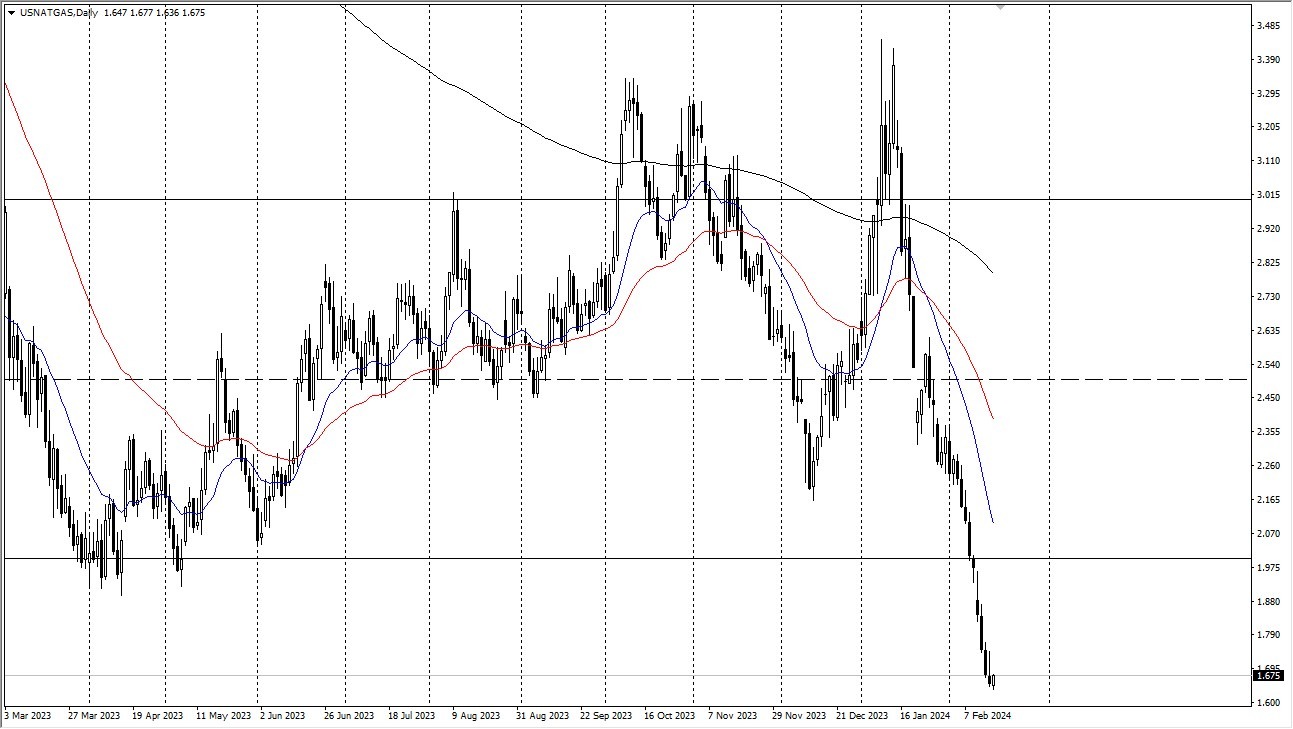

- The natural gas market had further declines during Friday's trading session, resembling a repetitive pattern akin to a skipping record.

- With prices continuing to plummet, attention now turns to the possibility of reaching the psychologically significant $1.50 level.

Throughout Friday's session, natural gas markets remained largely stagnant as investors searched for signs of a market bottom. The potential descent to the $1.50 mark seems increasingly plausible, reflecting the substantial selling pressure that has characterized recent trading sessions. Despite the relentless downward momentum, the question arises: who remains in the market to execute further sell-offs?

Top Regulated Brokers

Inevitably, such extreme market conditions often precede a sharp reversal, fueled by a significant short covering rally. Although predicting the timing of such a turnaround is challenging, historical patterns suggest that a rebound to the $2 level could materialize swiftly and without hesitation. Notably, the prevailing trend depicted by the downward sloping moving averages underscores the severity of the market downturn.

However, caution prevails when considering potential buying opportunities in natural gas. While the allure of bargain prices may tempt some investors, exercising patience for a longer-term signal is advisable given the current market volatility. Shorting natural gas has been discouraged since the $2 mark, highlighting the challenging nature of trading in such a volatile environment.

Drilling Will Stop

The fundamental dynamics of the natural gas market further complicate the outlook. With drilling activity potentially facing a decline due to diminishing profitability, questions arise regarding the sustainability of current supply levels. The abundance of natural gas reserves, exemplified by the practice of burning off excess gas on drilling rigs, underscores the challenges facing market participants.

Despite occasional bullish sentiment driven by seasonal factors, the inherent abundance of natural gas raises skepticism regarding its long-term prospects. Moreover, concerns surrounding environmental impacts, such as natural gas contamination in drinking water, contribute to a nuanced understanding of its value proposition.

Looking ahead, a balanced approach is warranted, with emphasis placed on analyzing weekly chart patterns for potential trading opportunities. While short-term fluctuations may offer speculative appeal, a comprehensive assessment of fundamental and technical factors is essential for navigating the complexities of the natural gas market.

At the end of the day, the natural gas market's current trajectory underscores the challenges and uncertainties facing investors. As prices continue to decline, cautious optimism is tempered by the need for diligent analysis and a prudent approach to risk management.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.