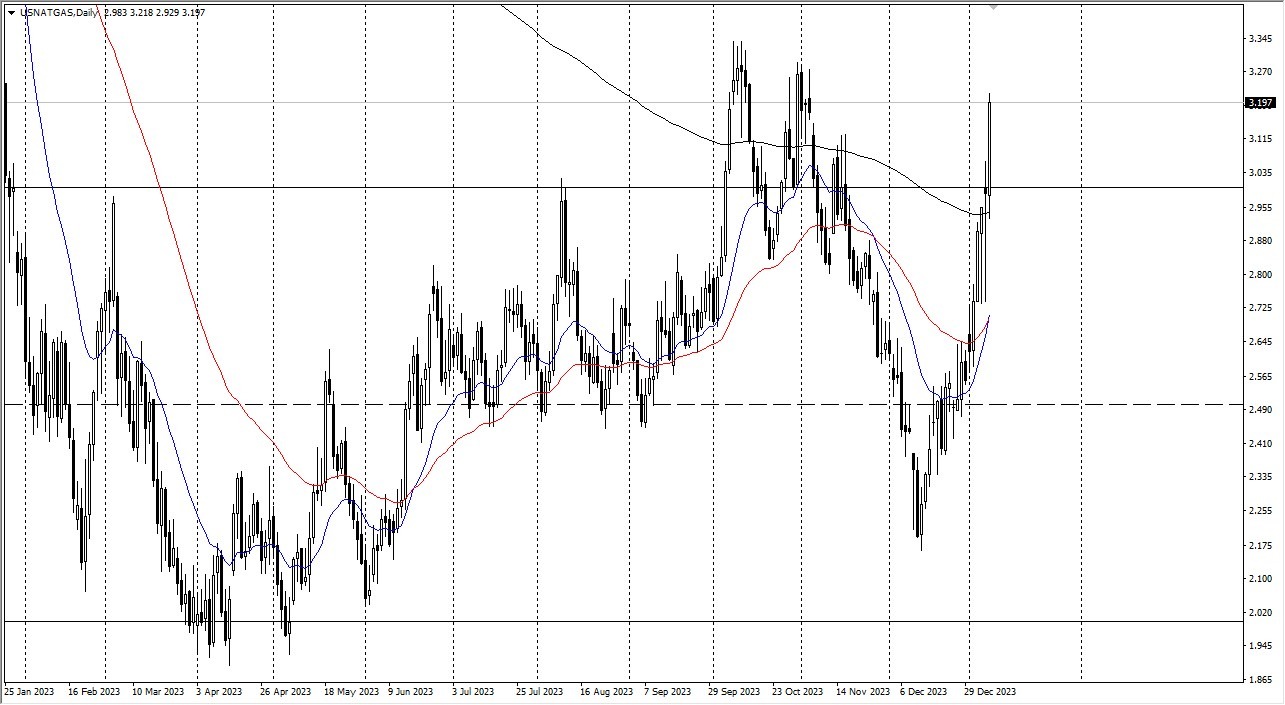

- Natural gas prices surged during the early hours of Tuesday's trading session, but they encountered a formidable obstacle just above. The critical resistance level at $3.33 has been a tough nut to crack for natural gas traders.

- It's important to recognize that this recent upswing in prices is primarily a response to a specific weather event in the northeastern United States.

- To put it simply, the fate of natural gas prices is closely tied to the Henry Hub contract, which originates from Louisiana.

When the storm in the Northeast subsides, we can expect natural gas prices to resume their descent. Currently, there are no signs of exhaustion in the market, which would signal a suitable time to initiate short positions. The natural gas market can be quite volatile at times, influenced by a few major players who can sway its direction.

Watch the Futures Markets

It's worth keeping an eye on the futures market, which is already starting to factor in February prices, indicating that March is not far behind. March typically brings warmer temperatures to the northern hemisphere, causing a decline in natural gas demand. While there may be intermittent price spikes, these should be viewed as short-term trading opportunities rather than long-term investments.

The overarching issue in the natural gas market is the surplus supply that continues to weigh it down. Despite recent drawdowns over the past week, the market fundamentals remain unchanged in the grand scheme of things. As an investor, it's prudent to be on the lookout for a telltale sign of exhaustion before considering short positions. While such a signal hasn't emerged yet, patience is key when navigating this market.

Top Regulated Brokers

In the long term, the natural gas market appears to be confined within a range, with a bottom around $2 and a ceiling hovering near $3.33. This range is likely to persist until there is a substantial shift in the supply-demand dynamics. Therefore, traders and investors alike must stay vigilant, adapt to changing conditions, and exercise caution when making trading decisions.

At the end of the day, the recent rally in natural gas prices is largely driven by a localized weather event and should be viewed as a short-term phenomenon. The long-term outlook for natural gas remains constrained by oversupply, making it imperative for market participants to exercise patience and closely monitor the market for opportunities to capitalize on fluctuations within the established price range.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity brokers in the industry for you.