- The natural gas markets recorded another decline on Friday, primarily due to the fading impact of the recent winter storm in the USA.

- Consequently, the markets are shifting their focus towards the looming concern of overcapacity.

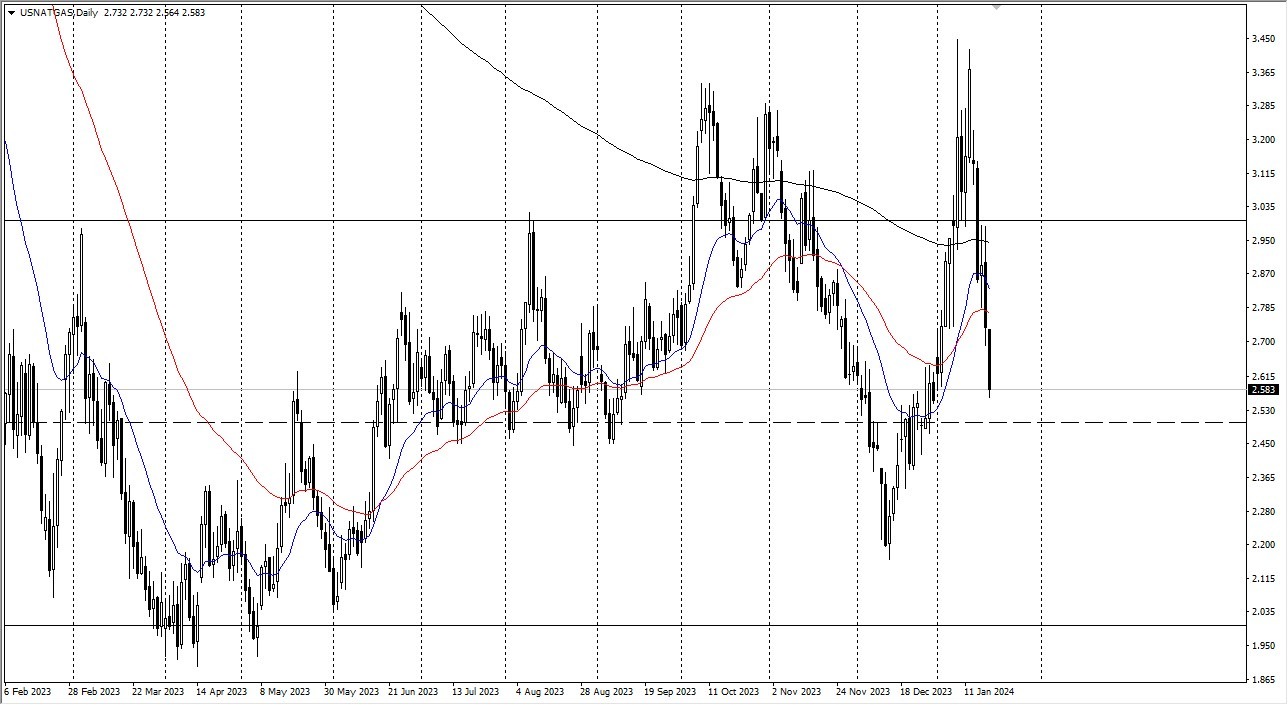

The trading session on Friday witnessed a downward move, with the market appearing to aim for the $2.50 level. This level holds particular significance, as it lies within the heart of the broader consolidation area and has previously served as a robust support level during the summer of 2023. Given this historical context, it is reasonable to expect this level to retain its importance once again. Such an expectation is likely to hold in the coming weeks, contributing to a period of market volatility.

In essence, the market is expected to have a collective memory of this pivotal price zone, which market participants will continue to monitor closely. It is pertinent to note that the recent spike in natural gas prices, attributed to the impending winter storm, is now dissipating as the storm subsides. As temperatures rise and natural gas production returns to normal, an oversupply issue has come to the forefront. Importantly, this oversupply concern is not temporary but rather represents a structural challenge.

Despite the intensity of the recent winter storm, it is crucial to recognize that such weather events are finite. Consequently, futures traders have started to reenter the market with their sights set in March. March typically signals the onset of warmer temperatures in the United States, posing a challenge to the natural gas markets.

Top Regulated Brokers

The $2.50 Level Matters

The $2.50 level has emerged as a price magnet, drawing the market's attention. A potential descent below this level could lead to a drop towards the $2.00 level, a substantial support level in the market. Should such a breach occur, it would raise a significant red flag. In such a scenario, consideration of buying opportunities on any subsequent rebound becomes pertinent. It is worth noting that reaching the $2.00 level is not an imminent eventuality, but it remains a factor to bear in mind as the market unfolds.

Ultimately, the natural gas markets are witnessing a decline as the impact of the recent winter storm fades, giving way to concerns of overcapacity. The $2.50 level holds significance as a historical support zone, with market memory playing a pivotal role. The oversupply issue is deemed a structural problem, not a transitory one. As traders anticipate the arrival of March and the accompanying rise in temperatures, market dynamics are likely to experience heightened volatility, necessitating vigilance and strategic decision-making in navigating the natural gas market.

ady to trade FX Natural Gas? We’ve shortlisted the best commodity brokers in the industry for you.