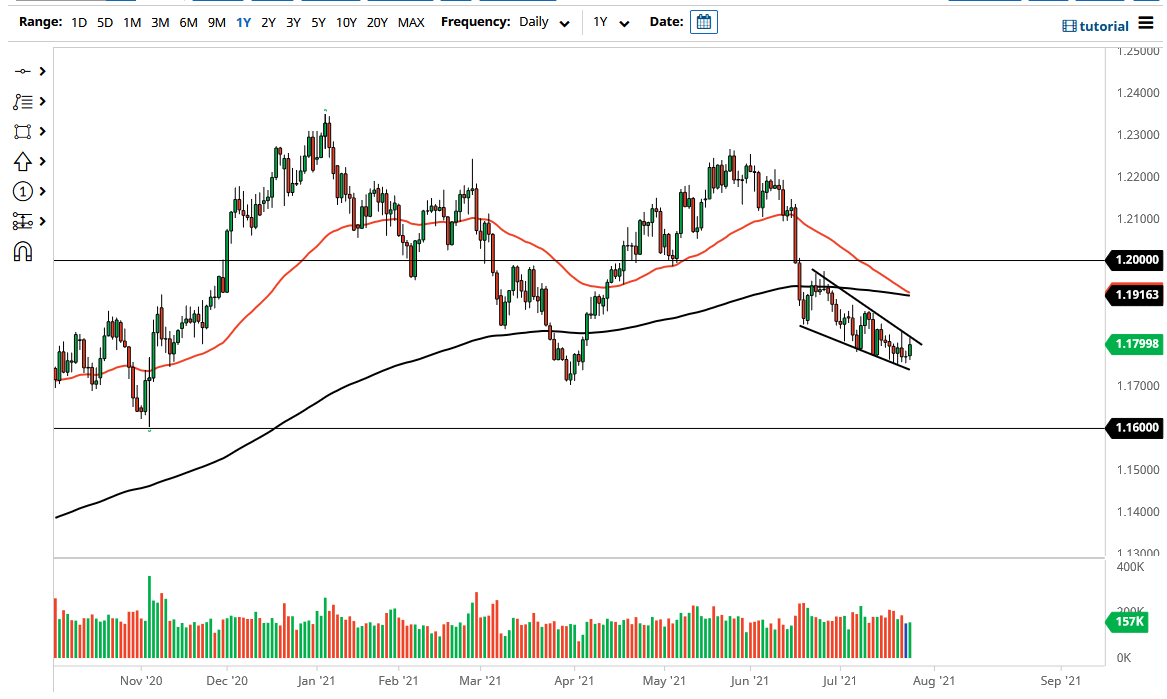

The euro fell a bit during the trading session on Monday only to turn around and rally towards the top of the wedge. The wedge that we have been in for quite some time is very clear in its construction, and the fact that the 50-day EMA is starting to break down below the 200-day EMA and threatening to form a “death cross” suggests that we are going to see further selling pressure. Ultimately, this is a market that is trying to figure out where it wants to go next, and if we break above the couple of highs that we have made over the last couple of sessions, it could open up the possibility of a move towards the top of the wedge itself.

That being said, it is also possible that any rally would get sold into, so it would be more or less a short-term trade than anything else. The longer-term move would be to the downside at this point, and I think that the 1.16 level is still very likely to be targeted. The Federal Reserve is on tap this week, and it is very likely that they will have their input when it comes to what happens with the greenback. Because of this, I think this week will be rather important when it comes to the future direction of the US dollar.

When you look at the 10-year note, it is worth noting that the yields continue to look as if they may be pushed lower, so it will be interesting to see if that is the case. If that is the way the market goes, then it should drive up the price of the US dollar as it would show an inflow into the US market. With this being the case, I think that we also have to pay close attention to the bond yield differential between Germany and the United States, which features negative yields in Germany. In other words, money is flowing to where it is being treated better, meaning the US. If that continues to be the case, then I think we will see a gradual drift lower. Regardless, the euro tends to be very choppy to say the least, and that is not going to change anytime soon.