- Early in the day on Wednesday, gold prices rallied, reinforcing the general bullish sentiment that surrounds the gold market.

- This upward trend aligns with the longer-term bullish outlook on gold, suggesting a potential for significant price increases in the future.

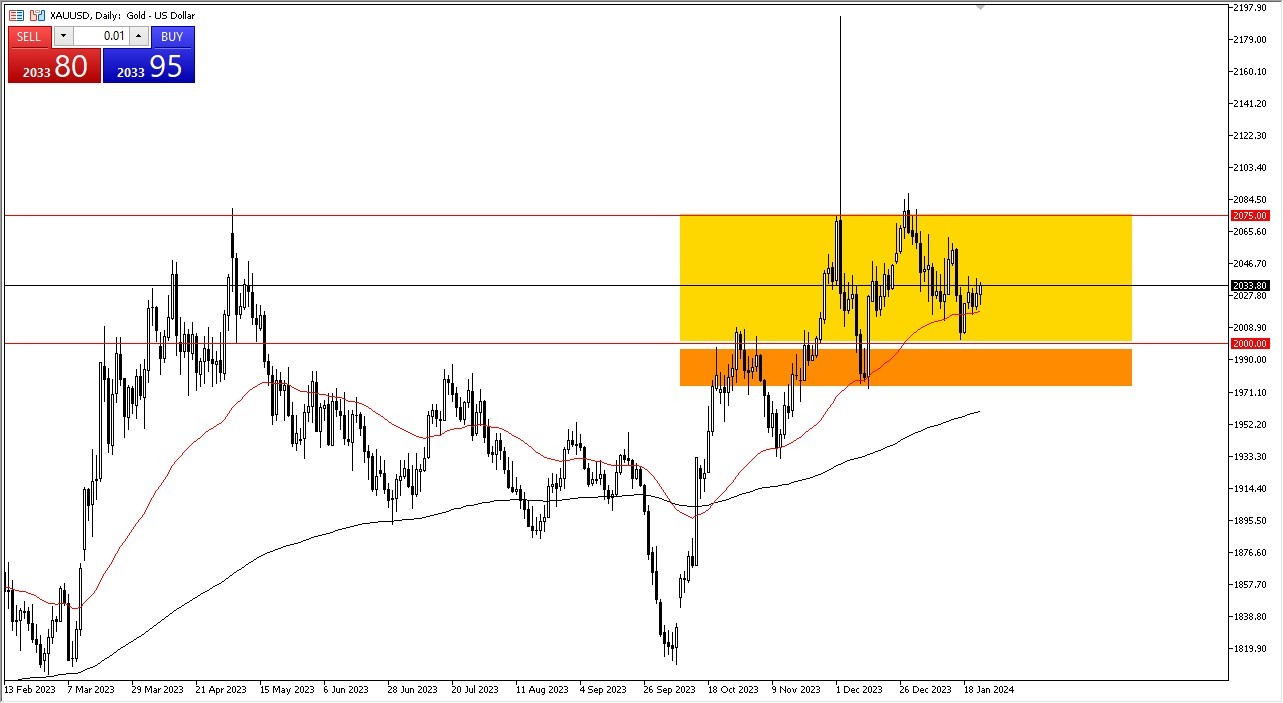

During Wednesday's session, gold experienced an initial decline, only to recover and demonstrate a resurgence in value. The presence of the 50-day Exponential Moving Average just below the current price level offers technical support, further strengthening the case for a bullish trend. The overall trajectory of the gold market points upwards, making it a prime candidate for buying. Current market analysis suggests that dips in gold prices should be viewed as buying opportunities. A critical support zone is identified between the $2,000 and $1,980 levels, which is expected to offer robust resistance against further price declines.

Target Above?

The immediate target for gold prices is the $2,075 level, a threshold that has historically acted as a significant resistance point. Breaching this level could pave the way for a more substantial increase in gold prices. One of the key drivers behind the current rise in gold prices is the anticipation of central bank policy loosening across the globe. Such policies typically result in lower yields, which in turn enhances the appeal of gold as an investment.

Top Regulated Brokers

In addition to economic factors, geopolitical concerns are also influencing gold prices. Issues such as the Red Sea attacks, ongoing conflicts in Gaza and Ukraine, and tensions between China and Taiwan, contribute to the attractiveness of gold as a means of wealth protection. These factors collectively underpin the current positive sentiment in the gold market.

It is only with a break below the $1,980 level that the market might consider a bearish stance towards gold. However, such a scenario appears unlikely under current conditions. Instead, the market may experience a range-bound movement with an upward bias. This outlook is based on the current market dynamics and the likelihood of sustained central bank policies that favor lower yields.

The current stance on the gold market is predominantly long, with a cautious approach towards any potential shifts in central bank monetary policies. However, given the current global economic and geopolitical landscape, a significant change in these policies seems improbable in the near term. This reinforces the bullish outlook for gold, suggesting continued opportunities for investors in this market.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.