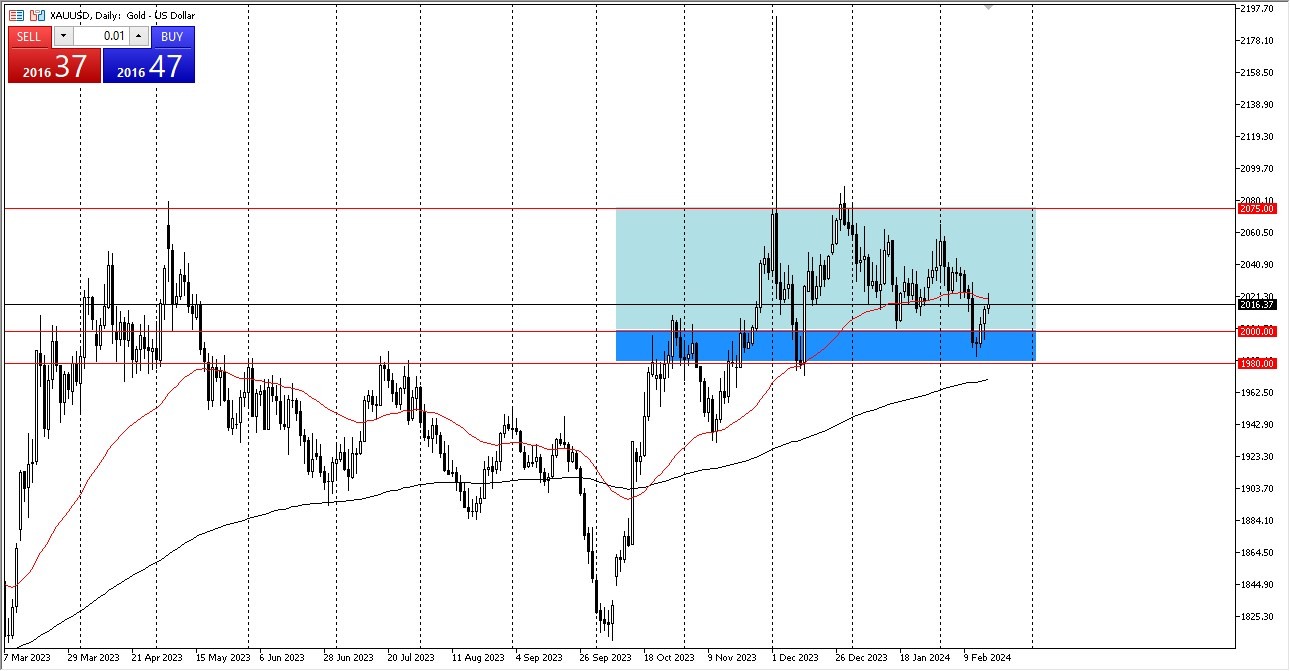

- As you can see, the gold market touched the 50-day moving average during Monday's trading session, leading to a small rally.

- It goes without saying that a lot of people will be keeping an eye on the 50-day EMA.

It's also important to remember that there has previously been some commotion at the $2,020 level. That said, I believe there is a scenario where a lot of attention will probably continue to be paid to that level in the market, but once we break above it, it's likely that we will move much higher.

Top Regulated Brokers

Thus, I believe we have arrived at a point whereby we may take a small step back, but that step back almost certainly creates another purchasing opportunity. Notably, Monday was President's Day in the US, so there might have been some liquidity issues, and there most likely would have been later in the day.

If we surpass the peak of the previous week's extremely negative candlestick, which was located at $2,030. After that, I believe there is a good chance gold will hit the $2,075 mark. Because it appears to be a support zone, the range below is the one in which I am most interested. That is, roughly, between $2,000 and $1,980. We have the 200 Day EMA racing towards that region as well, adding more credence to that level.

At this point, I believe the situation is one in which traders are still searching for value and seizing it when it materializes. I do believe there are many geopolitical reasons to own at least some gold in your portfolio, but I have no interest in shorting this market. Though I do think that in this market that has been rather erratic, you might be able to capitalize on a little correction for some small gains, I believe is attempting to create the required momentum for the market's next rise.

That being said, I expect a short-term pullback will occur, as we have a little bit of technical resistance, but given enough time I also believe that gold will continue to be a major winter when it comes to financial markets. After all, there are plenty of geopolitical issues, and of course central bank action out there that will come into the picture in general.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.