- Gold markets showed significant strength on Friday, responding to weaker-than-expected PPI numbers, contrasting the previous day's CPI data which was slightly stronger.

The rally in the gold market was prompted by the release of the producer price index, indicating a potential easing of inflationary pressures in the United States. As a result, gold reversed its course and began another upward move. In this context, buying on dips appears to be the prevailing strategy. Overall, it is likely that this market will ultimately experience a substantial upward movement.

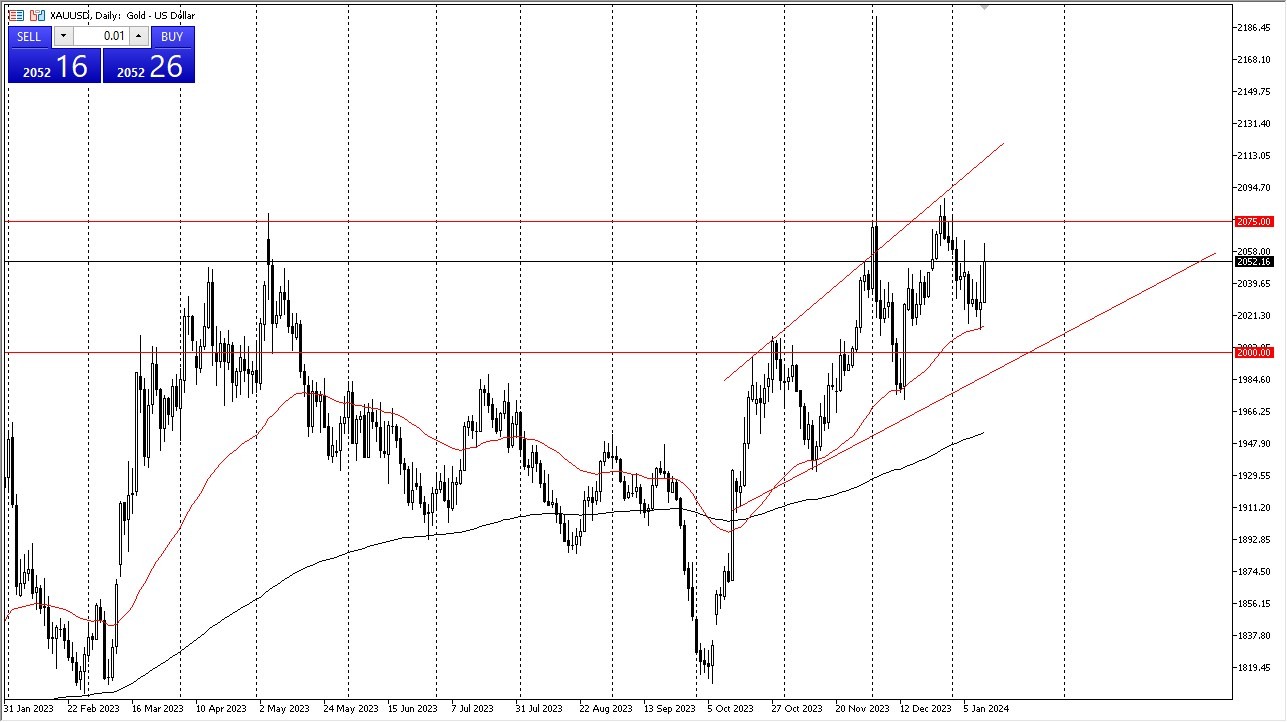

This development stands in stark contrast to the prior session when consumer price index numbers exceeded expectations but not to a significant degree. Consequently, the inflation situation remains uncertain, leading traders to speculate that the Federal Reserve may adopt a more accommodative monetary policy in the coming years. Given this outlook, gold could target the significant resistance level at $2075.

On a Breakout

A breakout above this level would likely propel the price higher. Short-term retracements continue to offer value, supported not only by the 50-day EMA but also by an underlying trendline. In summary, this market maintains a positive outlook. Despite the previous day's action, there was a prevailing belief that gold would eventually trend higher, even though there were uncertainties about revisiting the $2,000 level.

The current situation suggests a favorable environment for buying on short-term dips. Shorting gold remains a less likely option, at least until a decisive break below $2,000 occurs, which seems increasingly improbable in light of recent developments over the past 24 hours or so. I believe this will continue to be the way forward, as gold has a lot of different reasons to rally going through the rest of the year. War, recession, and a lot of overall concerns will continue to make gold attractive as a way to protect portfolios.

Top Regulated Brokers

The gold market reacts to interest rates in the US more than just about anything else, so watch the 10-year yield, as the negative correlation is something that has been a long standing feature of this market. The PPI numbers coming in weaker than expected certainly showed that on Friday. I believe this will continue to be the main driver overall, but there are all those other factors out there as well.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.