The West Texas Intermediate Crude Oil market has fallen again during the trading session on Friday as it appears that Texas energy companies are going to be coming back online, producing more crude oil, and filling some of the void that has been causing markets to rally even further. At one point, the United States had lost 40% of its oil output, so now it appears that we are looking at the supply coming back online and perhaps a bit of a pullback is coming.

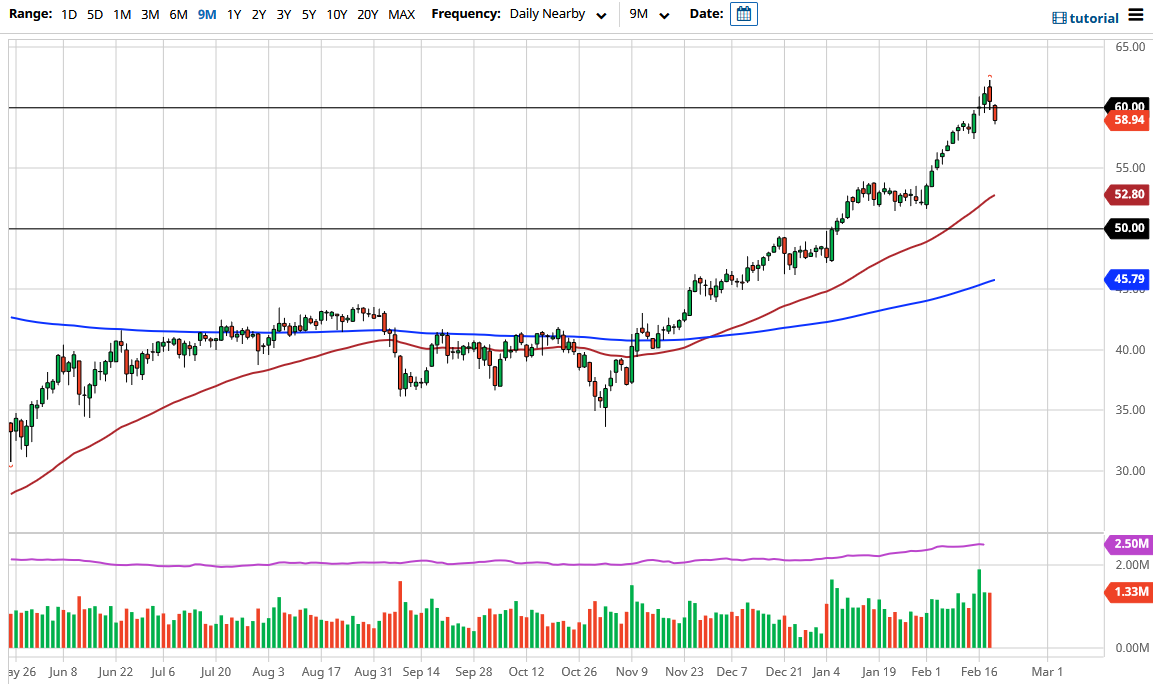

When you look at the weekly chart, we ended up forming a major shooting star, which is a very negative sign as well. Technical traders will look at that as a sign that exhaustion is coming back into the market, and if we break down below the candlestick from Friday, it is very likely that we would go looking at the $57.50 level as a potential target. Breaking down below there then allows the market to go looking towards the $55 level, possibly even the 50-day EMA. The 50-day EMA is sitting at the $52.80 level, which is an area where we have been clustering recently.

On the other hand, if we were to turn around and break to the upside, it could allow the market to go looking towards the $65 level. The $65 level is an area where we have broken down from significantly, so it is likely that the area could be a target for the extension of this rally; but given enough time, I think that a lot of sellers would be in that area assuming that we even get there.

The oversupply of crude oil could be an issue in the future, but right now we have a lot of catching up to do in order to boost the supply. A lot of what we have seen recently has been people trying to take advantage of the “reflation trade” that could be coming due to stimulus. There will be a huge bounce in the economy once everything opens up, but it will probably be short-lived to say the least. After all, there has been a lot of long-term damage done to the economy, so an elevated price for crude oil does not make any sense. We had been losing demand before the pandemic hit.