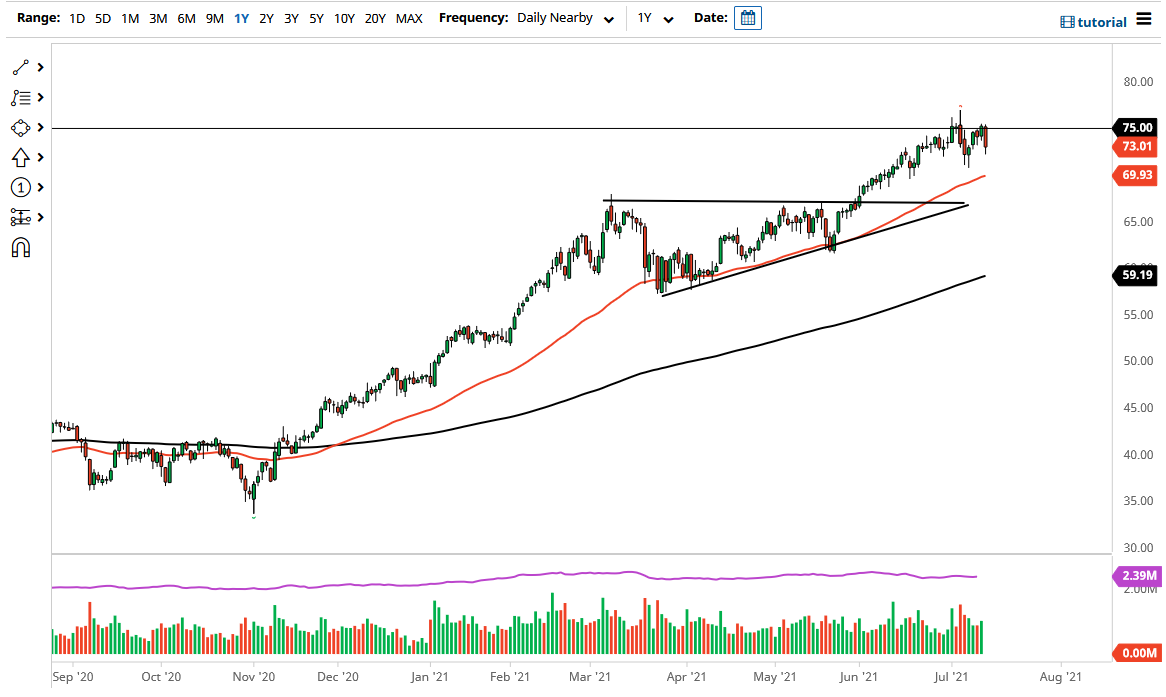

The West Texas Intermediate Crude Oil market fell significantly during the trading session on Wednesday as the $7500 level continues to offer significant resistance. That being said, the market is likely to see that level as a massive barrier to begin with, due to the fact that it is a psychologically important round figure. Furthermore, we have seen quite a bit of pushing to the downside over the last couple weeks, so it all comes down to whether or not we can break above there.

During the session on Wednesday, we have gotten a lot of noise coming out of OPEC+, as there were rumors that the United Arab Emirates and Saudi Arabia had come to some type of agreement when it comes to oil production. Shortly thereafter, the market also then heard the UAE refute that claim, so people are all over the place when it comes to the idea of whether or not there is going to be enough supply or if there will be too much, due to the fact that producers will be tempted to go on their own if there is no actual agreement.

With this, we continue to trade on the latest rumors, so all you can really do is look at the technicals and understand that just about anything is possible. This negative candlestick certainly suggests that we could go lower, and if we do, I think the most logical place to look for buyers would be near the $70 level. The $70 level also will feature the 50-day EMA, which is currently at $69.92 underneath. It has been rising for a while, and the 50-day EMA tends to be very important in this market as it has been so psychologically and structurally important. Underneath there, then we have the $67.50 below as it is the top of the ascending triangle that originally kicked this off. On the other hand, if we do turn around and break above the recent highs, then the market is likely to go looking towards the $80 level, and then perhaps even higher than that. This is a bullish market, and I do think that the reopening trade will continue to put a certain amount of bullish pressure on this market. With that, it still looks like a “buy on the dips” scenario.