- Over the past few sessions, the natural gas markets have experienced a notable upswing, and this Wednesday was no exception.

- Ultimately, the markets will persist in their efforts to rebound following a very severe selloff. Drillers might be leaving the fields at this point.

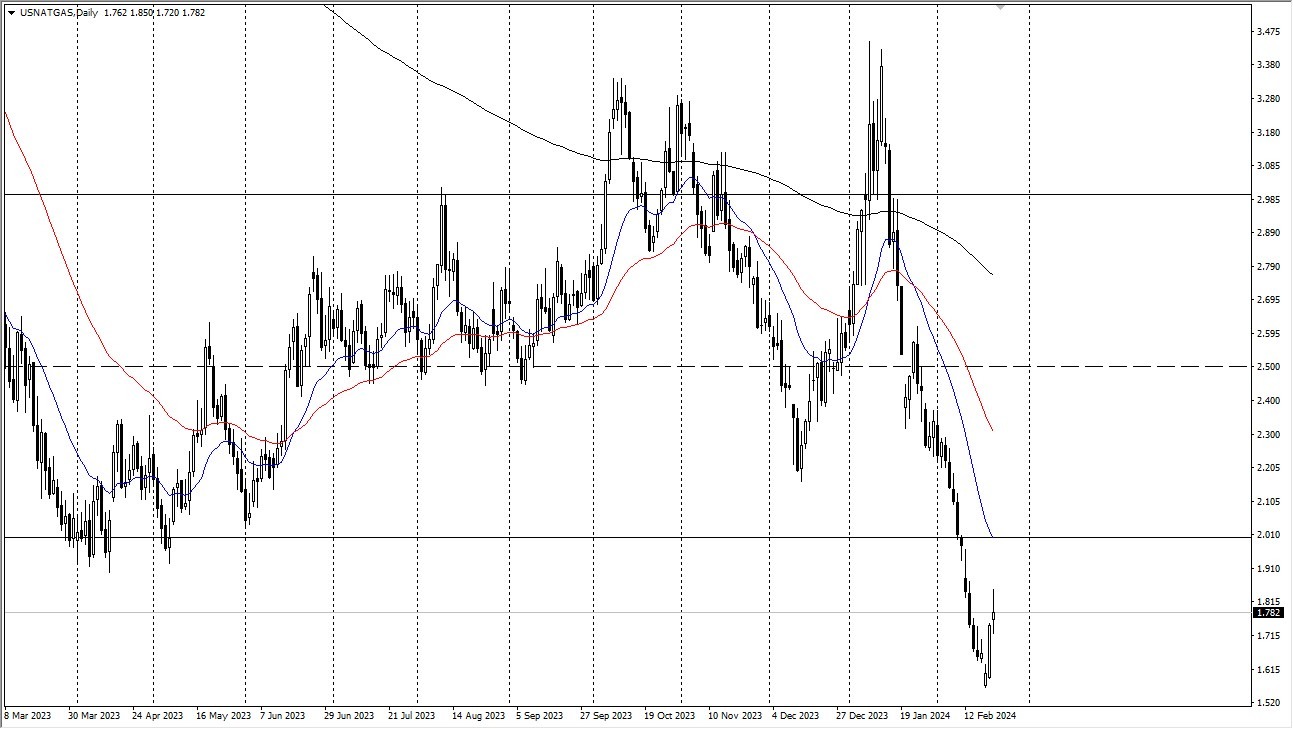

As you can see, during the trading session, there has been a minor rally in the natural gas markets. Wednesday, the 20-day EMA is present at the two-dollar level, which is obviously a sign that many traders are entering the market as we continue to observe a lot of noisy activity and it appears that we are attempting to approach the two-dollar level. Since the $2 level has historically provided quite considerable support, you should keep a close eye on it. Given this, there may be resistance there, but if we surpass it, I believe many would be eager to enter the market and possibly attempt to push natural gas up to $2.50 or so, as this is an area that a lot of people will be looking at as a “round figure.”

Top Regulated Brokers

Winter Has Been a Disaster

In any case, the winter has been a complete bust, but the market has just reached a significant floor. It's therefore not shocking in the slightest to witness a response. The natural gas market has moved by roughly thirty cents during the past two days. That is a really significant step, then. But the severity of the situation becomes evident when you examine the longer term chart.

I'm going to wait and see if we retreat and reach a deeper bottom as a result. If we do, there's a good chance I'll place on a swing trade that might last many months. However, bear in mind that summer is usually not the best season for natural gas prices, so it will probably need some convincing to go above $2.50. Although the natural gas markets appear to be gradually awakening, this does not imply that a bull market is about to begin. Maybe this is simply a brief covering of short positions as there can’t be that many people out there left to sell at this point in time.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.