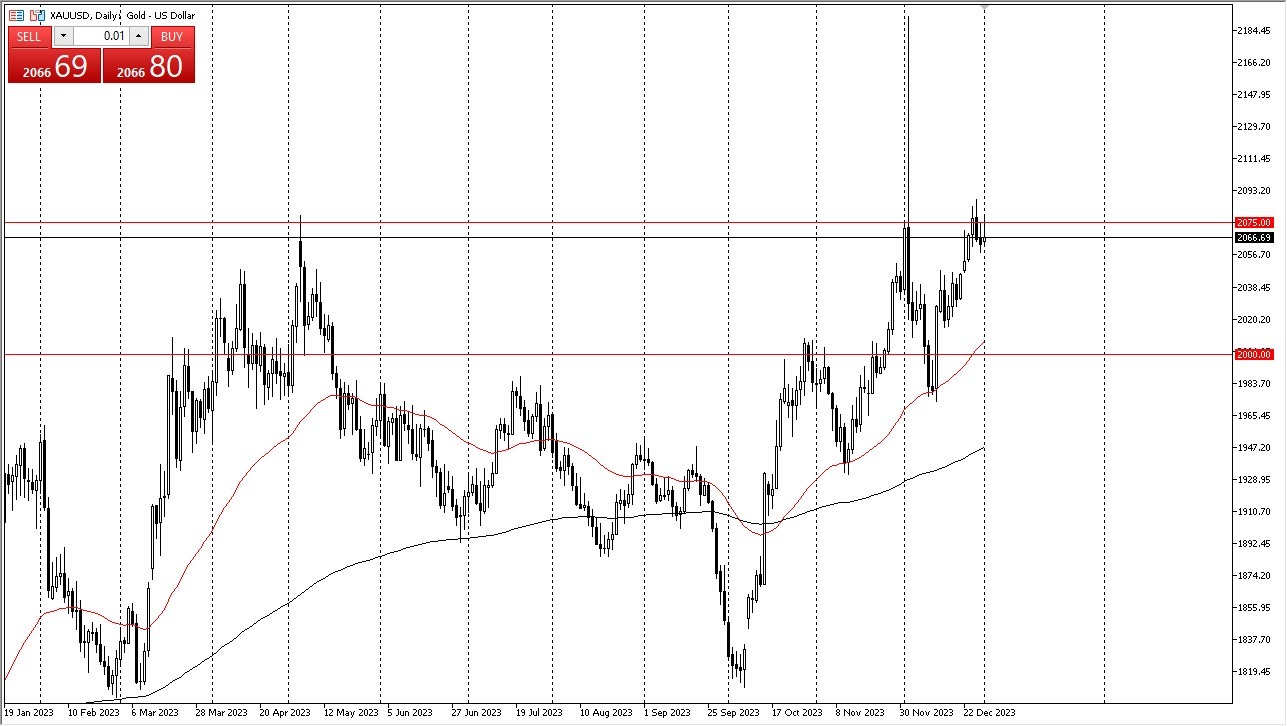

- Gold made an initial attempt to rally on Tuesday. However, it encountered resistance around the $2,075 level. Surpassing this level would open up the possibility of challenging the significant price movement observed on December 4th.

- At present, traders appear to be grappling with uncertainty regarding their strategies for the year 2024. The familiar dynamics of monitoring American yields, particularly the 10-year yield, continue to influence the gold market.

- A spike in yields often signals unfavorable conditions for gold as investors may opt for alternative investments. Conversely, when yields decrease, there is a flight to safety, and gold serves as a haven asset.

- Thus, the inverse relationship between interest rates and the US dollar is expected to significantly impact the market, with the $2,075 level having displayed resistance on multiple occasions in the past.

Consequently, it would not be surprising to witness a minor pullback, which could present a buying opportunity. Friday's release of job data has the potential to instigate notable market movements. Additionally, it's essential to consider that the market may experience liquidity constraints for the next few days as traders return from holiday breaks and establish their positions for the year. However, this is a situation where we are still going to be looking for stability.

A Bullish Stance is Maintained

Examining the support levels, the $2,000 mark holds substantial significance as a key level in the market. Any breach below this level could prompt a swift change in sentiment. However, given the considerable distance between the current price and that level, a bullish outlook is maintained, with a preference for a buy-on-the-dips approach. In the event of market entry, caution is advisable, particularly concerning position sizing, at least until the impact of the upcoming jobs report on Friday becomes clearer.

Top Regulated Brokers

In the end, gold's attempt to rally encountered resistance at the $2,075 level on Tuesday. The market's direction for 2024 remains uncertain, with traders closely monitoring American yields and their influence on gold. The inverse correlation between interest rates and the US dollar is expected to be a key driver. While a minor pullback may occur, the $2,000 level serves as a critical support threshold. Overall, a bullish stance is maintained, favoring a buy-on-the-dips approach with prudence in position sizing, especially ahead of the impending jobs report on Friday.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.