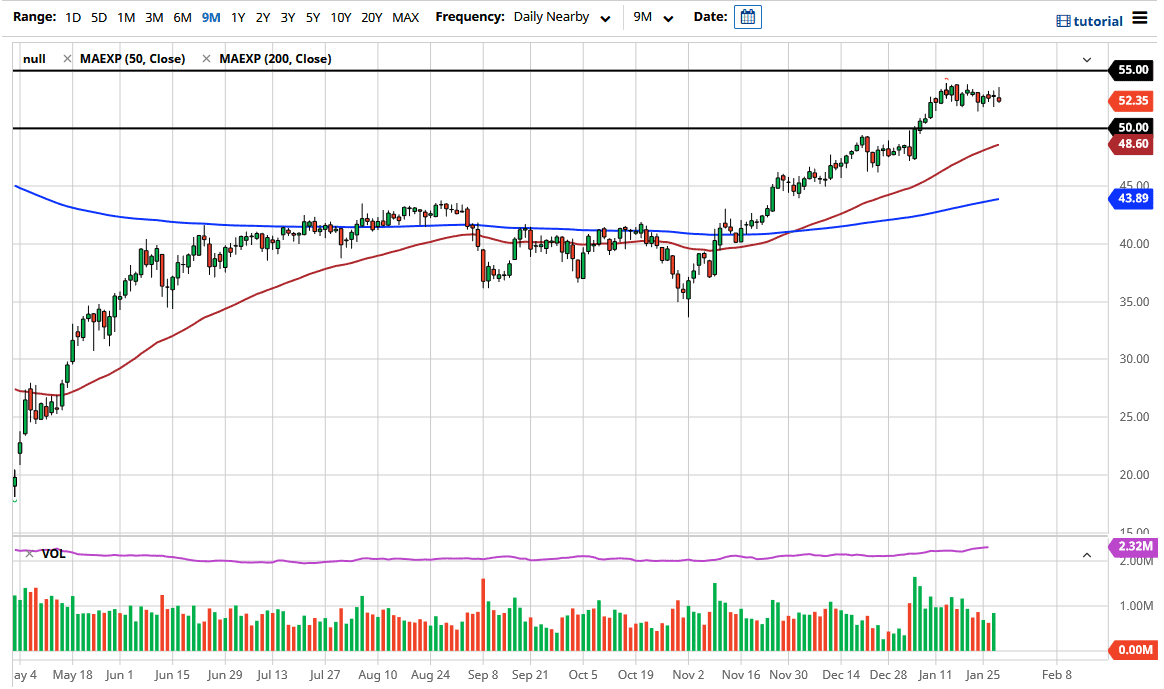

The crude oil markets still continue to go sideways overall, as we tried to rally initially during the trading session but gave back the gains. By forming the shooting star, it suggests that we continue to go sideways overall. We had a hammer from the previous session, but the fact that we turned around and repudiated this attempt shows just how much trouble the market is finding right now. Ultimately, I do think that the $50 level underneath will be a massive “floor the market”, while the $55 level above would be massive resistance. As we are sitting right in the middle of this range, it suggests that the market could still go either way.

If we do break above the $55 level, it will almost certainly open up another move towards the $60 level, but in general I think that what we see here is a market that is trying to figure out exactly what to do with this newfound strength. When you look at the longer-term chart though, it is important to notice that the $55 area was a major selloff point, and therefore one would have to think that there is a lot of resistance and supply just above. Whether or not we can break through there I think depends on whether stimulus is as big as people had hoped.

The one thing that most people are not paying attention to is the fact that crude oil was losing demand long before the pandemic started. Furthermore, we are starting to see the Baker Hughes Rig Count started to climb a couple of months ago and will probably continue to do so due to the fact that oil has recovered somewhat. In other words, one would have to think that there is only a matter of time before the supply starts to overwhelm again. For what it is worth, the most recent inventory numbers out of America showed that although there was a major drawdown of supply of crude, the reality is that the demand for gasoline has fallen off of a cliff. At this point, we have to wonder what happens next whether or not we can keep up any semblance of demand? This is probably being pushed due to the US dollar falling, but at the end of the day the uptrend has been a bit overdone and at the very least needs to work off some of the froth.