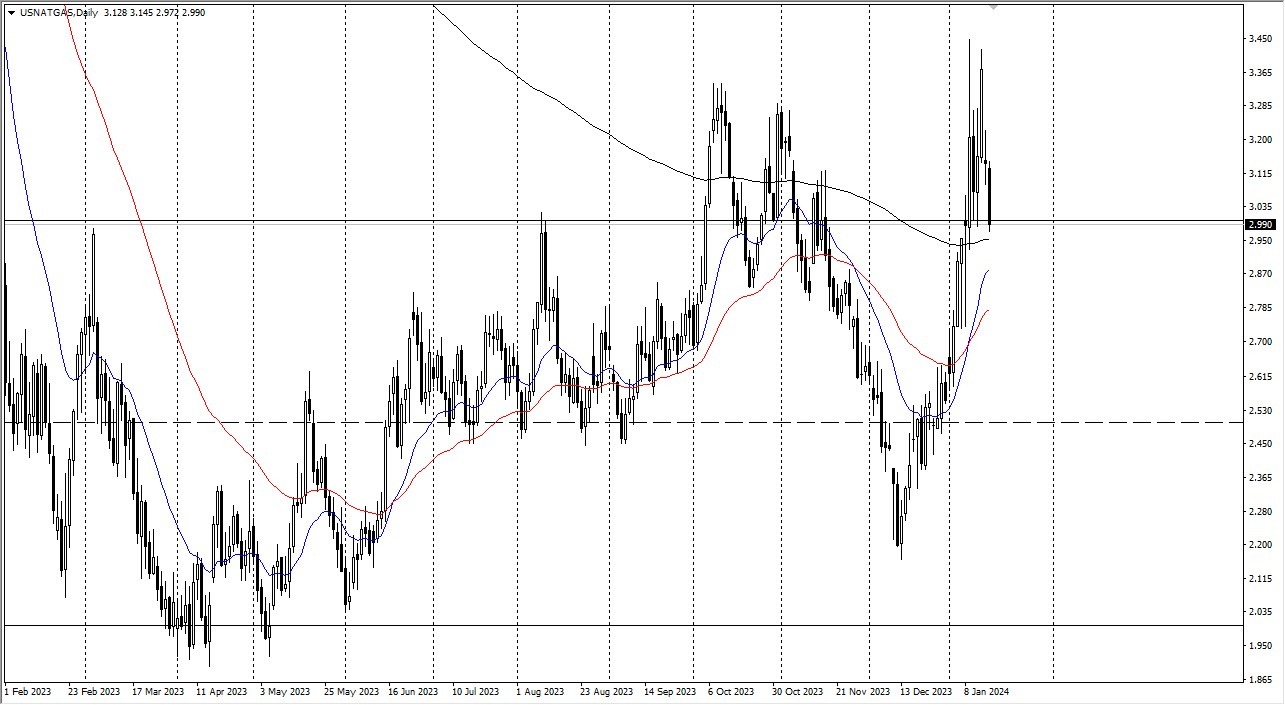

- The natural gas markets experienced a significant decline during Tuesday's trading session, signaling a potential end to the consolidation range that has characterized most of this year.

The recent performance of natural gas markets has been rather unremarkable. It appears that we are witnessing a retreat from the previously strong uptrend. This correction aligns with the market's overextension, primarily driven by concerns about storms in the eastern region. Considering these factors, it's prudent to view this market with caution and anticipate a potential retracement towards the 50-day Exponential Moving Average, or even around $2.50, depending on your CFD broker. In general, it's advisable to avoid overcomplicated trading decisions in this context.

The market has reached the upper boundary of its established range and is now showing signs of a pullback. While this presents a short-term selling opportunity, it's important to recognize that most natural gas trading is likely to be short-term moving forward. The market is anticipated to remain within a trading range for the remainder of the year, with approximately $3.33 as the upper limit and $2 as the lower boundary.

Heading Back to “Fair Value.”

Top Regulated Brokers

Currently, the market seems poised to gravitate toward the middle of this range as temperatures return to normal levels, leading to reduced demand. It's essential to remember that natural gas is a well-supplied market, and concerns regarding supply shortages are non-existent. Consequently, the recent surge in natural gas prices appears unjustified. Given the market's position at the upper limit of its range, a pullback is expected. As temperatures normalize, the focus will shift back to the issue of oversupply in the natural gas market, impacting pricing dynamics once more.

Ultimately, natural gas markets have witnessed a significant decline, potentially marking the conclusion of the prevailing consolidation range. Recent market performance has been lackluster, with a correction in response to the earlier excessive uptrend. Trading decisions in this context should be straightforward, with an eye on potential retracement levels. While short-term selling opportunities may arise, it's important to acknowledge that short-term trading is the likely trend in the natural gas market going forward. The established trading range for the year, spanning from $3.33 to $2, remains intact. As temperatures normalize, reduced demand will shift the focus to the issue of oversupply, influencing pricing dynamics once more.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity broker platforms worth trading with.