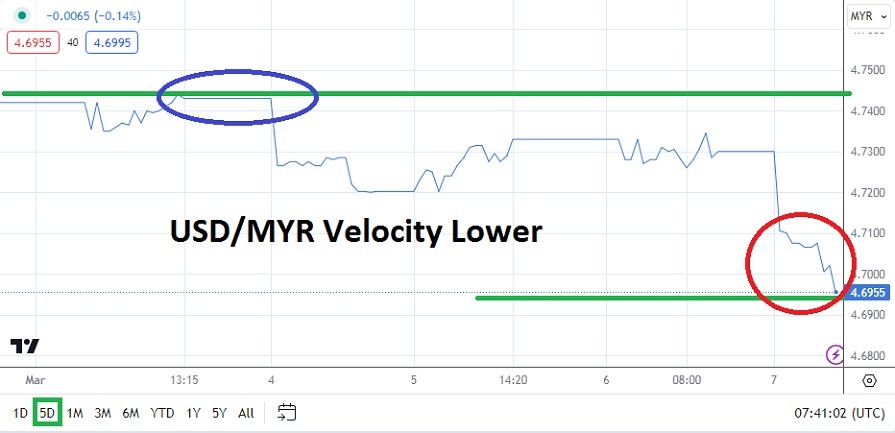

- The USD/MYR saw a rapid move lower in trading this morning as the currency pair has reflected the broad Forex market and reacted to the perception of a weaker USD.

- The current price of the USD/MYR is near the 4.6955 as of this writing, this after essentially beginning today’s trading near the 4.7305 ratio.

- The ability of the currency pair to not only move lower, but to break through support levels easily is intriguing for speculators.

The USD/MYR is now trading near values last seen in the middle of January, on the 16th of that month the currency pair did explore these ratios, but that occurred while a bullish trend upwards was being established. What may be of interest to speculators of the USD/MYR is the notion a value of 4.6450 was seen on the 15th of January.

USD/MYR Fast Movement and the Need for Risk Management

Speculators of the USD/MYR are urged to remain cautious and not get overly aggressive regarding the use of leverage if they want to pursue the recent downward price action which has developed. Traders need to remain realistic regarding their goals. While the USD/MY has correlated well with the broad Forex market there are risk events ahead today and tomorrow for all traders.

Later today Fed Chairman Powell will be speaking again in Washington D.C regarding monetary policy, in yesterday’s testimony before the U.S Senate Powell did say he believed the central bank had reached the end of its hiking cycle. However, Powell did not outline a timetable for cuts to interest rates. Yet it appears financial institutions globally, including in Malaysia took the comments as a sign the USD should continue to carry the perception of lower interest rates to develop in the mid-term. The notion of cuts to the Federal Funds Rate certainly seemed to spark USD weakness in many major currency pairs including the USD/MYR.

Top Regulated Brokers

Tomorrow the U.S Jobs Reports are on Schedule

The USD/MYR does not trade in a high volume manner and its trading hours get very quiet late at night. The U.S will release its jobs statistics tomorrow and this will certainly factor into USD/MYR trading tomorrow, but also into Monday as Malaysian financial institutions return to their offices and react in full to the results of the Non-Farm Employment Change and Average Hourly Earnings reports.

- If the USD/MYR can sustain value below the 4.7000 ratio, this could be a sign additional selling sentiment exists within the minds of large traders and lower moves could develop.

- But day traders should be cautious for the potential of sudden reversals higher to emerge, if USD/MYR players believe the currency pair has been oversold too quickly. Choppy trading may emerge in the short-term with this worry in mind.

USD/MYR Short Term Outlook:

Current Resistance: 4.7020

Current Support: 4.6910

High Target: 4.7230

Low Target: 4.6760

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.