- Silver displayed a back-and-forth trading pattern during Friday's session, reflecting a certain degree of caution prevailing in the market as the holiday season approaches.

- This cautious sentiment is quite understandable, given that, to put it simply, buyers have been dominating the silver market, but a brief pullback is expected after the rapid surge in prices.

- Currently, I have my eye on a couple of key areas that I believe deserve close attention, as they represent crucial support levels.

Top Regulated Brokers

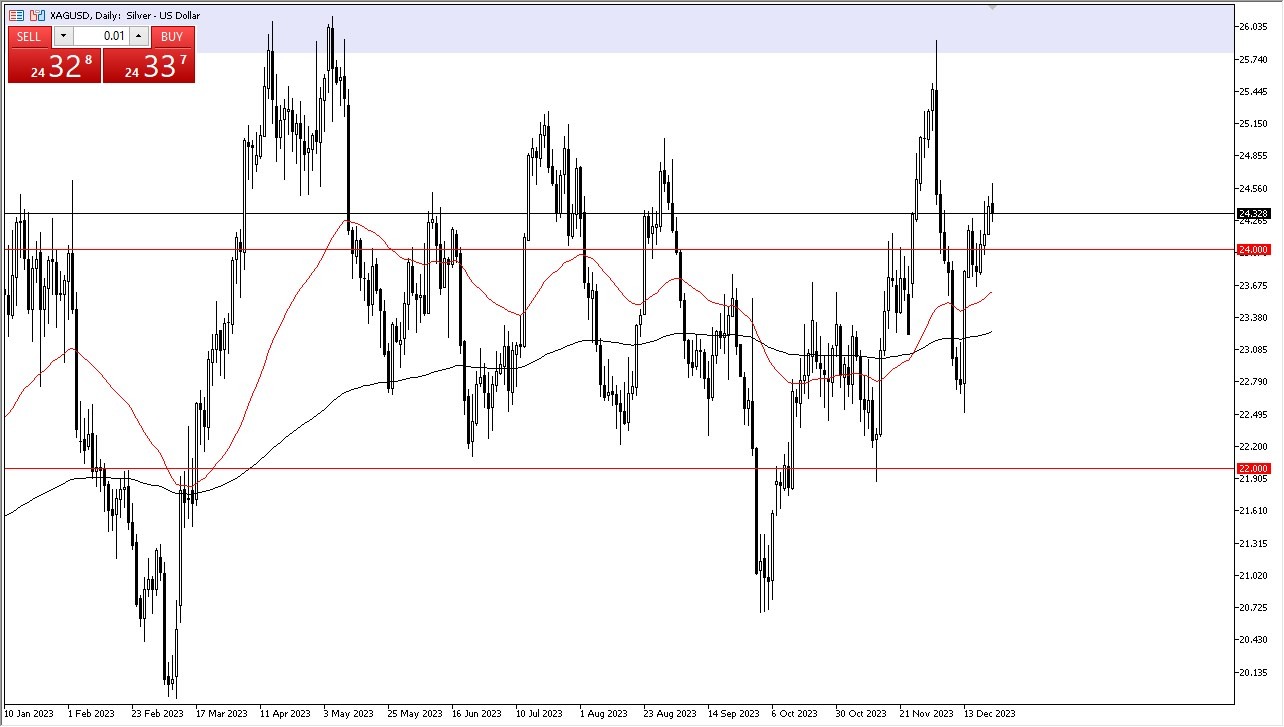

Beneath the current price action, the $24 level holds significance as a potential support level. In the past, this level had acted as resistance, and it has been a point of substantial trading activity. The concept of "market memory" comes into play here, contributing to the market's reluctance to break significantly below this level. Furthermore, the 50-Day Exponential Moving Average lies in proximity to the $23.50 level, attracting the interest of technical traders. All things considered, this scenario continues to entice traders whenever it offers value, primarily due to the ongoing decline in interest rates across the United States.

Fed Rate Cuts Coming?

The market continues to factor in the possibility of the Federal Reserve's actions next year, with many traders anticipating multiple rate cuts. This expectation benefits precious metals in general, as they are often seen as a means of preserving wealth. As interest rates decrease, the appeal of holding physical assets over paper assets tends to rise.

Conversely, if the market breaks above the highest point of the recent candlestick without experiencing a pullback, it could potentially pave the way for a move toward the critical $26 level. The $26 level represents a significant psychological milestone and has historically served as a formidable resistance point. Traders are likely to perceive it not just as a target but as a substantial obstacle as well. Given these dynamics, I am not inclined to consider selling silver in the foreseeable future.

Ultimately, silver's recent trading pattern reflects a cautious market sentiment as the holiday season approaches. However, the prevailing narrative continues to favor buyers, and key support levels should be closely monitored. The ongoing decline in U.S. interest rates is a crucial factor supporting precious metals, making them an attractive option for wealth preservation. While the $26 level poses a formidable challenge, the broader outlook suggests that silver remains an appealing prospect for traders, and selling is not on the horizon.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.