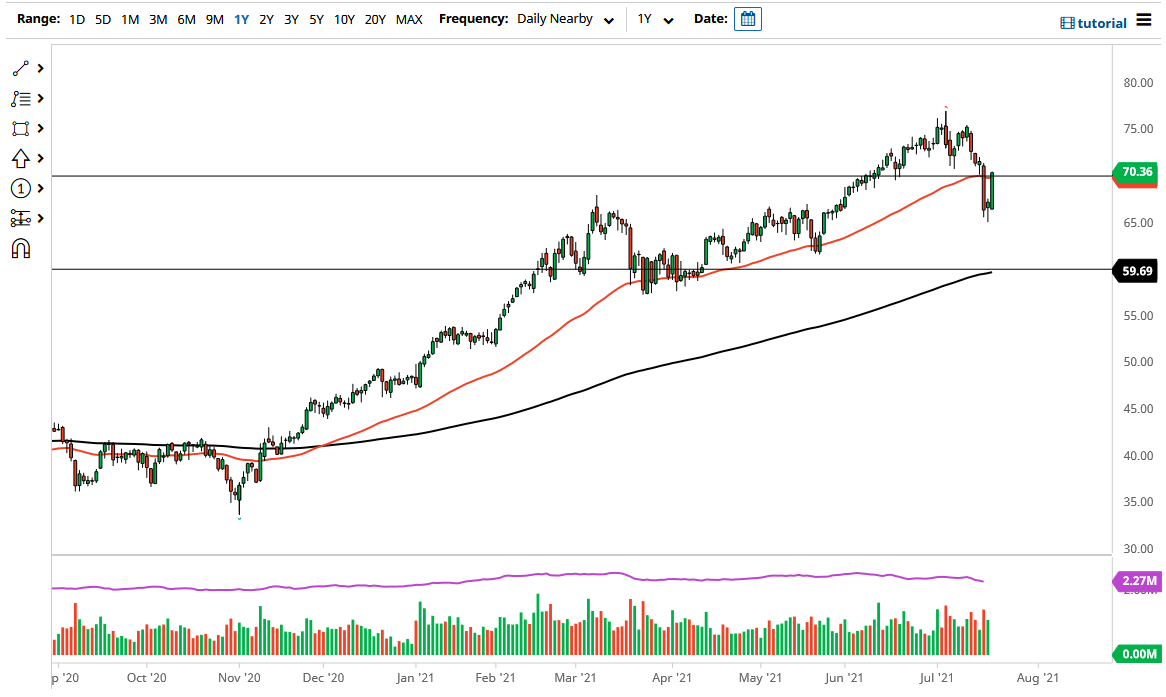

The West Texas Intermediate Crude Oil market rallied rather significantly during the trading session on Wednesday to reach above the $70 level. This is a very strong candlestick to say the least, as we have come very close to wiping out the losses from Monday. After that 8% drop, we did end up forming a hammer, which is a perfect opportunity to get long for most technical traders, and have now retraced about 90% of the losses. While this is a good sign, it is also worth noting that this type of instability normally leads to bigger issues down the road.

The inventory numbers in the United States came in much more bearish than anticipated during the previous session, so it is obvious that the market is not trading on fundamentals of this juncture; rather, it is trading on the idea of the world economy reopening and demanding more crude oil itself. That being said, as the end-user in the United States has not been demanding anywhere near as much crude oil as expected, it has caused a few headaches as of late.

When you look at this chart, you can see that the 50-day EMA is in this neighborhood as well, so that comes into play right along with that large, round, psychologically significant $70 level. If we do break above there, then I think we would see a significant amount of noise all the way up to at least the $75 level. Breaking above that obviously opens up the possibility of a move towards the $80 handle.

I believe that the next couple of candlesticks will be crucial for the crude oil market because it will give us an idea as to whether or not there is any real follow-through, or if this was simply a short-covering exercise. We have been slumping for a while, and as traders around the world try to price in the idea of Australia, Indonesia, and others locking back down, it will be interesting to see what they think about the crude oil market. I anticipate that we will continue to see a lot of noisy behavior, so at the very least you need to make sure that your position size is relatively small so you can protect your account. I will say that the complete reversal during the session on Wednesday was a very strong sign; but then again, one has to wonder what the real story will be.