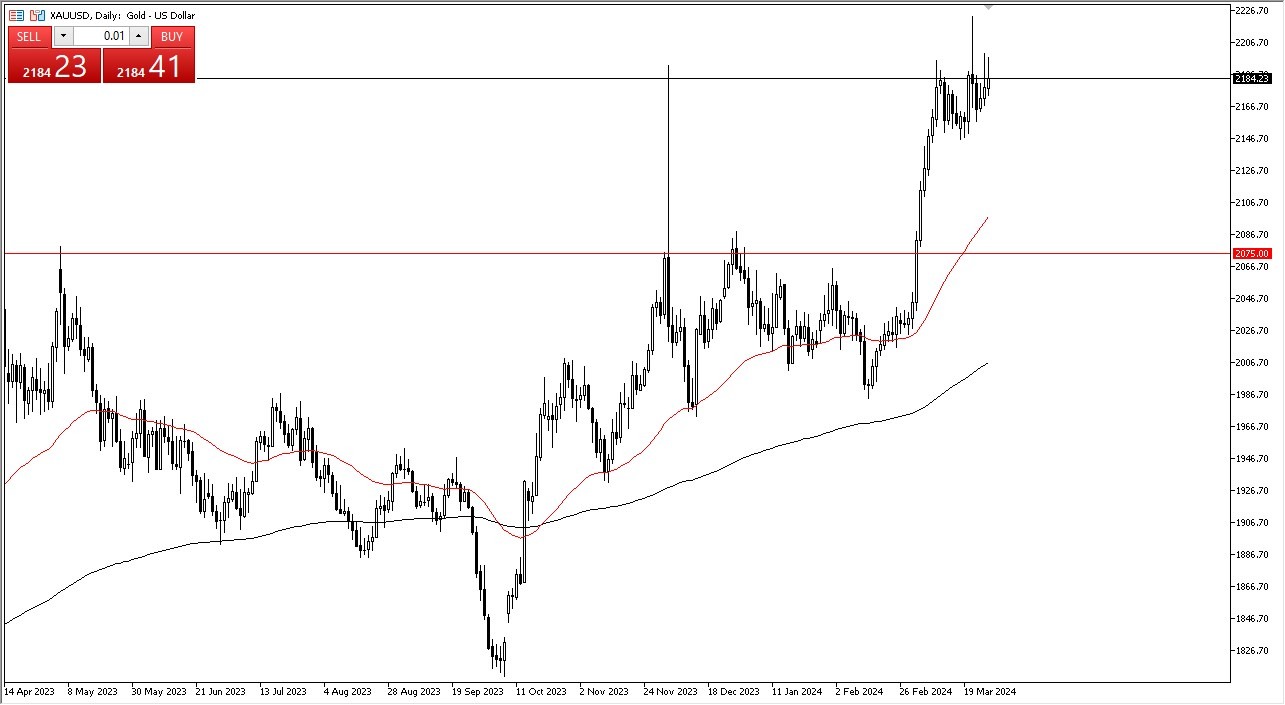

- Gold markets rallied rather significantly in the early hours on Wednesday, but as soon as futures traders came on, they got hammered again.

- So, at this point, I think we're just going to continue to try to grind higher, but it's not going to be very easy.

Ultimately, this is a market that I think, given enough time, probably breaks out above the shooting star from last week, and once it does, it really could start to take off. At that point, I would expect gold to go looking to the $2,500 level. The central banks around the world continue to buy gold. So that of course, provides a little bit of support. But at the same time, you also have to look at the fact that there are a lot of geopolitical concerns out there. In other words, a lot of people are going to need safety.

Top Regulated Brokers

The play when it comes to gold markets

Pullbacks at this point in time should continue to attract buyers, especially near the $2,150 level. And then again at the 50 day EMA. Central banks around the world cutting rates will also lead to upward pressure. So I think at this point, you have to look at gold as one of those assets that you want to own when it gets cheap.

I don't know when we break out to the upside, but it certainly looks like we are relentlessly trying to do so. And that's generally a good sign that it eventually happens. I think you have a situation here where the market continues to pull back occasionally and each one of those pullbacks will more likely than not attract a lot of value hunting. It has been noisy over the last couple of weeks, but if you look at the previous action, we went straight up in the air from about $2,050 to $2,200. So, a little bit of consolidation and grinding certainly would make a bit of sense. After all, we cannot go straight up in the air forever, and therefore some work will need to be put into this market currently.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.