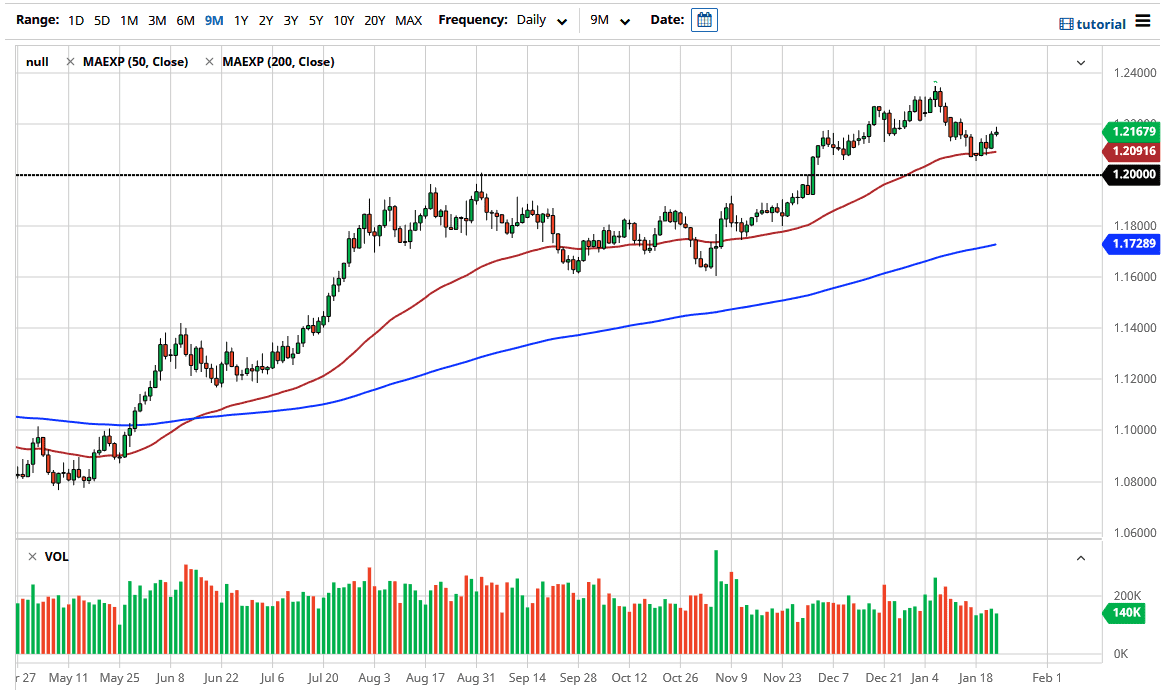

The euro initially tried to rally during the trading session on Friday but found enough resistance near the 1.22 level to turn around and form a shooting star. The shooting star is a negative candlestick, and that suggests that we probably will drift towards the 50-day EMA. The 50-day EMA is a very significant technical indicator for longer-term traders, and there are a lot of questions now about the potential stimulus coming down the road.

Stimulus has been driving down the value of the US dollar for some time, but recently we have seen a little less conviction as to whether or not stimulus is going to be strong enough to truly weigh upon the dollar for the longer term. There is stimulus coming, but it is not going to be anywhere near as big as once thought. It is likely, then that what we will see is a bit of strengthening in the short term for the greenback, and I think that opens up the possibility of the 1.20 level underneath. That is an area that I think continues to be of importance, as it was previous resistance and should now be support.

On the other hand, if we do turn right back around and break above the 1.22 handle, it is likely that the euro will go looking towards 1.23 level. The 1.23 level has been massive resistance previously, and that resistance extends all the way to the 1.25 handle. This is a market that will be very noisy, but more than anything else it will probably be range-bound over the next several weeks. In the short term, it looks like we may get a little bit of a pullback, but I would also note that a charge towards 1.20 level sees support all the way down to the 1.19 handle. In other words, we are stuck between two major levels on the chart that will continue to be the boundaries of the market in the meantime. This pair tends to be choppy to say the least, so we will tighten up quite nicely in this area, as it is a short-term opportunity in both directions.