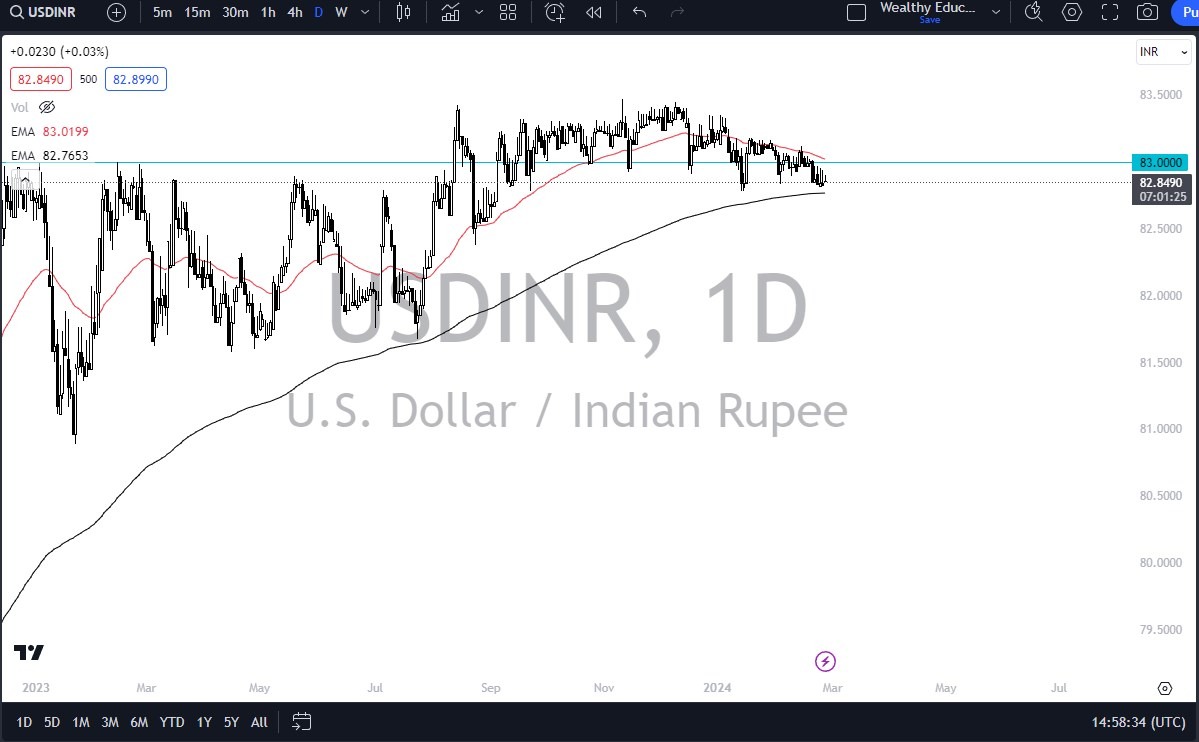

- The US dollar against the Indian rupee continues to be very sideways and noisy, and quite frankly really hasn’t done anything.

- At this point in time, the ₹83 level above seems to be significant resistance, especially considering that it has been backed up by the 50-Day EMA.

- The 50-Day EMA is an indicator that a lot of people pay close attention to, and it has been somewhat reliable in this pair.

However, underneath we have the 200-Day EMA that will come into the picture as well, and that could be part of what drives this pair going forward. As we are stuck between the 2 moving averages, there isn’t a whole lot to get excited about right now, it is probably worth noting that the central bank in India will quite often keep this pair in a rather tight range. I don’t see that changing, as the Indians prefer to have a very stable exchange rate.

Top Regulated Brokers

With that being said, if we were to break out of this little area it could be the beginning of something bigger, but right now a lot of this comes down to global growth or perhaps even the lack of global growth and a significant amount of concern when it comes to whether or not demand will pick up. Remember, India is one of the biggest emerging markets, so a lot of people will be looking at it through that prism. Because of this, I think that we have a somewhat sideways market just waiting to happen but it is worth noting that there have been several wicks that extended from the candlesticks.

If we break down below the 200-Day EMA, then it’s possible that the US dollar really starts to unwind. I don’t know how far it could go, because this is not a freely traded currency pair in the sense that most others are. There is a lot of central bank interference, and I just don’t see how that changes anytime soon.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.