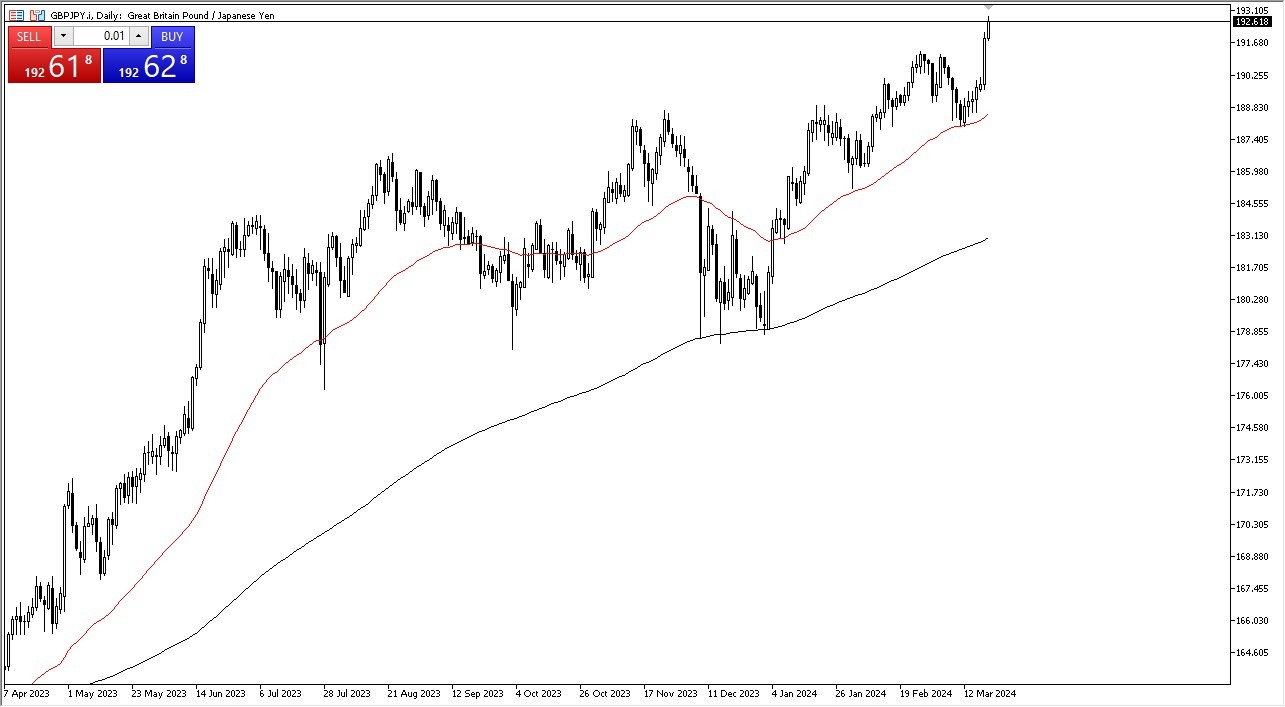

- The British pound has continued its drive higher against the Japanese yen, as we continue to see the Japanese yen get punished against most currencies.

- The fact that the Bank of England has a meeting on Thursday will also drive this pair higher if they sound even remotely hawkish.

- Even if they don’t, I look at any short-term pullback as a potential buying opportunity due to the fact that the Bank of Japan is nowhere near being able to tighten monetary policy in any significant manner.

- True, they just raised rates to 0.1%, but quite frankly that’s hardly worth mentioning other than the fact that it is at least somewhat positive I suppose.

Technical Analysis

The technical Analysis still looks very strong for this pair, and therefore I just don’t see how you can fight this type of momentum. I look at any pullback as a potential buying opportunity and would be especially interested near the ¥190 level, assuming that we can even drop that far. I would not hold my breath for that, because quite frankly this is a market that looks like it’s ready to just take off.

Top Regulated Brokers

The interest rate differential between the 2 currencies continues to be wide enough to drive a truck through, which of course means that people will continue to hang onto it. The 50-Day EMA since all the way down near the ¥189 level, and that of course is something that I think comes into the picture as well. With this, you need to be very cautious on any did, but I do think at the first signs of strength, you must be a buyer and jump in to take advantage of what could be a very strong uptrend just waiting to happen again.

I have no interest in shortening this pair, at least not until we break down below the ¥189 level, which would take quite a bit of shifting momentum. In that environment, we could see the market go down to the ¥185 level, but it doesn’t look to be very likely at this point. With that being the case, I remain bullish and I am more than willing to hang on to this pair.

For additional & up-to-date info on brokers please see our Forex brokers list.