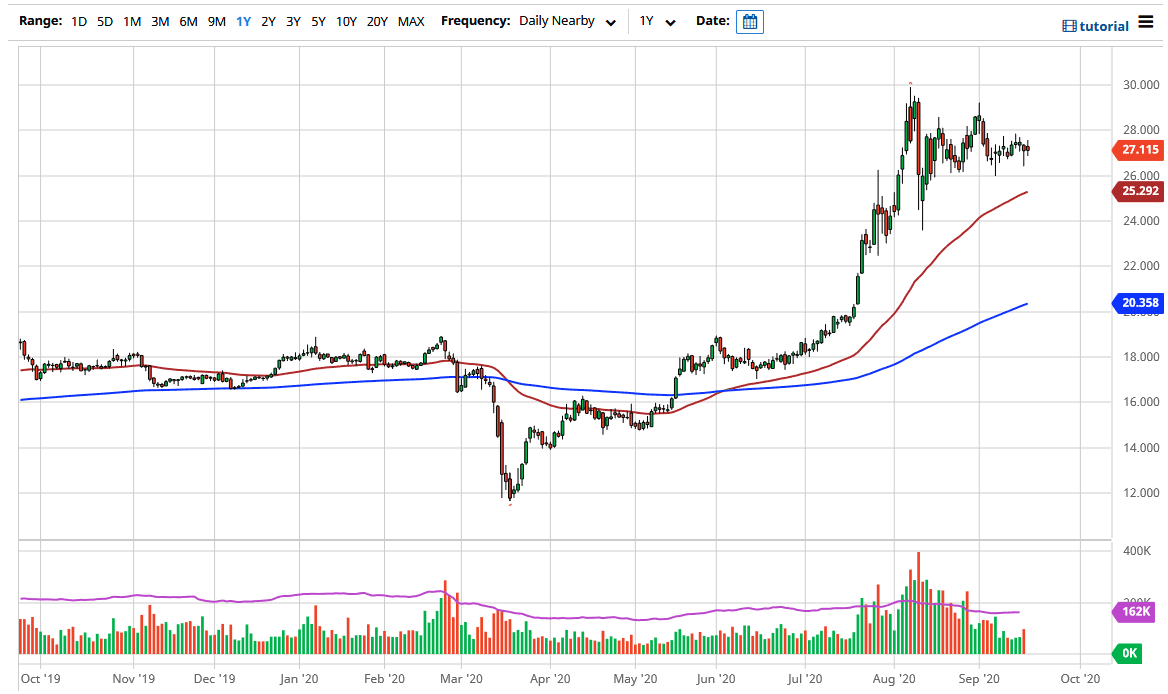

Silver markets went back and forth during the trading session on Friday, as we continue to see a lot of choppiness. Ultimately, I think that this market will make a bigger move, and I do believe that it is higher. However, the market is going to continue to see a lot of sideways action in the short term. After all, the market is dancing around between two major areas of interest, namely the $26 level on the bottom and the $28 level on the top. As we are essentially sitting at the $27 level, we are what I would consider to be “short-term fair value.”

As long as that is the case, I think that this is a market that will be short-term range-bound trading only. I think that short-term traders will continue to flock towards this market, as it is offering a nice range that is clearly defined. However, if we break down below the $26 level then I think the 50 day EMA comes into play as well as the $25 level which is a psychologically significant figure. Even if we break down below there, I think that it is only a matter of time before the silver markets picked back up again as central banks around the world continue to throw tons of liquidity into the marketplace which typically has people looking for hard assets.

To the upside, if we were to break above the $20 level, then it is likely that the market could go towards the $29 level next. After that, the market will go looking towards the $30 level. A break above that level and I do think that it will eventually happen, could send silver looking towards the much higher levels and more of a “buy-and-hold” scenario.

When you look at the chart, it is easy to keep in mind that the market probably needs to go sideways after we had shot straight up in the air for a while. That is essentially what we are seeing at the moment, so a little bit of stability and signs of the market being comfortable in this general vicinity is exactly what people will need to see in order to be comfortable holding onto silver for a long trade. All things being equal, I do not have any interest in shorting silver anytime soon.