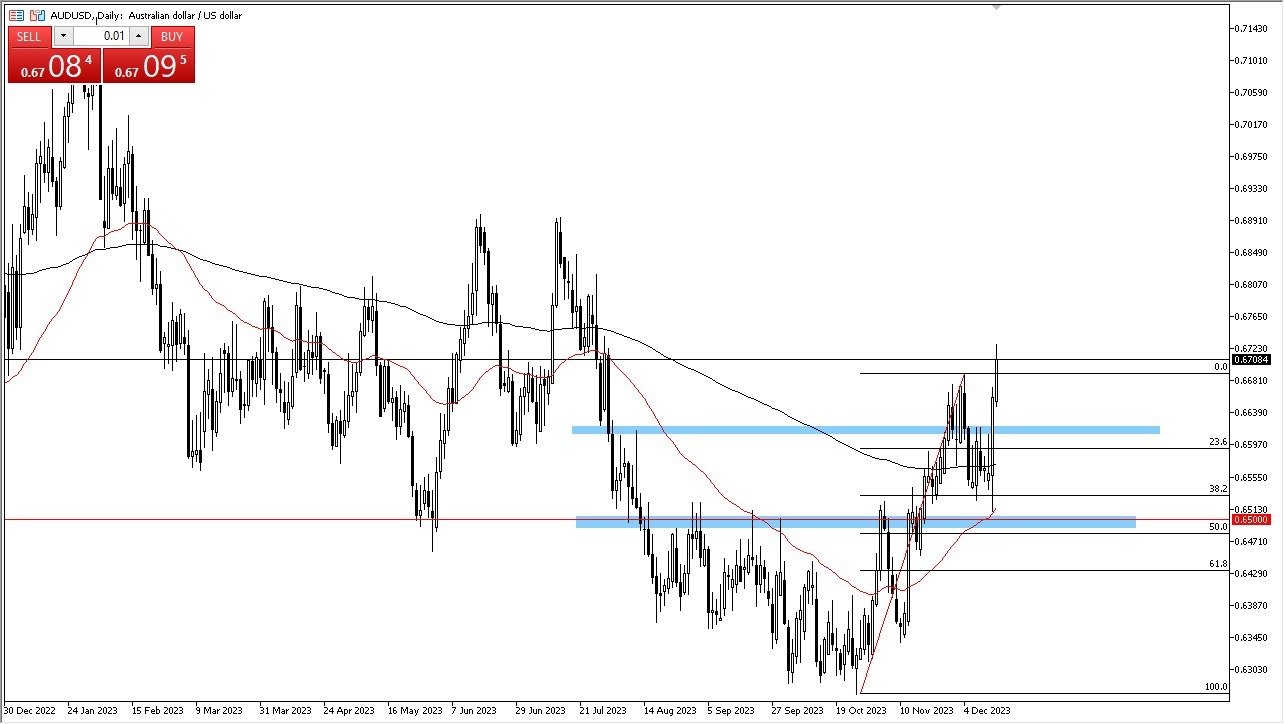

- The AUD/USD experienced a significant rally early in Thursday's trading session, displaying signs of vitality and suggesting the possibility of an upward movement.

- However, the market exhibited a fair amount of indecision, with some back-and-forth trading during the session.

- To make sense of this, we must consider whether the prevailing "risk-on behavior" will persist and whether market participants are factoring in the potential for the Federal Reserve to swiftly reduce interest rates.

Top Regulated Brokers

Conversely, there's an opposing argument that suggests the Federal Reserve's rate cuts might be a response to anticipated economic challenges down the road. However, it is improbable that the Fed views it that way. Consequently, it should not come as a surprise if this market remains somewhat volatile in the near term. Nevertheless, it is likely that investors searching for value will eventually step in to purchase Australian dollars, as it is closely tied to commodities and risk appetite, especially as it helps build emerging markets with its raw materials. Because of this, we have to look at it with the idea of whether traders are taking advantage of “growth prospects.”

Bond Yields in the United States

It is crucial to monitor US bond yields, as they exert a significant influence. Lower yields tend to favor gold ownership, as gold does not offer interest payments. There exists a robust long-term inverse relationship between the two, necessitating close attention. In the bigger picture, it appears that the Australian dollar is aiming to reach the 0.69 level. However, the path to this target may not be a straightforward ascent. It could involve market choppiness and intermittent pullbacks, creating opportunities for value-oriented investors.

At the end of the day, the Australian dollar witnessed a notable rally, but a degree of uncertainty continues to prevail. Its trajectory is intrinsically tied to the broader "risk-on" sentiment and expectations regarding potential rate cuts by the Federal Reserve. While short-term fluctuations and market indecision may persist, it appears that there has been a noteworthy shift in favor of the Australian dollar in the longer term, particularly against the US dollar. This trend could lead to increased selling of US dollars in 2024, aligning with the typical dynamics observed in Forex markets as investors embrace higher levels of risk and opportunity.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.