying attention to. The last couple of days have been rather difficult for the British pound a break above that level, so that is simply a demonstration of how important this level is. It should be noted however that the candlestick from the Thursday session was built a little bit like a hammer, so that does suggest that perhaps we are going to see buyers underneath.

However, if we break down below the candlestick from the Thursday session, that could open up fresh selling and send this market down to the 200 day EMA which is colored in black on the chart. That is a longer-term technical indicator that a lot of people pay attention to and it is worth noting that we have bounced from that level. Alternately, if we were to break above the 1.30 level, then it is likely that the market goes looking towards the 1.3250 level, and then perhaps the 1.35 level after that.

The British pound is, unfortunately, going to be held hostage by Brexit and all things involved with Brexit, which means that the markets could move on a sudden rumor, Tweet, or headline. After all, the Brexit situation is very unstable, to say the least, so it has this market-moving rather quickly in a flash at times. With that in mind I have been trading very little in the British pound, but what I do trade is typically with the position size that is much smaller than usual. The candlestick for the Friday session certainly suggests that we still have a lot of concern out there, so I do not necessarily think that we are going to break out right away. However, if we do come together in an agreement between the European Union in the United Kingdom, the British pound will skyrocket.

In that sense, it does not even really matter what the agreement is, just that there is one. As long as there is uncertainty, there is going to be a lot of volatility in the pound, so it is probably best to be very cautious about putting money to work. On a daily close above the 1.3050 level I believe that the buyers will have taken serious control. Alternately, if we break down below the 200 day EMA, the market could fall apart and go looking towards 1.25 handle.